EDF may face £1.5bn fee for BE takeover

French energy giant EDF is facing yet another hurdle in its British Energy (BE) takeover bid – a £1.5bn approval fee.

Close to finalising the bid, investors Invesco and M&G, which own 21 per cent of the shares, are understood to have pushed for a sweetener at the eleventh hour and will reiterate their position when EDF renews talks with shareholders this week.

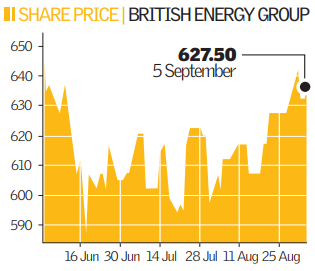

EDF, the world’s biggest energy producer, made a 765p a share cash offer for BE in July, valuing it at £12bn. However, Invesco and M&G said it undervalued BE at a time when energy assets are continued to grow.

Shareholders are now demanding £1 a share more. This would allow investors to take up to £1 of the offer in convertible stock and exploit any rise if the UK nuclear programme proves more profitable than forecast.

M&G have openly preferred a merger between UK-based energy giant Centrica and BE, which would lead to BE’s shares being worth about 925p. But serious consideration of this has been stunted by the government’s preference for a cash offer and a partnership with EDF, due to its nuclear expertise.

The government has been contacting investors, urging them to accept a deal with EDF as soon as possible. All eight of BE’s ageing power stations need to be replaced by 2023.

Although Invesco and M&G are holding out for a higher offer than the one rejected in July, the falling price of oil and other commodities could mean they end up getting less.

EDF chief executive Pierre Gadonneix is keen to secure an agreement that he can take to a board meeting on 17 September.