Dresdner Kleinwort set for job cuts after Commerzbank seals the deal

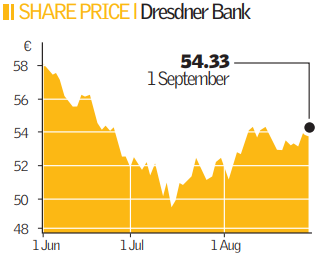

Dresdner Kleinwort employees were bracing themselves for a round of sweeping job cuts yesterday, after German bank Commerzbank completed a deal to buy Dresdner Bank from insurers Allianz at the weekend.

Dresdner Kleinwort, led by CEO Stefan Jentzsch and his team employs about 5,500 staff in the UK, with 2,000 of those based in the City. And Commerzbank revealed yesterday that its €9.8bn (£7.9bn) takeover of Dresdner Bank would see 9,000 job cuts, 2,500 of those coming outside Germany. It also said it would drop the Kleinwort name, one of the oldest banking monikers in the City.

The deal could see more than 1,000 people in the City losing their jobs, as Commerzbank looks to streamline its operations to squeeze some value out of loss-making Dresdner.

The bank has been an albatross around the neck of Allianz, which acquired it in 2001 for €23bn and has seen its shares fall around 61 per cent since then as it failed to turn the bank into a profitable unit.

Commerzbank’s main interest in acquiring Dresdner is the opportunity to become the largest high street bank in Germany by retail outlets, an indication that it is unlikely to have much interest in maintaining a large investment banking operation in London.

The bank has previously wielded the axe in its own struggling investment banking division, where it cut jobs, reduced its brokerage and research activity, and closed proprietary trading.

Those initiatives were spearheaded by chief executive Martin Blessing, who will head the new bank, giving weight to fears that job cuts will be high on the agenda.

The combined bank will be Germany’s largest by customer base, with a footprint of some 1,692 retail branches and an 11 per cent share in lending and around 12m retail customers in Germany.

But the new entity, with assets worth around €1.02 trillion will still play second fiddle to German market leader Deutsche Bank, which has €2 trillion in assets.

City Views: Should Dresdner Kleinwort employees be worried for their jobs?

Nic Clarke (Charles Stanley): “This brings to an end an expensive experiment in ‘bancassurance’ by Allianz given that the original price tag was €23bn in 2001. There are likely to be substantial job losses in London as Commerzbank looks to scale down the Dresdner Kleinwort investment banking operation.”

Darren Sinden (Lite Financial): “The majority of job losses are likely to be felt in Germany, so I’m not sure Dresdner Kleinwort employees should start to worry just yet. Also, the deal will take a good 18 months to go through and that’s a long time in the markets. Who knows what might happen.”

Justin Urquhart-Stewart (Seven Investment Management): “It’s not just Dresdner Kleinwort employees who should be looking over their shoulders if the number of mergers and acquisitions increases. There is simply not enough business and too many banks out there. The landscape of financial services is likely to look very different in two years from now.”