Crypto start up Amber Group valued at $3bn after bumper funding round

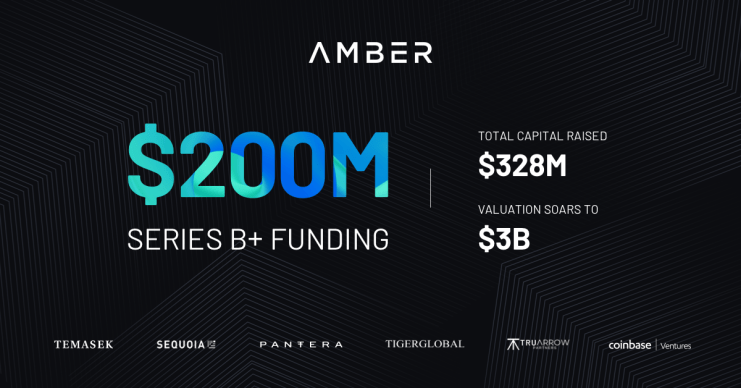

Crypto start up Amber Group claims its valuation has soared to $3bn after a bumper $200m Series B+ funding round.

According to a statement released today the investment round was led by Temasek, with participation from existing shareholders including Sequoia China, Pantera Capital, Tiger Global Management, Tru Arrow Partners, and Coinbase Ventures among others. It comes less than a year after Amber Group raised $100m in a June fundraising round.

“From radically transforming the concept of ownership and value in the global economy, digital assets are redefining the way we live outside of the financial ecosystem,” said Amber Group chief executive Michael Wu.

We want to help create a digital future where digital assets empower people with the opportunity and agency to shape a better world for all. We are proud to have the support of our investors who not only share this vision but also put their capital and trust in us to achieve it,” he added.

Founded in 2017, Amber offers products and services to both institutional and consumer clients. The firm provides liquidity and market making services as well as offering structured products, and advisory services. Amber Group offers services through its app WhaleFin and has launched a creator-focused arm called Openverse.

The company claims to have more than 1,000 institutional clients globally while assets under management exceed $5bn,

“It’s been exciting to see Amber Group’s growth, as both an investor and a trading partner,” said Dan Morehead, the chief executive officer of Pantera Capital.

“When we originally invested in the company, we had high expectations – reality has exceeded our expectations. Their 24/7 global coverage team has helped Pantera execute over $1.1b in trades in 2021 and that continues to grow,” Morehead added.

Read more: Crypto unicorn Bitpanda under fire from FCA over regulation claims