Darling Darktrace’s shares plummet despite boosting revenue outlook

Shares in cyber firm Darktrace fell over 11 per cent today despite upping revenue estimates once again this morning.

Revenue grew between 45.5 per cent and 47 per cent (previously 44.5 per cent to 46.5 per cent), and while margins beat prior forecasts at between 15 per cent and 17 per cent.

CFO of Darktrace Cathy Graham said: “In our third quarter, we sustained strong growth trends across our customer base, ARR and revenue, as well as maintaining the gains in churn and net ARR retention rates we made in the first half of the financial year”.

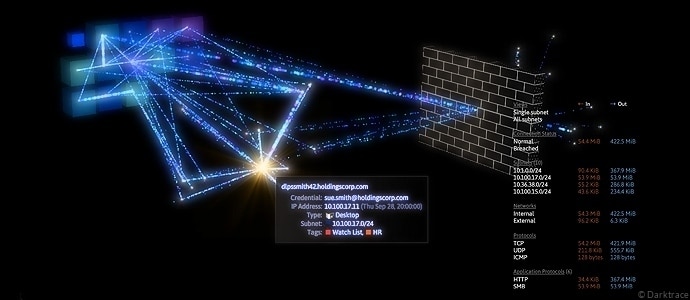

“As we pursue our goal of protecting organisations across the globe from cyber-attacks, we remain laser-focused on fulfilling our vision of delivering a continuous AI loop addressing today’s complex and constantly changing cyber challenges”, she added.

The ongoing spike of global online security risks has shown the need for Darktrace’s products, and this backdrop has fuelled sales for the tech darling in the past three months.

Whilst its debut valued the company at around £1.7bn, the immense growth of the British darling has been marred with stock turbulence and controversy.

An issue that has particularly stuck is its close ties with tech tycoon Mike Lynch, who was accused of fraudulently inflating the value of Autonomy when he sold it to Hewlett Packard for £8.6bn in 2011. This sent shares into a brutal frenzy.

Brokers have also weighed in on the legitimacy of the Cambridge-based company; a scathing Peel Hunt note last October rated it a ‘Sell’ stock, indicating that it was worth only half its value. They suggested intense marketing had overhyped the Darktrace offering.

In an interview with City A.M. earlier this year, CTO and founding partner of Darktrace Jack Stockdale was unsurprisingly dismissive of these criticisms.

He instead pointed to its 6500-strong client base, and high retention: 65 per cent of customers said they would spend more on Darktrace products, according to independent research from Berenberg.