Editorial: Can buy now pay later firms be blamed for consumers’ poor decisions?

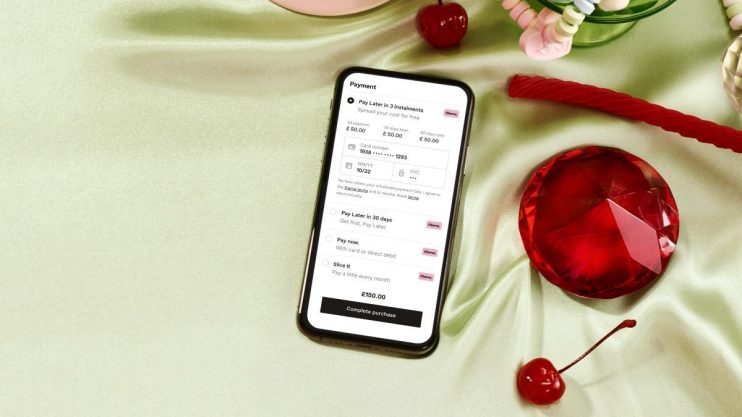

It is tempting to think of buy now, pay later as financial innovation. In truth it is not; it’s merely a new adaptation of an unsecured credit agreement. For all the adverts and branding, buy now pay later operators offer you the chance to pay in three instalments, rather than one.

Firms make money from the retailer, and yes, charge fees from those missing payments. As an industry, it’s flying; the number of Brits using it is going through the roof. It’s no surprise it’s therefore come under the watchful eye of politicians and the regulator.

Yesterday the FCA nibbled around the edges of a sector that it rightly says it doesn’t necessarily have the powers to regulate. There’s no doubt that it should have those powers – the more interesting question is what happens next.

Today new research from Barclays suggests that the problem with buy now pay later isn’t the product, but the people using it. A quarter are concerned about whether they can repay their installments; a further 31 per cent are overwhelmed by the amount coming out of their account. Barclays said their research “highlights that people are still not clear on the repercussions of not making repayments.”

The regulator, then, must now decide where to strike the balance between allowing these firms (which provide a useful service to retailers and consumers alike, employing plenty of people, and doing their bit to spur the consumer-led recovery) to operate freely and protecting the great British public from themselves. How much can the regulator be responsible for people going on spending sprees without thinking through the consequences?

There will be some who compare this new sector with the Wongas of the last decade. They are a very different beast, with revenues not dependent on ruinous interest but largely on their relationship with retailers.

The dilemma is how easy to make credit – and the regulator must decide whether it’s the creditor or the debtor at fault when it goes south.