Dubai puts in bold £469m bid for Refco

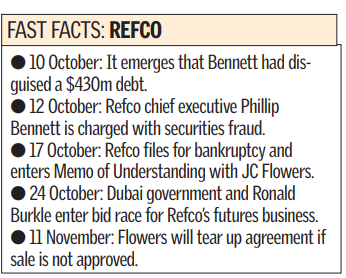

The fortunes of stricken American hedge fund Refco took a fresh twist yesterday after a bid led by the Dubai government and billionaire Ronald Burkle trumped offers for its future trading units.

The Dubai group’s $828m (£468.8m) offer exceeds a $768m bid by private equity fund JC Flowers and $790m from Interactive Brokers Group LLC.

It also emerged that Man Financial, the futures brokerage unit of Man Group that had previously ruled itself out of the running, may re-enter the fray bid for all of Refco. New York-based Marathon Asset Management, which is a creditor, is interested in the company.

More than 100 lawyers packed US Bankruptcy Judge Robert Drain’s hearing yesterday as rival suitors attempted to block the deal struck with JC Flowers. Refco entered a memorandum of understanding with JC Flowers on 17 October and had sought court approval for the deal, which carries a breakup fee of 2.8 per cent.

In court, rival bidders argued over the rules governing the auction. They questioned the breakup fee, whether the unit would be sold to the highest bidder and Refco’s haste to complete a deal.