Crypto nosedive may not signal an end to the bull cycle

A sudden crash across the crypto markets over the weekend was triggered by a perfect storm of several events, but does not mean the current bull cycle is over, experts believe.

Bitcoin bled out more than $10,000 as it fell from $54k to almost $42k, sending waves of panic among traders around the world.

According to GlobalBlock sales trader Marcus Sotiriou, the dramatic drop blindsided a great number of investors, as many were expecting a rally going into year end.

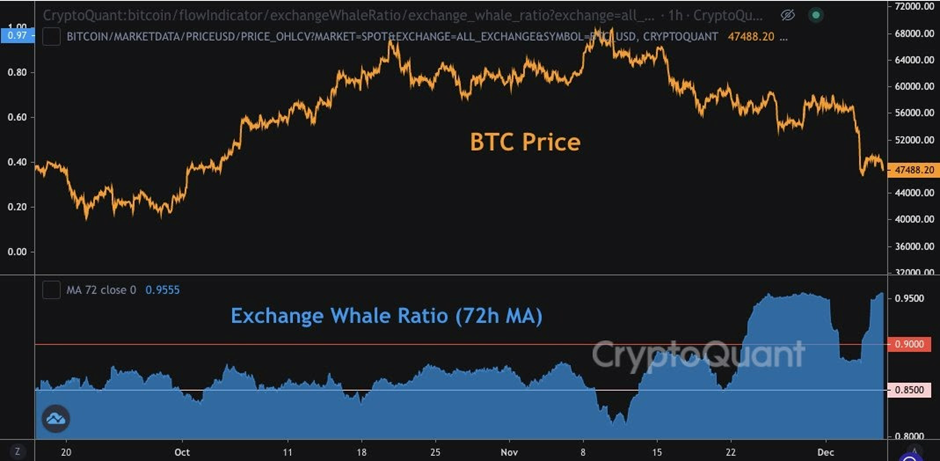

However, digital asset markets have seen huge amounts of selling from crypto ‘whales’ who have been moving Bitcoin from wallets and depositing to exchanges at a staggering rate (see graph below).

“The crash was also down to a cascade in liquidations, as more than $2 billion of leveraged positions were wiped out on Saturday,” explained Sotiriou.

“This deleveraging was exacerbated by the fact that it occurred on a Friday night in the US coinciding with the weekend in Asia, which is one of the lowest periods for liquidity.

“This meant that even though leverage was actually lower than it has been in previous crashes, the effect was still substantial. This shows that event though markets have become more efficient over time, it still has a long way to go to avoid these situations of forced selling.”

The risk aversion was likely down to several factors, including worries regarding the Omicron variant, Evergrande moving closer to default, and, most importantly in Marcus Sotiriou’s opinion, institutions wanting to secure profits going into the year end to manage risk.

“However, I don’t think this is the end of the bull cycle and believe this sell-off has given weight to the lengthening cycle theory, where this bull market could extend into 2022, contrary to many analysts’ expectations of a blow off top in 2021,” he added.