Docusign chief: Brexit has slowed UK dealmaking – but that’s an opportunity for us

The chief executive of contract management company Docusign has said Brexit and British red tape have stifled dealmaking in the UK, making it much slower compared to the US.

Allan Thygesen, who took over as chief in September 2022, told City A.M. that Brexit and the regulatory and compliance issues that have come with it “just adds burden” to operating in the UK, he said.

His comments come as the firm looks to push into Europe and the UK, spurred by new research from the firm and Deloitte suggesting that fewer European customers are using ‘intelligent contract analytics’ than US customers.

Europe, the Middle East and Africa (EMEA) is also the region that is slowest for processing agreements, taking an additional 16 hours compared to the global average, the research found.

For this reason, the San Francisco-headquartered company spies a big opportunity. “We’re very bullish on Europe,” said Thygesen, “we think it’s probably our biggest growth market outside the US.”

Thygesen previously spent a decade leading Google’s advertising division in the US and he has put his expertise to good use with a rebrand of Docusign, including changing its logo.

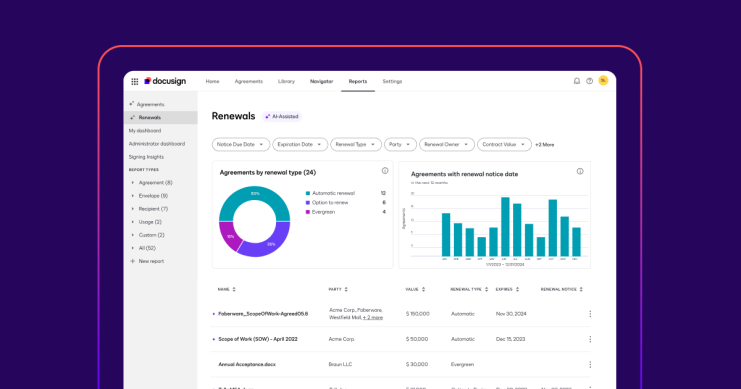

He has also introduced a new AI suite of tools for its customers, with the aim of creating a broader revenue stream for the company beyond its trademark e-signature product.

Thygesen has also introduced a new artificial intelligence platform called Intelligent Agreement Management, designed to be an end-to-end service for the whole process of contract management, including the negotiation stage.

AI has had a “very dramatic shift in capability” over the last 18 months, Thygesen said. “And so we saw that and said, ‘well, this potentially resets what’s possible in contract management’.” He added that AI will continue to create “a lot of new work opportunity”.

He may be hoping this will reverse the company’s stock price, which came crashing down in 2022 after struggling to maintain the momentum it saw during Covid-19, when sales boomed as companies relied on digital document solutions to keep business operations chugging.

In February, Docusign was forced to launch a restructuring plan, including laying off six per cent of its global workforce, mainly in sales and marketing.

His comments also come amid rumours that private equity firms Bain Capital and Hellman & Friedman were competing to acquire Docusign for nearly $13bn, although Thygesen told CNBC that the company is focused on being an independent company “right now”.