Economy: Why the latest data makes a ‘technical’ recession seem (almost) inevitable – with pub spending the only white knight

A ‘technical’ recession is now more than likely to be confirmed when the next official figures arrive.

The UK’s economy shrunk 0.1 per cent in the third quarter of last year, and October and November figures haven’t looked that much prettier.

The question now is whether Brits spent enough in December to keep us out of the red – and perhaps, save much embarrassment for the government .

A technical recession is confirmed when a country records two consecutive quarters of negative growth – so whether or not the UK enters one is on a knife-edge.

Retail sales in December were what many optimistic economists were hanging their hat on. Alas, that hasn’t proved to be the case.

Sales on the high street and e-commerce sites crashed more than 3 per cent year on year, as Brits reined in their Christmas spending.

In a consumer-driven economy, that’s not good news.

According to Capital Economics, the retail sales indicate a -0.15 percentage point reduction from GDP, which isn’t a margin the UK obviously has to play with.

Kathleen Brooks, research director at trading platform XTB, tried to find bright spots: chiefly, that stronger than expected November retail sales may mean that consumers simply bought their spending forward to Black Friday sales.

Ironically, as Danii Hewson at AJ Bell points out, it’s also possible that whilst Brits stopped buying, they didn’t stop going out. Pub groups have reported bumper Christmasses, so did we all get on the sauce instead of buying presents?

“The big question is did people spend their money elsewhere or not all? The answer to that is likely to be the deciding factor in whether or not the UK has fallen into a technical recession,” Hewson said.

But despite that potential fillip, Brooks’ conclusion was clear – those figures “increase the chance of a recession for the UK.”

The news comes at the end of a miserable week of data dumps.

Inflation surprised many analysts to the upside, coming in at 4 per cent on an annual basis in December. Worse, core inflation – a more stable measure less impacted by monthly variations – stayed at a frustratingly high 5.1 per cent.

That forced traders to cut back their expectations on when the Bank of England might begin to cut interest rates – in turn, dampening the UK’s growth prospects.

And wage growth, too, was revealed to have slowed significantly.

“Despite optimism around interest rate cuts, the UK economy certainly isn’t out of the woods,” was the verdict of Charlie Huggins, a portfolio manager at Wealth Club.

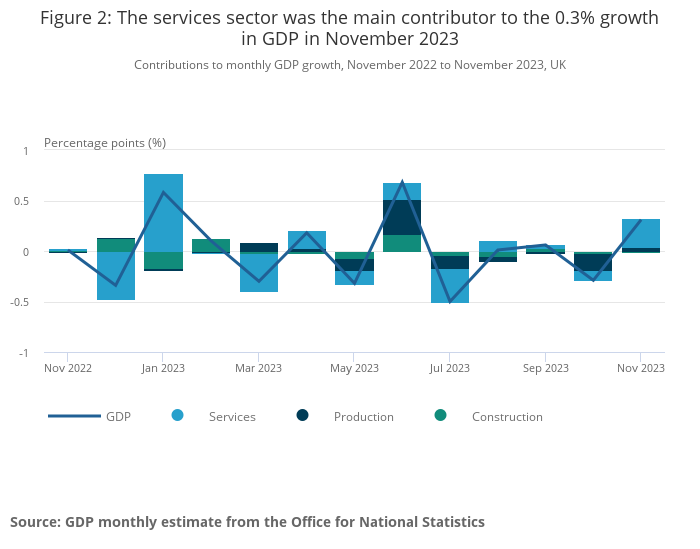

So will the UK enter recession? The odds are surely now on yes, though as we can see from the above chart, volatility has been the name of the game this year.

The bigger question is whether the ‘recession’ tag really matters.

After all, ‘recessions’ are backward-looking. It’s hard to look at Q2 (flat growth) and Q3 (negative growth) and argue that if the fourth quarter is again flat – ie, avoiding a technical recession – its good news.

Consumers feel the pinch before the official stats show up. And more than that, so do businesses.

The most useful canary in the coalmine is usually recruiters – and a series of downbeat updates from Robert Walters, Hays and Pagegroup over the past fortnight tell their own story, with temporary hiring the only bright spot in the fourth quarter.

The one person for whom a recession really will make a difference? Rishi Sunak.

Economic data may be largely backward-looking, but a recession-related hit to already troublesome polling intention figures would be a very clear sign of things to come at the election.