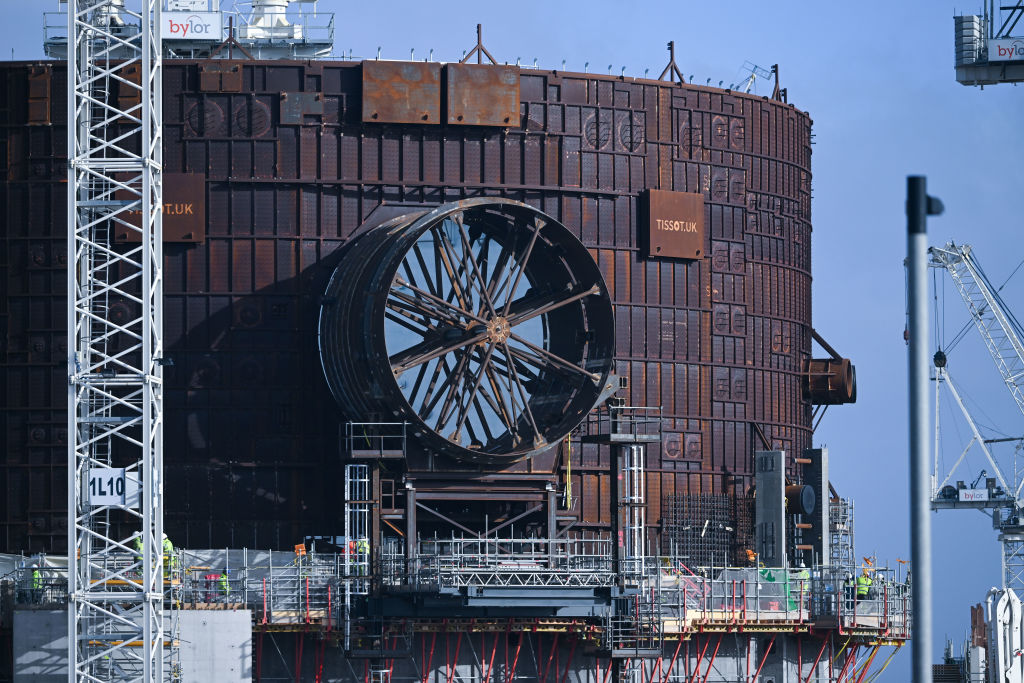

EDF: Inflation drives Hinkley Point C nuclear plant costs from £26bn to £33bn

EDF has told investors that the cost of Hinkley Point C nuclear plant in Somerset could balloon to £33bn – a near 30 per cent hike on previous estimates of £26bn.

The French energy giant revealed costs for the behind schedule over-budget project have been bloated by inflation.

EDF said: “Based on inflation indexes as of 30 June 2022, the estimated nominal cost at completion could reach £32.7bn.”

The cost estimates are unchanged on 2015 prices when EDF made its calculations ahead of the 2016 funding deal for the plant,

However, inflation has since pushed up the price of labour to raw materials, worsened by the pandemic and economic instability.

Estimates for the cost in developing the power plant had already risen from £18bn to £26bn, while its completion date has stretched from 2025 to 2027.

EDF faces funding challenge for nuclear goals

EDF has committed £13bn of investment over the next three years to completing the power plant – and consumers are not on the hook for construction overruns.

However, the price of electricity from Hinkley Point C will rise in line with inflation.

The new estimate also exposes the challenge of reviving the UK’s creaking nuclear fleet, with nearly all of the country’s reactors set for decommission over the next two decades.

The government is targeting a ramp up from 7GW to 24GW as part of its energy security strategy following Russia’s invasion of Ukraine.

Hinkley Point C could generate enough electricity to power six million homes, but funding will be more difficult for EDF in the coming years, with Chinese state nuclear group CGN unlikely to cough up more money to support the project.

The company has a one-third stake in Hinkley, but its contractual funding commitments are expected to be exceeded this year.

This means EDF will have to contribute the remainder of the project costs – with the firm smarting from record £4.4bn losses following the French government’s intervention in the energy crisis.

What does this mean for Sizewell C?

EDF’s latest setbacks come with the company awaiting a final investment decision on site nuclear power plant Sizewell C in Suffolk – with estimates for the project varying from £20bn-£35bn.

Last November, the government committed £700m towards Sizewell C, including about £100m buying CGN out of the project amid security concerns.

The government and EDF currently each have a 50 per cent stake in its development but want to reduce these holdings to 20 per cent by luring external investors in to fund the project.

The site is being supported through the regulatory asset base model, which means taxpayer money will fuel the opening stages of the project.

EDF confirmed that after the financial close, its shareholding in the project will be no more than 19.9 per cent.

Meanwhile, the Nuclear Industry Association has released nuclear’s generation statistics over 2022, revealing that output increased last year to 43.6 TWh.

This helped to avoid the burning of 9bn cubic metres of gas, the equivalent of 15m million tonnes of CO2 emissions – worth more than £1bn at today’s carbon price.

Raised output was driven by £450m of investment and maintenance in nuclear fleet, despite two plants retiring.