Crypto Spot Volumes Reach Record Lows for 2022 as Bitcoin Miners Offload Their BTC

Data from CryptoCompare shows that the price of Bitcoin moved sideways throughout the last week, starting at $22,000 and quickly surging to $24,000, before enduring a correction that took BTC right back to where it started.

Ethereum’s ether, the second-largest cryptocurrency by market capitalization, moved slightly upward, starting the week at around $1,500 and moving up toward the $1,600 mark before correcting. After testing resistance at $1,600 three times throughout the week, it dropped to $1,535, where it’s currently trading.

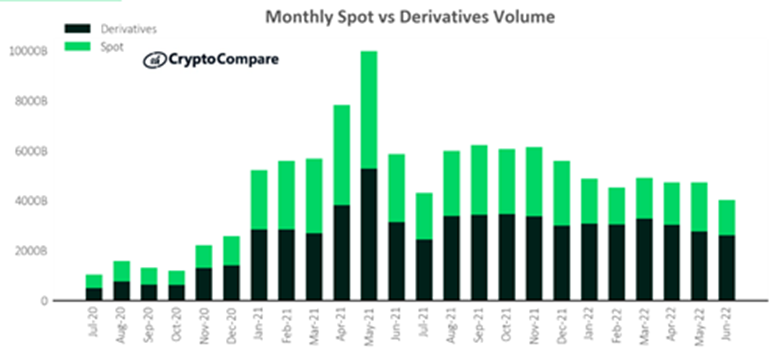

Over the past week, it was revealed the spot and derivatives trading volumes in the cryptocurrency space reached record lows for 2022 in June, with spot trading volumes across all centralized exchanges falling 27.5% to $1.41 trillion, the lowest figure recorded since December 2020.

That’s according to CryptoCompare’s latest Exchange Review, which also added derivatives trading volumes, which represent 66.1% of the market, fell 7.01% to $2.75 trillion, marking the lowest derivatives volume recorded since July 2021.

Amid waning crypto trading volumes, Bitcoin miners have had to offload some of their cryptocurrency holdings in a bid to stay afloat, with 14,000 BTC being moved out of wallets known to belong to cryptocurrency miners in a single 24-hour period.

Bitcoin miners have offloaded the largest amount of BTC since January 2021, a phenomenon some call “miner capitulation,” in which these miners sell their coins to cover ongoing expenses.

Miners aren’t the only ones selling their BTC holdings, however, as electric car maker Tesla has revealed it sold $936 million worth of Bitcoin, equivalent to 75% of its holdings, in the second quarter of the year to maximize its cash position “given the uncertainty of the COVD lockdowns in China.”

Tesla CEO Elon Musk added that Tesla is open to boosting its bitcoin exposure in the future and that “this should not be taken as some verdict on Bitcoin.” Musk also said Tesla did not sell any of its Dogecoin.

Ethereum Merge Projected for September

While several large crypto industry players have been selling their holdings and trading volumes are dropping, technical developments are still being made. Ethereum’s long-anticipated Merge upgrade, which sets the stage for future scaling upgrades and is expected to reduce the network’s energy consumption by 99.95%, has been projected to occur in September.

It’s worth noting the Merge is not expected to reduce Ethereum’s transaction fees, but will have a significant immediate impact on energy use while opening the door for upgrades that will reduce transaction fees.

Chicago-based cryptocurrency market maker Cumberland has said institutional investors have been increasing their bets on Ethereum’s ether ahead of the Merge.

Over the past week Polygon, a Layer-2 scaling solution for Ethereum that provides users with faster transactions and lower costs as a parallel blockchain running alongside the main Ethereum network announced the launch of Polygon zkEVM (zero-knowledge Ethereum Virtual Machine), which it said to be the first Ethereum-compatible scaling solution using zero-knowledge proofs.

Zero-knowledge proofs are a verification method that occurs between two parties, in which one can prove to the other that they have knowledge of a specific set of information without revealing the information itself.

Polygon zkEVM is expected to include a fraction of the transaction fees seen on Ethereum while inheriting the blockchain’s security. The network improves capital efficiency through faster transaction settlements.

SEC Calls 9 Cryptos ‘Securities’

The U.S. Securities and Exchange Commission (SEC) has used its insider-trading case against a former Coinbase product manager to formally declare nine digital assets as “securities” in its ongoing practice of defining its crypto oversight through enforcement actions.

The regulator filed a complaint on Thursday alleging the former Coinbase product manager gave his brother and friend tips on which assets the exchange planned to list in the near future.

The tokens the SEC identified as securities were Flexa’s AMP, RLY, DDX, XYO, RGT, LCX, POWR, DFX and KROM.

Meanwhile, Paraguay’s Senate has passed a bill setting up a new licensing for cryptocurrency trading platforms and new rules for miners, among other areas. The bill is now headed for the country’s president.

The Paraguayan central bank has concerns that a legal regime for digital assets would entail drawbacks, including “energy consumption” related to cryptocurrency mining operations and a “loss of reputation” for the financial system.

In Italy, several cryptocurrency exchanges have been gaining regulatory approval. This week both Coinbase and Crypto.com received a green light from the Organismo Agenti e Mediatori (OAM).

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.