East African states strive for single capital market as Mauritius diversifies

CFA Institute has examined Africa’s 10 largest capital markets in a major report compiled by Heidi Raubenheimer, CFA, our senior director for journal publications. Here we highlight key developments across East Africa and also take a look at island nation Mauritius.

East Africa: Kenya leads way as tech platform links markets

The East African Community (EAC) is the fastest-growing economy in sub-Saharan Africa in the past three years.

The EAC, which includes Kenya, Tanzania, Uganda, Rwanda, Burundi and South Sudan, has a combined population of 172 million and a combined GDP of USD172 billion (about £130bn).

The EAC has developed the Capital Markets Infrastructure, a technology platform linking the capital markets of the partner states by connecting their exchanges and central securities depositories.

Kenya’s equity market, the Nairobi Securities Exchange (NSE), is the most vibrant and diverse in the region. In addition to its main market, it has an alternative investment market and a growth enterprise market. It lists a wide range of debt securities from government and corporate issues to Real Estate Investment Trusts (REITs) and an exchange-traded fund (ETF) based on gold bullion.

Tanzania is a smaller but growing market. Incentives to issuers include reduced corporation tax, tax deductibility of initial public offering (IPO) costs, and no capital-gain taxes for investors or stamp duty on transactions.

Rwanda’s incentives also include an exemption from capital gains taxes. The Capital Market Authority of Rwanda has launched a capital market masterplan setting strategy for the next 10 years.

Plans for the EAC are focused on establishing a single market in financial services among EAC partner states, with a view to making financial products and services available to all at competitive prices.

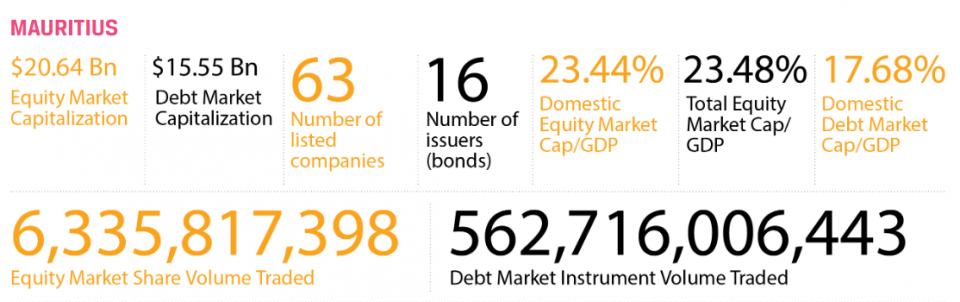

Mauritius: island nation’s internationalisation drive sees foreign listings grow

As a former sugarcane monocrop economy, Mauritius has developed significant financial services, real estate and tourism sectors.

Of the 300 sugar mills operating in the mid-19th century, just three remain. But some of the companies that operated the mills still survive, having spun off their operations into multi-sector conglomerates, banks and insurance companies.

The largest of these conglomerates are listed on the Stock Exchange of Mauritius (SEM), growth of which being facilitated by the creation of multi-currency listings, trading and settlement in 2012.

As a result of an expansion of the multi-currency platform and an internationalisation drive to position Mauritius as an international financial centre, foreign listings are growing. The majority of these are Real Estate Investment Trust (REIT)-type companies, which now represent 16% of the local market.

In debt markets, an uptick in the secondary market for sovereign bonds can be ascribed to changes in the primary dealer system in 2017. Primary dealers must now offer 60% of their domestic sovereign debt holdings for sale, act as market makers, and flag all trades on Bloomberg’s E-bonds system.

Corporate debt issuance does not match demand, with the result that corporations tend to issue bonds as a cheaper alternative to bank loans.

The future development of Mauritian capital markets depends on the ability to lend securities, to short sell and to use derivatives; reduced settlement times; and local investors diversifying wealth from bank deposits and real estate to stocks and bonds.

In future postings… we will take a look at capital market developments in Nigeria & Ghana; and Egypt & Morocco. Click the following links for our earlier look at developments in South Africa & Namibia and Botswana & Zimbabwe.

Visit CFA Institute for more industry research and analysis.

About the report

Our tales of African capital markets’ history and future reflect the journey of CFA Institute: from a lunch group in New York City in 1937 to a diverse collection of 170,000 members and 157 societies worldwide in 2019, united with the purpose of leading the investment profession globally for the ultimate benefit of society.

Some of Africa’s exchanges were established in early colonial times. South Africa led the way on the heels of the diamond and gold rush, followed by Zimbabwe, Egypt, and Namibia (a German colony at the time) – all before 1905. Some didn’t outlive the commodities rush but others are still thriving – substantially diversified and modernised.

Some capital markets were established more recently, and their development tells of independence and nation-building: Nigeria in the 1960s; Botswana, Mauritius and Ghana in 1989; Namibia post-independence from South Africa in the 1990s. Others, particularly the East African exchanges, are new and leapfrogging toward greater participation.

All tell of how regulation, trading technology and fintech are enabling fairer, faster and lower-cost participation in finance and investment for more market participants.

The CFA Institute Research Foundation brief was developed in conjunction with the African Securities Exchanges Association (ASEA).

Authors:

East Africa

Aly Ramji (Director), Virginia Wairimu (Research Analyst) & Martin Mwita (Research Analyst) – all Mediapix Limited; & Rufus Mwanyasi, Executive, Canaan Capital

Mauritius

Bhavik Desai, Head of Research, AXYS Stockbroking Ltd