Diageo: Glass half-empty as Latin American horror show continues for Guinness maker

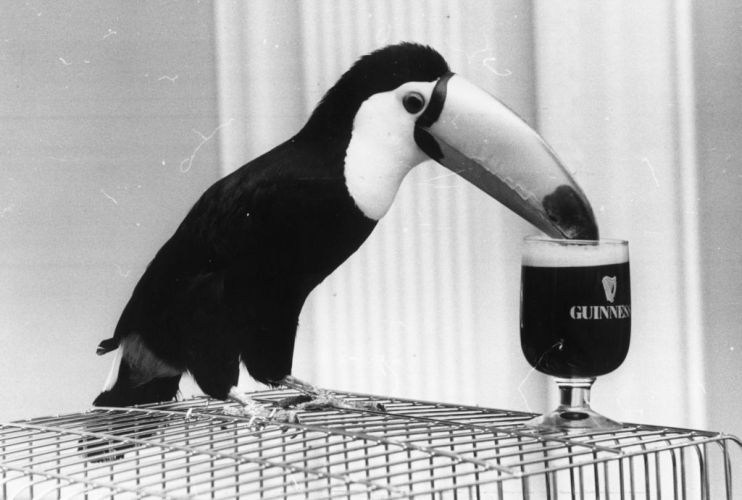

Diageo, the drinks giant behind Guinness and a host of top-shelf spirits, has seen growth slip in every region across the world, dragging profits sharply southward.

Shares fell more than 3 per cent in early trading.

The FTSE 100 firm told the London market this morning operating profit declined 11.1 per cent to $3.3bn (£2.6bn) across the first half of the year, much of which driven by a particularly grim performance in Latin America.

Net sales sank by 18 per cent across the region, following a warning last year that this market was steering clear of top-shelf liquor.

The firm expects to stem losses in Latin America by reducing inventory.

“As a result, we expect organic net sales in LAC to decline between the range of -10% to -20% in the second half of fiscal 24, compared to the second half of fiscal 23. However, we expect to close fiscal 24 with a more appropriate level of inventory for the current consumer environment,” the firm said.

Volumes slipped across every region, though net sales did reach positive growth territory in APAC and Europe.

Diageo, which also makes Smirnoff vodka and Captain Morgan rum, has around £29bn wiped off its market cap value over the past year amid a slowdown in trade.

The group has also not been helped by hiking prices for consumers – which it issued twice last year – chalking the decision up to rising costs.

Debra Crew, chief executive, said:”The first half of fiscal 24 was challenging for Diageo and our sector, particularly as we lapped strong growth in the prior year and faced an uneven global consumer environment. Excluding LAC, our group organic net sales grew 2.5 per cent, driven by good growth in Europe, Asia Pacific and Africa.

“While North America delivered sequential improvement in line with our expectations, we are focused on returning to high-quality share growth as consumer behaviour continues to normalise in our largest region.

She added: “As previously announced in November 2023, materially weaker performance in LAC, driven by fast-changing consumer sentiment and high inventory levels, significantly impacted total business performance.”

“Having conducted a review of inventory levels and monitored performance in the critical holiday season, we have taken action and have further plans to reduce inventory to more appropriate levels for the current consumer environment in the region by the end of fiscal 24. This is a key priority.”