DeFi defying gravity: risk, reward, hype and FUD

DeFinition…

DeFi is an acronym for Decentralised Finance, an ecosystem of decentralised applications (dApps) that provide financial services built on distributed networks without any centralised governing body.

Decentralised finance applications aim to become an alternative to the banking sector and replace the traditional technologies of the current financial system with open-source protocols. That is, to give a large number of people access to decentralized lending, new investment platforms and other basic and advanced financial tools.

Problems with centralised financial institutions

Imagine that you have an employee in an essentially supporting role, demanding more and more maintenance, but failing to provide adequate value to productive parts of your team or company as a whole. It seems like a no-brainer to part ways with this “passenger” and hire a more productive actor, for a fraction of the price, unless this employee is in some deep relationship with stakeholders…

Replace “employee” with “financial institution” and “company” with “global economy”, and this becomes a summary of the role of current financial institutions in the global economy. It is quite possible that honest and earnest players in the DeFi space could serve as viable candidates for the job at which current “too big to fail ” financial and banking incumbents fail to perform, while cashing in yearly bonuses out of bailouts funded by ordinary taxpayers.

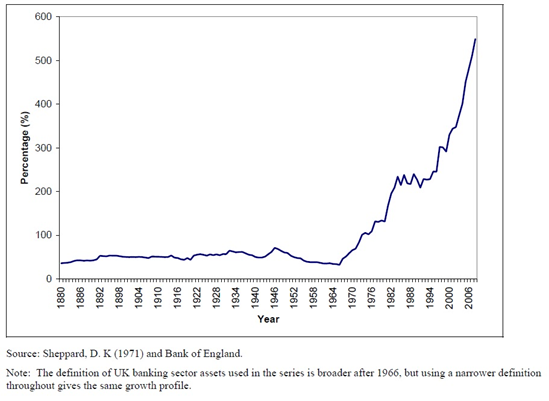

UK Banking sector assets as percentage of GDP

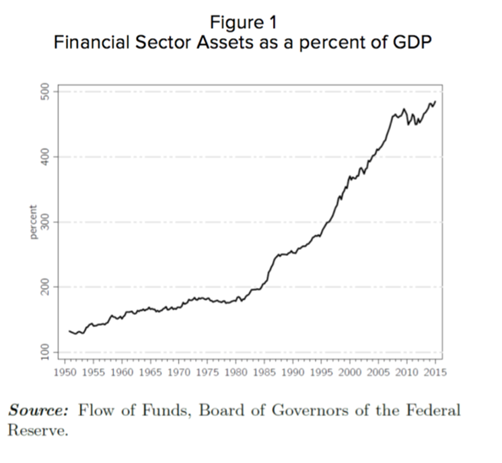

Interest rates on today’s banking deposits are close to 0% or even negative, especially in Europe. Just two European Union members – Croatia (2.5%) and Romania (1.25%) – have interest rates above 1%; the other countries in the Euro area have 0%. The interest rate in the US is 0.25%. Moreover, trillions of dollars in global assets bring negative returns. The market value of the Bloomberg Barclays Global Negative Yielding Debt Index at the end of 2020 rose to $18.04 trillion.

This combination of low or negative interest rates and high liquidity makes alternative investment methods extremely attractive. DeFi services offer users potentially significant interest in crypto or stablecoins. That’s why many people use or consider using DeFi. Investing in DeFi also attracts crypto-enthusiasts and hodlers, who believe that the coin’s value will grow and want to get additional income from it.

DeFi apps enable their users to access effective protocols to swap, transfer and lock liquidity and get extra income. Trust and reliable DeFi projects work similarly to traditional banks on the surface: clients make deposits in crypto or stablecoins and the DeFi app invests this liquidity, then the income is shared with clients according to the relevant smart contract.

Advantages of DeFi: potentially high rates of return

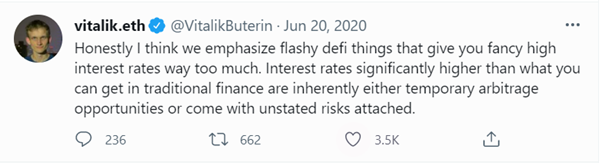

The unique value proposition of DeFi is high rates of return. However, this tweet from Ethereum’s founder, Vitalik Buterin, offers vital insight:

Due to the inherent volatility of digital currencies, depositing stablecoins is a type of DeFi activity with less user-facing risk, compared with the alternatives. There are various platforms that aggregate existing offers, such as Staking Rewards. Different services offer anything from 3-4% right up to 40% interest per year for deposits in stablecoins. In April 2021, the cryptocurrency exchange Binance was ready to pay up to 37.36% in USDC.

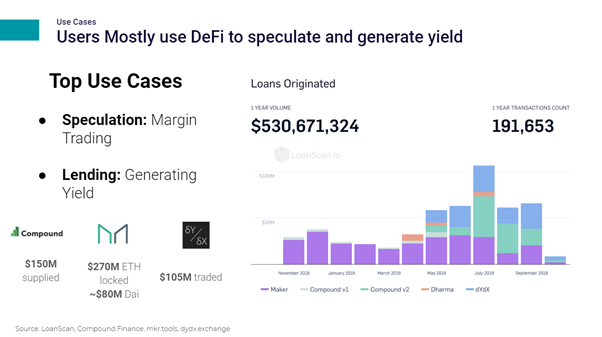

Lending protocols like Maker and Compound get income like classic banks – they borrow and lend crypto. The Compound’s borrow rate for ETH is 3% and Tether 2.9%. The supply rate for ETH is 0.15%. Consequently, users of Maker can earn significant returns in a bull market, locking their ETH and getting part of its value in return. This action can be repeated for one deposit and it’s called the liquidity cascade.

Decentralised Exchanges (DEXes) such as Uniswap, Sushiswap and PancakeSwap pay part of their trading commissions to liquidity providers, who deposit liquidity on smart contracts. On some rare pairs, Uniswap can give up to 1% per day in crypto. For pairs with stablecoins it’s about 0.1-0.3% per day.

In addition to depositing stablecoins, DeFi services offer the opportunity to invest stablecoins in yield farming. In this case, the risks increase – as do the returns. At some sites, the expected yield in such pairs exceeds 100% and can reach 400% or more per annum. The income in yield farming isn’t in stablecoin but in crypto, and only half the deposit is safe (denominated in stablecoin) in the case of a market drop. The other half is denominated in the highly volatile cryptocurrency.

One of DeFi’s success stories is making 25-year old Cooper Turley a millionaire. He lent his ETH via a DeFi lending protocol and invested the funds he got into yield farming. In bullish markets, DeFi investors get both income from the growing price of crypto and their interest rate in this crypto, such as when the price of Uniswap jumped from $2 in October of 2020 to $43 in May of 2021. Combined with the interest rate for locking liquidity in UNI, that’s a significant profit that rivals the best-performing assets of any class. There is another famous anonymous DeFi millionaire, Razoreth, who described in his Twitter a story of turning $800 into $1,000,000.

Risks and Trends

Risks…

One of the main risks of investing in DeFi is the same as with crypto in general: the bear market. Many investors have recently discovered the unhappy implications of this risk for the value of their portfolios.

Overall, according to the report “Defi Demystified: The Investor Guide To Decentralized Finance” by Daniyal Inamullah and Jacob Stelter (Sarson Funds, February 2021), the main types of DeFi risks include:

- smart contract functionality risk

- external call function risk

- ‘run-on-the-platform’ risk

- frontrunning risk

- human risk

- opaqueness risk, and

- impermanent loss risk.

For example, according to the part of this report concerning regulatory risk, “KYC, AML, and taxes are critical regulatory hurdles that certain jurisdictions will need to deal with for the future of DeFi. While we see massive growth in both developed and emerging markets, regulation can have a chilling effect on capital allocation. In the US, the departing Comptroller of the Currency, Brian Brooks noted “our current bank regulations exist mainly to prevent human failings… ” and that “in the absence of federal regulatory clarity, US states rush to fill the void and create a patchwork of inconsistent rules that impede the orderly development of a national market”.

Some DeFi protocols already lost liquidity because of hacks, tech issues or bank runs, and relevant DeFi investors suffered, including billionaire Mark Cuban in the case of Iron Finance. According to Cypher Trace, $156 mln has already been stolen from DeFi protocols this year.

Also, the rate in any DeFi smart contract isn’t technically stable. The high rate of return from staking, yield farming and liquidity lock may be real, but it is likely to last for a very short time, since most rates are floating. Moreover, any DeFi investor should understand that their income depends on crypto market trends, since for most DeFi it’s in crypto. Also in the case of a crypto market fall, some DeFi institutions may lose liquidity and somehow default on their obligations.

Let’s take a look at potential risk/reward scenarios for locking liquidity in pools on the PancakeSwap DEX. One of the most popular options for liquidity swap on this exchange is swapping it into Syrup pools. If the user swaps Pancake’s native coin – CAKE – with 108% APR this means that for a year of depositing 100 CAKE, a user will get 108 CAKE income, or a total staked deposit of 208 CAKE. Of course, doubling the deposit in crypto doesn’t mean that its fiat value will grow too; that depends on the CAKE price. Two months ago it was above $40, but now it’s only $12. This means that an investor’s profits and losses depend on the moment when he or she enters the market.

Trends…

The key metric for DeFi is TVL – Total Value of Locked funds on smart contracts. As a side note, ETH’s price correction played a positive role for DeFi adoption, since the transaction fees dropped from $10-40 to $2-3.

Despite the listed risks and crypto price volatility, demand for DeFi and the resulting TVL that has grown exponentially in 2020 remains very significant and stays around the $100B-$150B level. And this is just the first inning for this technology and its business model.

Conclusion

“The experience of all ages and nations, I believe, demonstrates that the work done by slaves, though it appears to cost only their maintenance, is in the end the dearest of any.”

Adam Smith, Wealth of Nations (1776)

Adam Smith explains that slavery is, in general, highly inefficient. By his account, the net product under freedom is 12 times larger than under slavery. However, he observes that, despite its inefficiencies, slavery at the time of his writing persisted in most of the world.

Why did the elite – owning slaves and holding political control – fail to make themselves better off by freeing their slaves?

Smith gave two answers to this puzzle:

- The first is psychological: Smith asserts that people have a fundamental desire to dominate others, and slavery provided that opportunity for the slaveholding elite.

- The second explanation involves commitment problems. Freeing the slaves would deprive slaveholders of their property. How would they be compensated? Masters could not be assured they would, in fact, be better off freeing their slaves. Slaveholders therefore rationally avoided emancipation despite its inefficiency.

Similarly to Smith’s view, I believe that the work done by existing financial institutions, though it appears to cost only their (now very hefty) maintenance, is in the end the dearest of any, because of the hidden friction and huge inefficiencies, plaguing all major sectors of the economy.

It is likely that DeFi – done right – could replace banks and other traditional financial institutions. It is also quite likely that the global elite’s fundamental desire to dominate others and their interest in keeping the status quo will present an obstacle to moving the economy to a more efficient state.

However, this analogy should keep one cautiously optimistic, since slavery was globally abolished within a few decades of publishing Smith’s book. One can hope that we’ll see a fair and efficient state of the global financial system powered by DeFi soon enough.

This article does not provide any personal financial advice, please do your own research before joining DeFi or any other project as an investor.