Deliveroo: Top bosses get first pay rise since tumultuous London IPO

The top bosses at Deliveroo have been awarded their first pay rises since the company’s float on the London Stock Exchange almost three years ago.

The business completed its IPO at the end of March 2021 with an offer price of 390p per share. However, its shares plunged by as much as 30 per cent on the first day, wiping over £2bn off its valuation.

Ahead of the float, the listing had been hotly anticipated as it was the London Stock Exchange’s biggest IPO since Glencore’s market debut in 2011.

Deliveroo currently has a market capitalisation of just over £1.7bn with its shares changing hands for around 118p each.

Earlier this month, the company said that a strong demand for takeaways and lower costs helped it record a positive EBITDA last year. Overall, the company’s loss for the period was £32m, compared to £262m last year.

Now, Deliveroo’s newly-published annual report has confirmed that the company’s top executives have been awarded a 3 per cent pay rise.

The business said the rises are the first since its IPO and “were made against the backdrop of increases provided to the broader employee population over the last three years”.

It added the increases were below the average rises being awarded to the wider workforce of around 4 per cent.

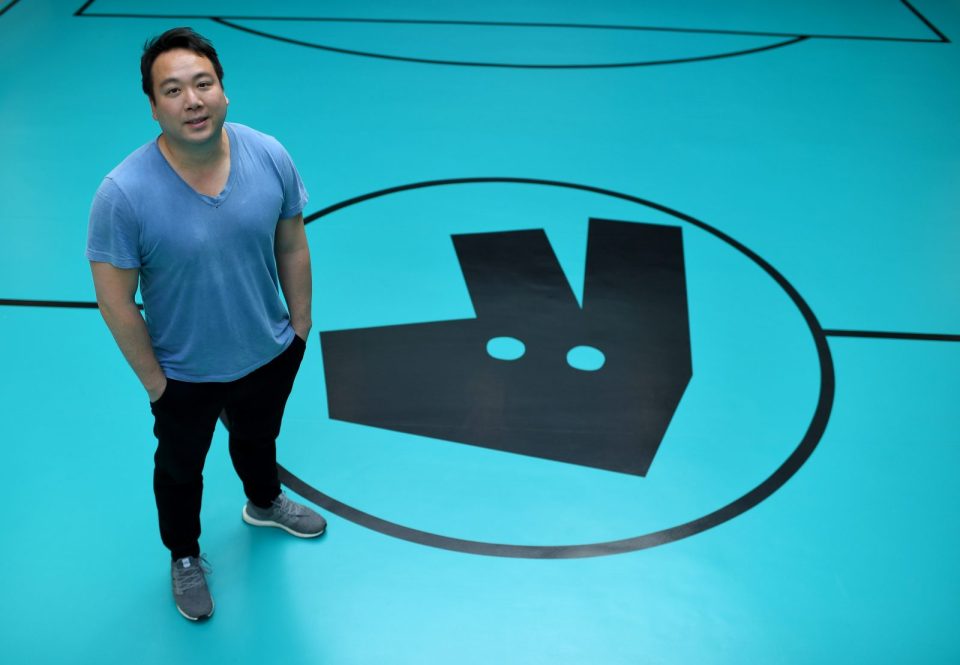

As a result of the change, chief executive Will Shu’s annual salary has been used to £618,000 while chief financial officer Scilla Grimble’s pay now stands at £515,000.

The fees of Deliveroo’s chair and base fees for non-executive directors have also been upped by 3 per cent to £438,000 and £93,000 respectively.

In the annual report, remuneration committee chair Dame Karen Jones said: “The committee continues to support the group’s strategic priorities by carefully balancing the implementation of the remuneration policy while also taking into account market conditions and making permitted adjustments where necessary.

“We are committed to equipping Deliveroo with the necessary tools to attract, retain, and motivate executives and the wider organisation to achieve the company’s ambitious plans in a competitive global marketplace, whilst balancing the long-term interests of the company and our shareholders.”