Darktrace revenue hits $200m as it confirms London float

Darktrace today said its revenue surged to almost $200m (£146m) thanks to the pandemic as it confirmed plans to float on the London Stock Exchange.

In a filing this morning the Cambridge-based tech firm unveiled its intention to list in London, with its registration document due to be published later today.

Darktrace did not provide details of pricing, but it is reportedly seeking a valuation of up to £3bn.

The listing will be a major test of investor appetite for tech floats in London after Deliveroo’s disastrous debut last month.

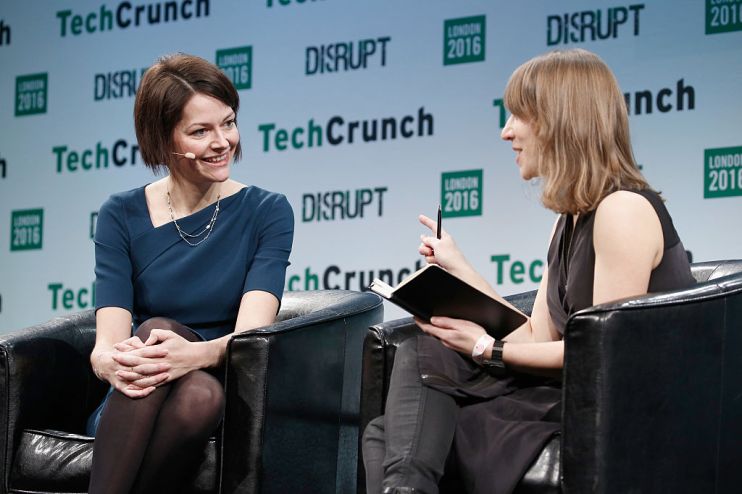

The cyber firm, founded in 2013 and led by Poppy Gustafsson, has cashed in on higher demand for its services due to the shift to home working during the pandemic.

Revenue hit $199m in the year to the end of June 2020, up from $137m the year before. It also narrowed pre-tax loss to $27m thanks to lower travel expenses.

Darktrace, which makes the vast majority of its revenue from subscriptions, has more than doubled its customer base in the last two years.

The company’s float plans suffered a setback earlier this year after UBS resigned from its position as one of the lead investment banks on the IPO.

The shock move came against the backdrop of extradition proceedings against Mike Lynch, the billionaire founder of Autonomy who is facing fraud charges in the US relating to the company’s $11bn acquisition by Hewlett Packard.

But since then the firm has made a number of high-profile appointments to bolster its board, including former BT chief executive Sir Peter Bonfield and former government minister Lord Willetts.

Darktrace has confirmed the appointment of former Capita executive Gordon Hurst as its new chairman.

Boss Gustafsson said the company’s float plans marked a “major milestone in Darktrace’s history of rapid growth and a historic day for the UK’s thriving technology sector”.

Jefferies, Berenberg, and KKR Capital Markets are acting as joint global coordinators and joint bookrunners on the IPO.