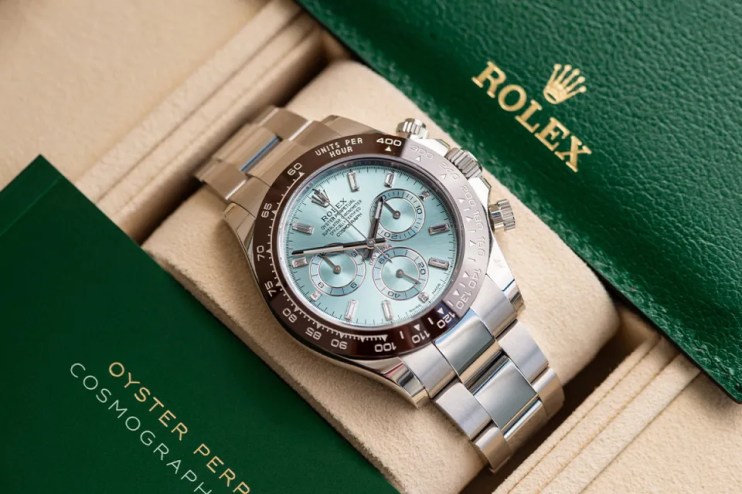

Demand for Rolex and Tag Heuer watches slump as demand in China falls

Monthly exports of pricey Swiss watches such as Rolex and TAG Heuer have fallen for the second time in three years, led mainly by lower deliveries to Greater China and Hong Kong.

The Federation of the Swiss Watch Industry said today that exports dropped 3.8 per cent in February after more than two years of steady growth.

The number of watches shipped to Switzerland also fell by 5.2 per cent to 1.2m units.

Among the main markets, the United States, Japan, Singapore, the United Arab Emirates, and France remained on a positive course in February.

However, their growth was not enough to offset the sharp decline in demand for Rolex and other watches seen in mainland China and Hong Kong , which slumped by 25.4 per cent and 19 per cent, respectively.

Most markets in Europe saw a fall in performance, ranging from -2.1 per cent for the United Kingdom to -16.8 per cent for the Netherlands.

Consumers’ appetite for luxury goods such as watches and jewellery has fallen amid a period of economic uncertainty.

A number of designer retailers, such as Watches of Switzerland and Burberry, have reported a slowdown in sales as shoppers scale back on big purchases.

Watches of Switzerland said in January it now expects revenue for the full year to be in the range of £1.53bn to £1.55bn, down from a guidance of £1.65-£1.70bn.

Speaking at the time, Brian Duffy, chief executive officer, said: “The festive period was particularly volatile this year for the luxury sector, with consumers allocating spend to other categories such as fashion, beauty, hospitality and travel.”

Russ Mould, investment director at AJ Bell, said: “Watches of Switzerland continues to suffer from the downturn in the luxury goods market and a nice Rolex or fancy Omega were not in Santa’s sleigh a month ago.”

British fashion house Burberry also slashed its profit guidance for the year, in response to a slowdown in demand for luxury purchases.

China’s slow rebound from the pandemic has also bruised luxury markets, as the country traditionally has a strong appetite for European designer goods.

Earlier this year, analysts at Jefferies agreed to cut their 2024 industry demand growth assumption for global luxury brands from four per cent to two per cent.