EDF prepared to work with nuclear rivals as French energy giant commits to UK

There is room for multiple winners in the race to build mini-nuclear power plants in the UK, argued one of the country’s biggest energy providers.

Sandro Baldi, commercial director for EDF’s proposed small modular reactors (SMRs), told City A.M. that EDF was still open to developing its projects in the UK, even if it was potentially picked alongside several other competitors.

He believed that the SMR market was still at an early stage with most developers at a similar phase of maturity – and revealed EDF wanted to take a diplomatic approach in the push to build nuclear reactors in the UK.

“Good competition is good for us, because we will achieve better results and a better performance,” he said.

He argued that the “market will be huge” if SMR designs could be both standardised, and if the origination of market could be well-supported with state financing.

“If the market is huge, there will be a place for two or three major vendors. These will be the ones that have the necessary maturity not only in terms of technology, but particularly in terms of the overall industrial ecosystem around them to develop SMRs,” the commercial director explained.

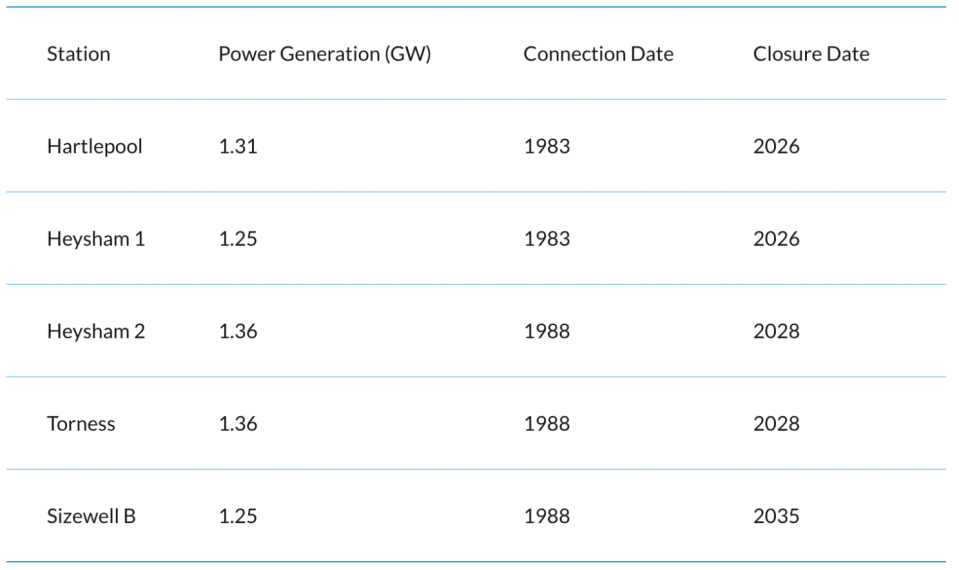

The UK’s ageing nuclear fleet is set for winding down, creating an urgent need for new projects

SMRs are scaled down nuclear power plants, typically offering potential capacity at a cheaper rate than full-scale sites, which can be built in factories and transported to locations.

The government is aiming to revive the UK’s nuclear ambitions – ramping up generation from 7GW to 24GW, so that it will make up 25 per cent of the energy mix to meet a historic electrification challenge in the push to net zero by 2050.

With no new nuclear power plants built this century, and 85 per cent of the country’s ageing fleet set for retirement in the next 12 years, it has turned to SMRs to boost generation.

Freshly-unveiled industry vehicle Great British Nuclear has shortlisted six potential contenders in a competition to build sites in the UK, with EDF included alongside GE Hitachi, Holtec Britain, Nuscale Power, Rolls Royce and Westinghouse.

The designers will be invited to bid for government contracts later this year with successful companies announced next spring, and contracts awarded in the summer – backed by a £20bn tender.

EDF: We’re a ‘local guide’ for UK nuclear aims

Baldi also was open to working with rival bidders on standardising the designs for SMRs, so that new nuclear power plants can be connected to national grids more quickly across multiple markets.

This was because the challenge of reviving nuclear energy was not unique to the UK, but a worldwide struggle.

He felt that nuclear contenders in the government’s ongoing SMR competition should be looking to create designs that “can be deployed across different multiple countries and regions” without “having to go through redesigns.”

“We need to work together with the other competitors. We strongly believe in cooperation with other vendors and stakeholders to create these conditions,” Baldi said.

EDF’s ‘Nuward’ proposal consists of two scaled-down pressurised water reactors, generating 340MW, with a lifespan of at least 60 years.

The company has highlighted two potential sites it owns to build its first SMR: Heysham and Hartlepool.

A CGI rendering of EDF’s proposed ‘Nuward’ SMR plants (Source: EDF)

However, EDF has declined to confirm the potential cost of each SMR and the full ambitions of the company, insisting the number of projects approved in the UK is a matter for GBN.

EDF is also currently overseeing the construction of Hinkley Point C – a 3.2GW power plant in Somerset that could power over six million homes, which is set for completion in 2028 – three years late and more than 60 per cent over-budget.

It is also the largest shareholder in proposed plant Sizewell C, a near identical project in Suffolk, which the government has committed over £1bn towards and is targeting a final investment decision before the end of this parliament.

Baldi considered the French-state owned EDF to be “partially markedly British, having been operating and investing in UK for more than 20 years.”

This meant, despite the challenges in building Hinkley Point C, he argued EDF was best placed for public trust in new projects due to its history of operating in the UK.

“We are kind of a local guide. If you want to go and climb new mountains, you probably want to rely on a local guide than someone that’s never done it before,” he said.