Dragon Oil share price soars as board agrees £3.7bn takeover offer

Dragon Oil’s board yesterday approved a sweetened takeover offer from Emirates National Oil Company (ENOC), breathing fire into its share price on hopes that minority shareholders will accept the deal.

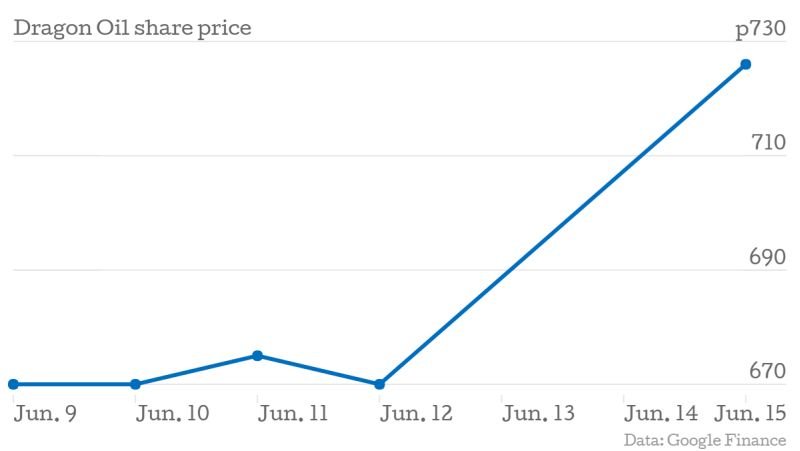

Shares in the oil explorer, which operates in Turkmenistan, soared 9.6 per cent to a record high of 734p in early trading, before settling to close 8.4 per cent higher at 726p. Analysts put the Dubai state-owned oil company’s raised offer of 750p per share – which values the company at £3.7bn – at the higher end of their estimates.

ENOC already owns 53.9 per cent of Dragon Oil. It needs the majority of the other shareholders to agree to the deal, around 23 per cent. ENOC then plans to delist the firm from the Irish and London stock exchanges.

ENOC said the deal aligns with its strategy to become “a fully integrated global oil and gas company”, adding Dragon Oil’s upstream asset to its downstream and midstream business.

Dragon Oil’s largest minority shareholder Baillie Gifford, which has a 7.2 per cent stake in the company, is rumoured to think the 750p offer is inadequate. The asset manager declined to comment. “I think Baillie Gifford will play hardball to get more money, but it’s unlikely they’ll be able to as it’s not a hostile takeover – it has been recommended by the board,” said oil and gas analyst Malcolm Graham-Wood.

ENOC made an offer of 650p per share in March, which it raised to 735p per share at the end of May. It also made a rebuffed offer back in 2009.