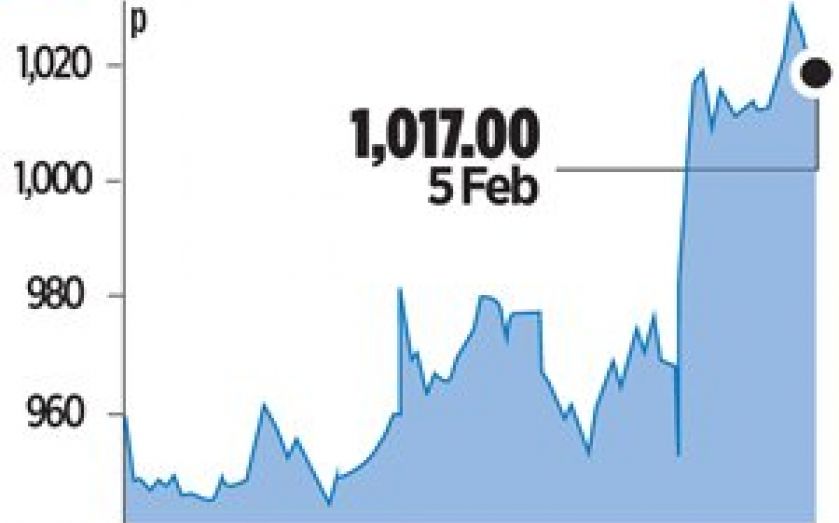

DMGT shares hit 13-year high as Zoopla eyes float

PROPERTY search website and app Zoopla is heading towards a London initial public offering (IPO) after its majority owner, the Daily Mail & General Trust (DMGT), yesterday confirmed Zoopla’s board was considering “strategic options” for the company.

Shares in DMGT rose to a 13-year high after the news emerged and closed up five per cent at 1,017p.

DMGT also reaffirmed that Zoopla has hired Jefferies and Credit Suisse to help it explore options, of which analysts say a float is the most likely.

“The likely decision to pursue an IPO of Zoopla should help crystallise a rising sum of the parts valuation [of DMGT],” said Canaccord Genuity analyst Simon Davies.

After the release of DMGT’s interim management statement finance chief Stephen Daintith refused to comment on any float plans but said that his company’s investment in Zoopla had been significantly under £100m to date. Analysts yesterday said DMGT’s 52.6 per cent stake in Zoopla could be worth between £575m and £680m if sold, with Zoopla expected to achieve a valuation of above £1bn.

“Our view is that DMGT is not a strategic holder of Zoopla and a sale of the stake could drive cash returns,” said Liberum analyst Ian Whittaker.

DMGT also reported its online advertising revenue grew by £5m to £14m for the quarter, offsetting a £1m drop to £53m in print advertising revenue at the Daily Mail and Mail on Sunday.

Underlying revenue at the group reached £472m in the three months to 31 December.