Dell goes down to the wire as vote is delayed

DELL has posponed a shareholder vote on its chief executive’s $24.4bn buyout offer until next Wednesday, after failing to get enough support to seal the deal, despite winning over several large investors at the eleventh hour.

The adjournment of the meeting – called yesterday, minutes after shareholders gathered at Dell’s headquarters in Texas to decide on what could be the largest buyout since the financial crisis – buys time for co-founder and chief executive Michael Dell to persuade naysayers to switch sides.

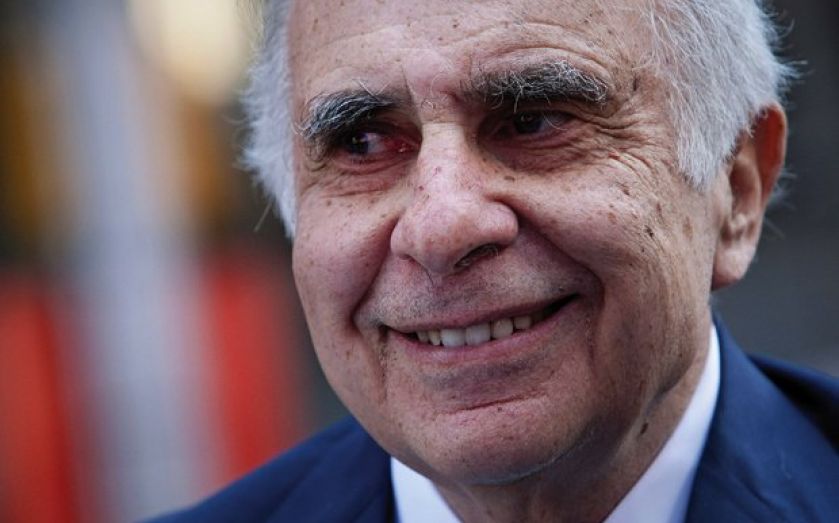

Complicating matters, billionaire investor Carl Icahn, who has amassed an 8.7 per cent stake in Dell, is leading a charge with major shareholder Southeastern Asset Management against the buyout with an offer of his own. He and others say Michael Dell’s deal undervalues the world’s third largest PC maker.

In the week leading up to yesterday’s meeting, Icahn’s team and Dell’s special board committee – which supports the CEO – have flooded shareholders with letters and documents to argue their respective positions.

Vanguard and BlackRock are now on board with the proposal, sources familiar with the matter said.

Icahn was quick to respond to what he called an “unfortunate” adjournment. “This delay reflects the unhappiness of Dell stockholders with the Michael Dell-Silver Lake offer, which we believe substantially undervalues the company,” he said in a statement issued with Southeastern.