Diageo bullish as profits rise

With two world wars and a few revolutions under its belt, alcoholic drinks giant Diageo is well placed to weather the economic downturn, its chief executive Paul Walsh said yesterday when announcing the group’s results – despite warning of slowing growth ahead.

The maker of Guinness and Smirnoff posted a 2 per cent increase in full year net profit, buoyed by strong sales of Scotch in South America, beer in Africa and premium spirits in the US.

“We can be confident that our brands will continue to do very well. They have faced more economic cycles than we’ll ever see – world wars and revolutions – and have still gone strong,” said Walsh.

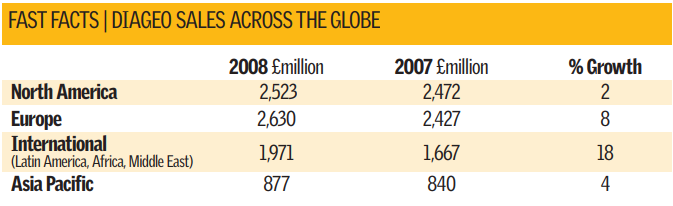

Net profit in the year ended 30 June was up to £1.52bn, from £1.48bn in 2008, while revenues also rose by 8 per cent to £8.09bn.

But he warned that profit growth in 2009 might slow as its biggest markets, Europe, teeters on the brink of recession.

“We enter the new financial year facing slowing global GDP growth and more challenging global economic trends.”

The company is banking on strong growth in emerging markets like Latin America and Asia to make up for tougher conditions in Europe and the UK. “The strength of global diversity in our business allows us to mitigate risks,” said Walsh.

He added that three new premium brands, designed to cater for America’s new-found taste for upmarket liquor, would improve the firm’s prospects in the US.

Shares in Diageo rallied on the results closing up by just over 2 per cent at £10.

Analyst Views: Does Diageo’s global footprint leave it well placed to deal with the downturn?

Richard Hunter (Hargreaves Lansdown): “The fact that they have got global diversity gives them an advantage, even though they have seen slower growth in the US. Drinks are like food, in that they have a defensive nature in a downturn and tend to be more resistant. We’re seeing the diet in emerging economies change, and there’s no reason that this shouldn’t apply to spirits. China and Japan are becoming more attuned to premium brands, and Diageo is likely to benefit from this.”

Sam Hart (Charles Stanley): “Diageo is experiencing good growth in emerging markets like Africa and Latin America, where wine and beer sales are strong. Although it’s had a hiccup in Asia – after Korea imposed a temporary ban because Diageo distributed using unlicensed wholesalers – the long term prospects there are good, and it is performing strongly in Thailand, China, and to a lesser extent, India. The growing demand for premium brands also leaves it well-exposed.”

Adil Bahar (researchoracle.com): “Despite emerging markets being major growth drivers for Diageo, the company derives 60 per cent of its revenues from the US, UK, Spain and Ireland, which are currently experiencing slowing economic conditions. Hence, we believe that since the company’s revenue mix is biased towards these developed economies, growth from emerging markets is unlikely to completely offset the overall economic slowdown being felt in more mature and developed markets.”