Deutsche delays legal bills and gains from bond trading recovery

SHAREHOLDERS welcomed Deutsche Bank’s unexpectedly strong profit figures yesterday, but the troubled lender still faces more legal bills in the months ahead.

Analysts had predicted the giant German institution would make a loss in the fourth quarter with legal bills of as much as €1bn (£752m). But some costs were postponed, reducing the hit to €207m.

Trading revenues were stronger than those seen at rival investment banks in the US, and Deutsche also met its leverage ratio target a year early.

Pre-tax income came in at €253m for the three-month period, compared with a loss of €1.8bn in the same quarter of 2013.

Overall profits for 2014 came in at €3.1bn, more than double the €1.5bn made in 2013.

Revenues rose 19 per cent on the year to €7.8bn for the fourth quarter.

Deutsche’s corporate banking and securities business performed well, with revenues up 20 per cent to €3bn and pre-tax incomes up from €132m to €516m.

Equities trading revenues increased 35 per cent, while fixed income trading improved 13 per cent, defying a downward trend across other investment banks.

Global transaction banking profits also improved sharply, from €86m to €265m, while asset and wealth management profits rose from €200m to €365m.

However, private and business clients’ pre-tax income fell 75 per cent on the year to €55m.

Deutsche Bank also improved its capital position, with its core equity tier one position improving to 11.7 per cent, and its tier one leverage ratio rising to 3.5 per cent, hitting its target a year early and reassuring investors.

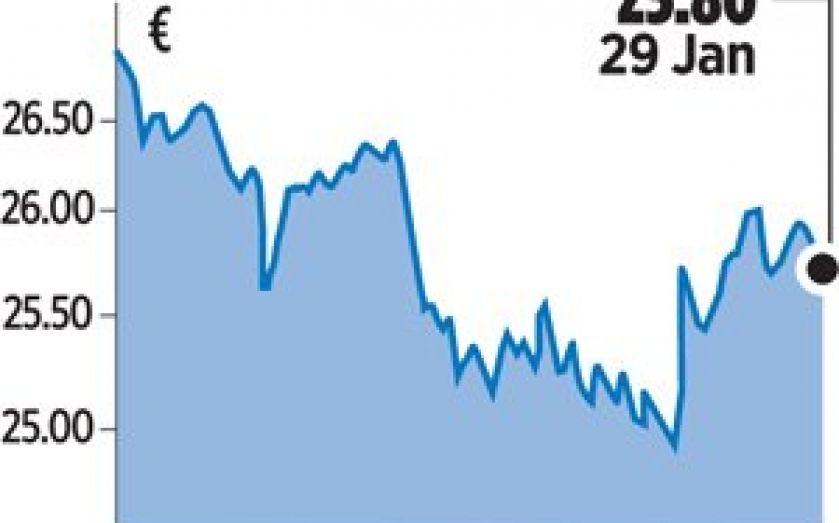

The bank’s shares rose four per cent on the day.