Crypto set to overtake traditional investments within 10 years, new report claims

Research conducted by a global cryptocurrency exchange has found that investors strongly believe digital assets will outgrow traditional investment within a decade.

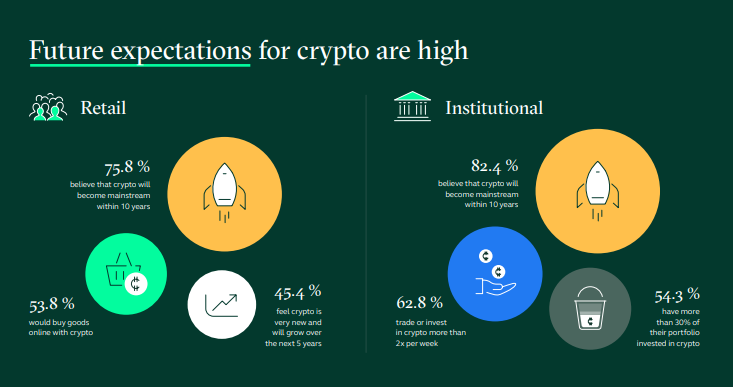

The findings from the Bitstamp Crypto Pulse survey revealed 88 per cent of institutional respondents and 75 per cent of retail investors believe crypto will see mainstream adoption within a decade.

Remarkably, a further 80 per cent of institutional investors reported that crypto will overtake traditional investment vehicles — showing a particularly bullish attitude from financial professionals on the future of crypto as an asset class.

From the retail respondents, 54 per cent believed that crypto will overtake traditional currencies within a decade. The survey also found that levels of trust in crypto as an asset class was high, with 71 per cent of investment professionals and 65 per cent of everyday investors stating they trusted crypto.

The data came from a wide survey of 28,563 respondents — including 5,450 senior institutional investment strategy decision makers and 23,113 retail investors — from 23 countries across North America, Latin America, Europe, Africa, The Middle East, and Asia-Pacific.

Key findings included 67 per cent of retail respondents believe crypto is a trustworthy investment, while just 11 per cent said that crypto was untrustworthy, showing little hesitancy in investing.

It also showed that 70 per cent of institutional investor respondents said that crypto was a trustworthy investment, with 68 per cent actively recommending crypto in investment strategies.

As a relative infant compared to traditional asset classes, crypto is trusted less than property ownership (averaging around 80 per cent for both retail and institutions) and shares and stocks (69 per cent for retail; 77 per cent for institutions). But the current level of trust indicates that the universal adoption of crypto in mainstream investing will continue to grow.

Julian Sawyer, Fleet Street-based CEO of Bitstamp, explained the adoption of cryptocurrency was advancing quickly.

“In the last few years, cryptocurrencies have moved from the outskirts of the financial ecosystem to find themselves front and centre of mainstream investing, with many of the largest trading venues in the world now catering to both retail and institutional crypto needs,” he said.

“We’ve seen interest propel in the years since the pandemic, and crypto is now part of the wider conversation in global macro-economic matters.

“The survey shows something we have long advocated – talking about survival of digital assets is firmly over, the question is now about evolution.”