Domino Printing share price jumps by a third after £1bn Brother Industries buyout

Shares in Domino Printing Sciences, the UK tech company, jumped more than 31 per cent to 945.7p in early trading after it revealed it had been bought for £1bn by Japanese printer giant Brother.

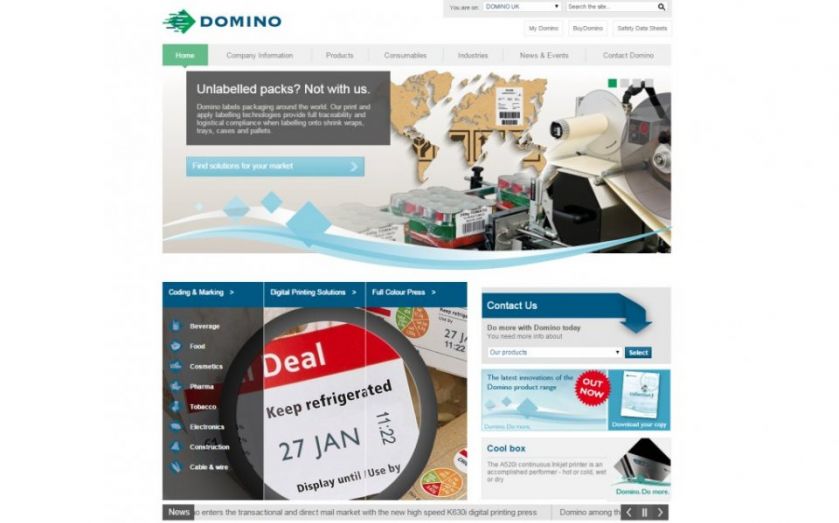

Under the terms of the deal, shareholders in FTSE 250-listed Domino, which makes printers that put sell by dates and bar codes on packaging, will receive 915p in cash, representing a premium of 26.9p on Tuesday's closing price. Crucially, they'll also still be paid the 14.76p per share dividend they had been promised.

Brother – which recently engaged in a slightly bizarre UK ad campaign for its label-making devices – insisted Domino will be operated as a standalone company, rather than being absorbed into it.

Domino employs 2,300, with operations in the UK, Germany, Sweden, China, the US and India. This morning Peter Byrom, its chairman, said:

Domino is a unique company with a strong track record, which has established itself at the forefront of the coding and marking industry through consistent innovation and delivering solutions that meet its customers’ needs.However, the markets in which Domino competes are evolving, with the increasing adoption of digital printing technology, and attracting a new breed of competitor with significantly greater scale and financial firepower than Domino. It has become increasingly clear that maintaining its position in the enlarged markets will require Domino to find the appropriate partner that brings complementary skills and strengths in digital printing.