Dealmaking in Europe stutters to 10-year low

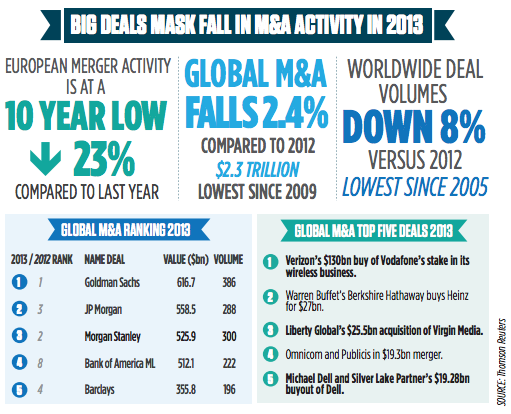

M&A PLUNGED to its lowest level in a decade across Europe this year amid a slowdown in global dealmaking, fresh figures out today reveal.

The total value of European M&A deals was $529.4bn (£323bn) this year, a 23 per cent fall from last year and the slowest year since 2003.

The preliminary figures, published by Thomson Reuters, are in stark contrast to public equity markets across Europe and the US which have reached record highs in 2013.

Overall dealmaking across the globe fell two per cent – propped up by a spate of US mega deals in the communications sector, including Verizon’s $130bn acquisition of Vodafone’s stake in its wireless business, which softened the fall.

US deals accounted for over 43 per cent of the world’s total this year, while M&A in the telecoms sector doubled to 11 per cent of the global total. Energy and power deals remain the most common type of M&A with 15 per cent of all deals done this year in that sector.

Despite the slowdown, investment banks continued to rake in fees, with Goldman Sachs topping the list again this year, handling the most deals for the most amount of cash.

It worked on 386 deals last year worth over $616bn. It was on the ticket for five of the top 10 global deals this year, including advising Virgin Media on its $27bn takeover by Liberty Global. This helped it hold off a challenge by number two placed JP Morgan which worked on 288 deals worth over $558bn. JP’s deal work helped propel it into second place at the expense of Morgan Stanley, which slipped to number three in the list.

The biggest riser was Bank of America Merrill Lynch, which stormed into the number four spot from number eight after working on 222 deals worth over $510bn.

Private equity firms – often a major driver of M&A volumes – increased their deal making by 24 per cent this year across the world. European private equity dealmaking was up 34 per cent alone.