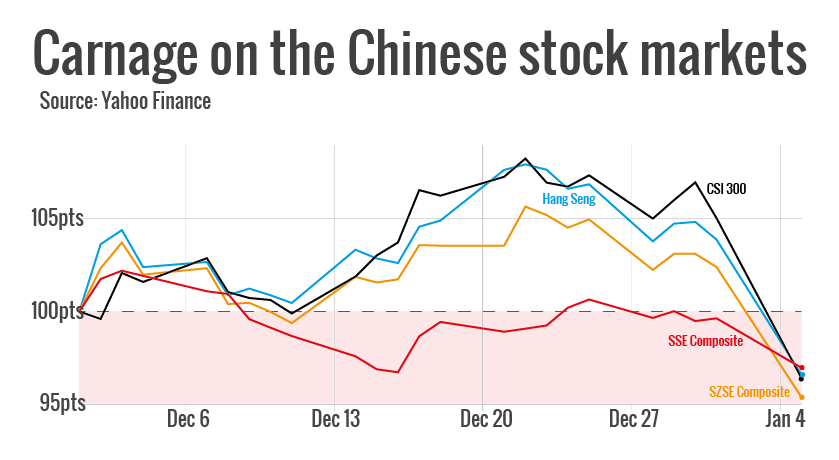

CSI300, Shenzhen composite index and Shanghai composite index: The full scale of China’s stock market carnage

Chinese stocks kicked off the new year dispiritingly, after trading was suspended on its blue-chip CSI300, which suffered its worst day in nine years.

The CSI300 crashed down seven per cent, and triggered the so-called "circuit breaker" suspension mechanism. The measure, which was introduced to curb volatility in the wake of Black Monday, was used for the first time today.

This ripped through Chinese stock markets, with the Shanghai composite index finishing 6.86 per cent lower at 3,296.26 points, and the Shenzhen Composite index down 8.2 per cent at 2,119.16 points.

Hong Kong's Hang Seng index also closed down 2.68 per cent at 21,327.12 points.

In Europe, Britain's blue-chip FTSE 100 slumped two per cent to 6,116.40 points. Meanwhile, the German Dax and the French Cac fell 3.09 per cent at 10,410.55 points and 2.07 per cent at 4,541.09 points respectively.

Here's what that did to Chinese stock markets:

It followed weak manufacturing data, with the Caixin manufacturing Purchasing Managers' Index (PMI) down 48.2 in December, compared to the 48.6 a month earlier

But market mavens said investors were concerned about the imminent expiration of a share sales ban on listed companies' major shareholders, which had been imposed during the market crash last summer.

"[The sell-off] has far more to do with worries that major shareholders will reduce their positions after the ban of share sales and short selling which came in at the end of trading on Friday," Mark Dampier, head of investment research at Hargreaves Lansdown, said.

For some, it's likely to bring back memories of last August's Black Monday, when the CSI300 shed 8.75 per cent to close at 3,275.53 points. This sent shockwaves across global markets, wiping as much as $1.6 trillion from blue-chips in just one day.

However, Matthew Sutherland, investment director for Asian equities at Fidelity International, said the sell-off wasn't a cause for concern.

"It's important that investors don't panic on weak days, but continue to take a disciplined and calm approach to investing. This is particularly true with regard to China."