Deutsche Bank profit squashed by legal costs

DEUTSCHE Bank’s turnaround efforts are being hindered by mounting litigation costs, as the giant investment bank’s profits are increasingly being used to pay the bills.

It set aside another €894m (£706m) for litigation in the third quarter, pushing the bank to a net loss of €92m for the three months.

In the same period of 2013, it made a profit of €51m.

Revenues improved by two per cent on the year to €7.9bn.

Corporate banking and securities revenue jumped nine per cent to €3.1bn, largely on the back of a 15 per cent improvement in debt and sales trading.

Its private and business clients revenue edged up three per cent to €2.4bn.

Non-interest expenses fell 3.7 per cent to €7.3bn, and co-chief executive Anshu Jain said Deutsche had hit its €3.9bn cost savings target three months early.

“The litigation provisions had a significant impact on profitability,” said Jain. “We are working towards a resolution… but we recognise the timings are not solely in our control.”

But chief finance officer Stefan Krause warned more costs could be on the way: “We are reserved for known topics. Some topics are further down the process than others. Forex is not far down the process.”

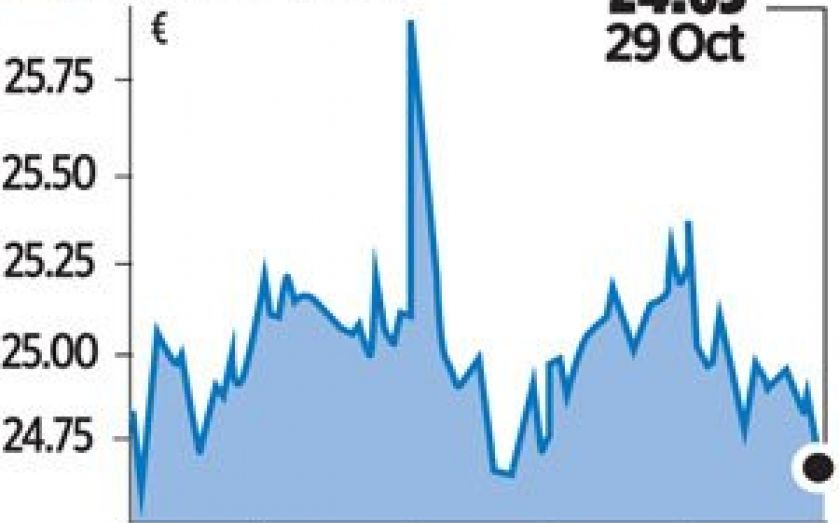

Deutsche Bank’s shares closed the day down at €24.65.