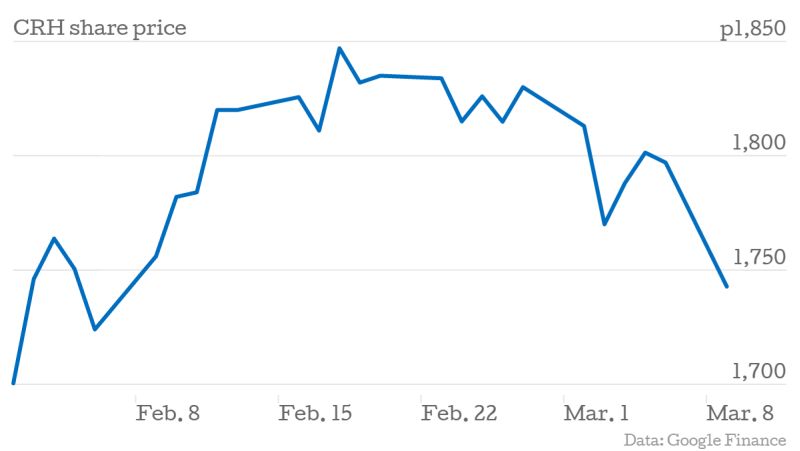

CRH share price dives as doubts of Holcim-Lafarge merger hit Irish firm

Shares in Irish building supplies company CRH plummeted yesterday amid reports that a merger between Swiss cement maker Holcim and its French counterpart Lafarge could fall apart.

The fears arose after Holcim’s largest stakeholder, Thomas Schmidheiny, who owns about 20 per cent of the company, demanded a better deal, according to Swiss weekly SonntagsZeitung.

The companies hope a combination, which would create a business with $44bn (£29bn) in annual sales, will help them to cope better with the overcapacity and sluggish demand that have dogged the construction industry since the 2008 economic crisis.

However, analysts have seen a potential divergence in earnings prospects as opening the possibility of a renegotiation of the deal which is based on each Lafarge share being swapped for one Holcim share.

According to reports, Schmidheiny sees two possible solutions. One is to change the exchange ratio of shares to favour Holcim investors, rather than being one-for-one. Another is a special dividend.

Dublin-based CRH had agreed to buy €6.5bn (£4.6bn) of assets that Lafarge and Holcim planned to shed to assuage competition concerns about their merger. Many analysts view those purchases by CRH as potentially transformational.

Not only would they boost its presence in eastern Europe, but they would also see CRH enter Brazil and the Philippines.

Cantor Fitzgerald analyst Ian Osburn last month estimated that the businesses CRH planned to purchase would have boosted last year’s earnings before adjustments by 41 per cent, or some €750m.

He forecast that if CRH succeeds in buying the assets, the deal could add 300p on to the FTSE 100 company’s share price. Shares in Holcim were up by 0.81 per cent on the Swiss stock exchange yesterday, while Lafarge fell by 1.32 per cent in Paris.