Cryptocurrency is struggling with a reputation problem, research finds

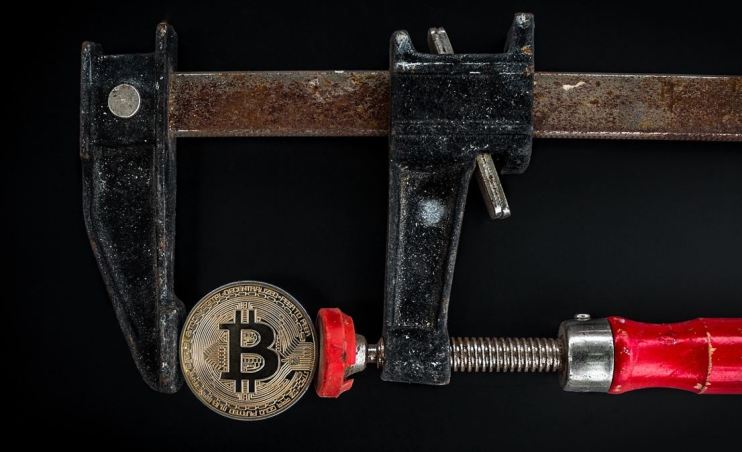

The cryptocurrency industry is struggling to improve its reputation, according to research by blockchain protection company CoinCover.

The report – based on a survey of 16,316 people in nine countries – found that the two most significant barriers to mass crypto adoption were volatility and security risks.

CoinCover’s research was also based on an extensive literature review, and interviews with market experts.

The report argues for the creation of voluntary industry standards, alongside mechanisms for users to identify providers that adhere to these standards, encouraging an environment whereby consumers move to these recognised providers.

Research says cryptocurrencies have vast potential for growth…

- Ownership is on the rise: 17% of those surveyed currently own cryptocurrencies while 30% say they are likely to invest in cryptocurrencies in the next 12 months. Bitcoin is the most popular (46%), with NFTs in second (18%), ahead of Ethereum (17%).

- Attitudes and curiosity: More than half (55%) of respondents were at least crypto-curious, with 11% stating they were active or committed (highly invested in the market).

- Positive investment returns: 50% of respondents were positive about their financial returns from crypto holdings, compared to 20% who are dissatisfied with their returns.

However, there are obstacles to overcome…

- Cynicism: 19% of consumers said they were cynical about crypto while 25% said they were closed to cryptocurrency entirely.

- Trust issues: Crypto exchanges are the least trusted financial services provider among non-crypto users with 30% saying they didn’t trust them at all.

- Technology concerns: When asked about their thoughts on a range of technologies, crypto concerns consumers the most, with 30% worried about it – ahead of artificial intelligence (AI) at 25%.

- FTX scars: The collapse of FTX damaged the industry’s reputation, with 20% of people now more cynical towards the entire market because of the scandal and 16% more cautious about which providers they choose.

- Criminal associations: The research found that crypto is more likely to be perceived as an enabler of criminal enterprise, financial fraud, and corporate crime over potential benefits like financial innovation and privacy.

- Barriers to investment: Across both users and non-users, the two biggest barriers to investment were identified as price volatility and security concerns. For users, the third biggest barrier to entry is losing keys/access while for non-users it is complexity.

- Security hurdles: When asked about threats, 52% of people were most concerned about fraud, followed closely by theft – including hacking – at 51%. Only 54% of people who own crypto assets were satisfied with their providers’ commitment to security.