Darktrace: What we learned from building a £2.5bn UK success story

There were just a handful of us clustered around a Bloomberg screen waiting for the moment that Darktrace would finally be launched onto the London Stock Exchange.

In the end, that’s what a float comes down to – the final few seconds before the clock ticks round to 8am and the numbers start moving. If they head in one direction you triumph. If they go in the other you’re humiliated. Everything is on the line and nothing you can do will change the outcome.

When the markets finally opened Darktrace’s share price went up, and up: a rise of forty per cent on the day. Once the story was clear we swapped the screen for a bottle or two. We had built a two-and-a-half-billion-pound company.

Read more: Darktrace races out of the blocks: A boost for London’s IPO market after Deliveroo’s flop

And, ever since, people have been asking us the same questions – how did you do it, and how can we build more Darktraces in Britain?

Sadly, there is no secret formula. Each business follows its own path, wins its own battles and makes its own mistakes. But there were some lessons to be learned along the way.

Enjoy the whiteboard stage – it’s the most fun

The early days of Darktrace are fresh in my mind; it only took us eight years to get from a concept on a whiteboard to those numbers on the Bloomberg screen. But the whiteboard stage, where suddenly we could see how we were going to bring all of the pieces together to create something new, was the most enjoyable.

Until then cyber security meant trying to build all-powerful digital walls around firms to keep bad people out. But I’d served on the board of the BBC, where someone was making a few quid selling data about star salaries to the papers. The offender hadn’t hacked into the Corporation; he or she was almost certainly sitting on the inside leaking data back out.

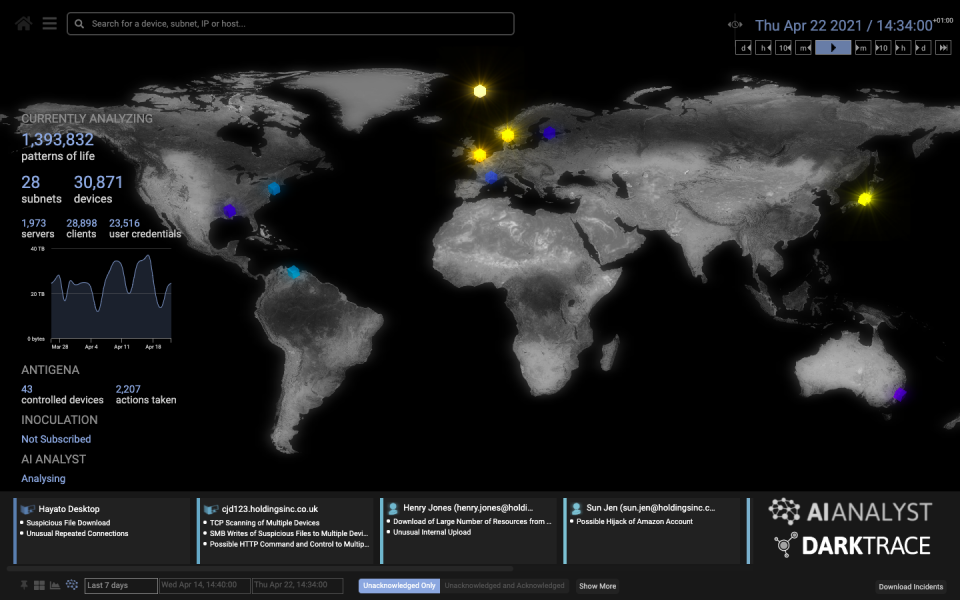

That episode sparked the realisation that drove Darktrace – we would never make organisations secure by surrounding them with ever higher virtual barriers. The challenge wasn’t creating an impregnable defence. It was realising that intruders were almost certainty already inside organisations then taking action against them.

With the help of a brilliant coder called Jack Stockdale we realised that we had to turn the way we thought about cyber security on its head. We were creating, I realised, an immune system rather than a defensive barrier – an AI-powered tool to spot and repel damaging forces from within.

Those days, when we were turning these concepts into new products, were the most satisfying.

Read more: Darktrace’s bright future: The CEO behind the company tipped to be the UK’s next tech unicorn

New UK tech firms need more time and space to concentrate on the technology

There are plenty of British entrepreneurs with great ideas, and plenty of investors looking for a return, but building a successful firm demands much more than pairing them up. Having developed the concepts that underpinned Darktrace within our company – Invoke Capital – we then gave our technologists the space to concentrate on technology whilst we provided our people and expertise to create marketing and sales strategies. Invoke was involved day in, day out making decisions about the core technology and the direction of the business, but we also did all the operational work you need to make a firm grow.

Nor did the technologists have to make round after time-consuming round of funding applications to venture capitalists, or face pressure to sell to an early buyer for a quick return. Invoke provided long term funding too.

It really is all about the talent

There was one other key feature of this story. You can’t build a great tech firm without great tech talent – and Invoke hoovered up the best technologists we could find long before Darktrace was launched.

Emily Orton, who became Darktrace’s Chief Marketing Officer, Nicole Eagan its chief strategy officer, and that coder Jack Stockdale were all Invoke hires, as was Poppy Gustafsson – who became the chief executive and took the company onto the London Stock Exchange.

The tough message for the UK is that all this work is normally easier in Silicon Valley. Whether you want technologists or teams of salespeople or marketeers, or funders who really understand tech, there are typically more of the people you really need in California.

The UK has great scientists in great universities, but it’s still missing some of the key features you need to build great companies. At Invoke, we tried to fill in those gaps with a business model that is still uncommon.

And then we backed away. That’s part of the model too. Once Darktrace reached maturity, we gave the business space to find its own way and it ran independently. But what mattered in the early years was a new model that saw Invoke provide an idea, leadership, financial and practical support. The model worked, and it would work again. If we want more Darktraces, the UK needs more Invokes.

Read more: London raked £1.8bn in tech funding last year, almost double its next closest rival