Crypto markets undergo brief correction after Bloomberg reports that Biden plans to double capital gains taxes for the rich

Despite lots of bullish news that came out during the previous week, the price of Bitcoin and other cryptoassets ended the week on average by 10-20 per cent after many crypto investors panicked on Thursday and Friday when they found out that President Biden intends to double capital gains taxes for those earning more than $1 million.

On Monday (April 19), the Bank of England (BoE) and HM Treasury announced the joint creation of a Central Bank Digital Currency (CBDC) Taskforce to coordinate the exploration of a potential UK CBDC. The press release went on to say that “a CBDC would be a new form of digital money issued by the Bank of England and for use by households and businesses”.

Also, a representative from Coinbase told Reuters that “options on Coinbase Global Inc (COIN.O) are set to start trading on Nasdaq options exchanges” from April 20, less than one week from the date that Coinbase shares (NASDAQ: COIN) had their NAsdaq debut.

Charles Hoskinson, Co-Founder and CEO of IOHK, the company responsible for building Cardano, explained in a video he released on his YouTube channel why he believes that the Biden-Harris administration could introduce cryptocurrency-related legislation in the coming months.

Hoskinson started by mentioning that according to a breaking report by Fox Business the Biden administration is “in the early stages of developing a regulatory approach to the booming crypto biz”.

Charles Gasparino, who is a Senior Correspondent for Fox Business Network, presented his report to Liz Claman, the host of the Fox Business program The Claman Countdown.

Here is what Gasparino told Claman:

“Over the weekend, as you know, prices of Bitcoin started to tank dramatically… and it’s more on this notion of a crackdown from the Biden administration….

“The Biden administration is in what’s been described to me from people close to them as the early stages of developing a regulatory approach to the crypto market… it’s being debated inside the Biden administration. From what I understand, SEC Chair Gensler… is waiting for some direction from Treasury for the overall policy before he develops a more specific regulatory approach to crypto, which will likely be the types of enforcement actions he goes after…

‘They’re going to outlaw it’

“I do think crypto is here to stay. I don’t think — based on the people I’m talking to — they’re going to outlaw it… I just don’t think that’s going to happen here… too many American investors are this space right now. There will probably be more regulation.”

As for Hoskinson, here is why he believes that in the US new crypto regulations are coming this year:

“There’s no reality that a government as regulation-friendly as the United States government will allow an industry with a market capitalization of over a trillion dollars to be unregulated or to live in this weird gray area of enforcement.

Hoskinson concluded his remarks on this topic by saying that he believes there will be “a big discussion” and hopes that that “the industry as a whole” will “rally and get involved” and find “a way to get out of it”. He also feels that any crypto regulations in the US will not “ultimately kill cryptocurrencies” and that cryptocurrencies are “here to stay”.

MV Index Solutions (MVIS), a subsidiary of global investment manager VanEck, in partnership with CryptoCompare, a leading provider of digital asset data, launched the MVIS CryptoCompare DeFi 20 Index (Bloomberg ticker: MVDEFI).

The MVIS CryptoCompare DeFi 20 Index is a modified market cap-weighted index which tracks the performance of the 20 largest and most liquid decentralised finance (“DeFi”) protocols. The index applies most demanding size and liquidity screenings to potential index components to ensure investability. The digital assets classified by CryptoCompare as DeFi as of the announcement date qualify for inclusion.

Charles Hayter, Co-Founder and Chief Executive Officer of CryptoCompare, commented:

“With the surge in popularity of DeFi projects and growing appetite from institutional investors, the MVIS CryptoCompare DeFi 20 Index makes this new asset class more accessible and offers investors an entry point to gain exposure to the top DeFi protocols.”

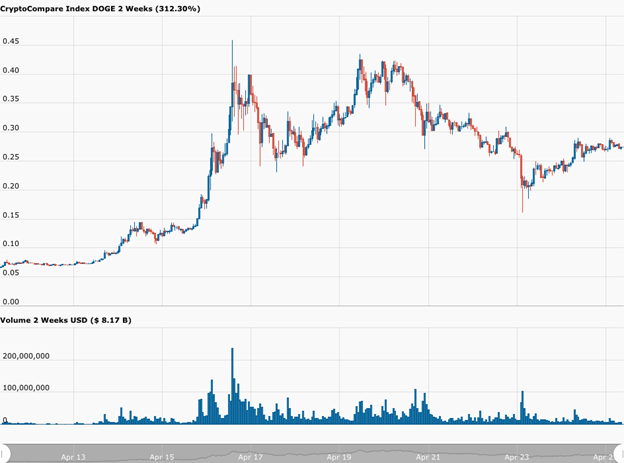

Excitement by retail investors over “Doge Day” (April 20) helped the Dogecoin ($DOGE) price get as high as $0.4346 (according to data by CryptoCompare).

Bullish news

So much bullish news came out on Tuesday (April 20).

First, California-based tech-focused online retailer Newegg announced it is now accepting Dogecoin as an official payment method via BitPay.

Second, legendary American value investor William H. Miller III shared his latest thoughts on Bitcoin.

Miller is the Founder, Chairman, and Chief Investment Officer of investment firm Miller Value Partners, as well as the portfolio manager of firm’s mutual funds “Opportunity Equity” and “Income Strategy”.

During an interview with Kelly Evans, the host of CNBC’s The Exchange, Miller was asked how much more upside there is for Bitcoin.

He answered:

“There are many many different ways to look at Bitcoin. The simplest one is just supply and demand … Supply’s growing 2% a year and demand is growing faster. That’s all you really need to know, and that means it’s going higher. So… it’s gonna have these kinds of volatile days. It was down 20% peak-to-trough over the weekend…

“With Bitcoin, volatility is the price you pay for performance, and I think that it’s like digital gold… it is a much better version as a store value than gold… And then there’s $15 trillion of negative yielding bonds out there… Why would you have that when you can own something that at least has the potential to go up?”

Third, American commercial real estate company WeWork announced that it is now accepting cryptocurrency as a form of payment and that it plans to hold Bitcoin ($BTC) on its balance sheet. WeWork, which is a global flexible space provider, was founded in 2010 and is headquartered in New York City.

According to WeWork’s press release, “in partnership with BitPay and Coinbase, the company will expand its flexibility by utilizing cryptocurrency for inbound and outbound transactions”.

With the help of crypto payment processing firm BitPay, WeWork will accept Bitcoin ($BTC), Ethereum ($ETH), USD Coin ($USDC), Paxos Standard ($PAX), and several other cryptocurrencies as payment for its services.

As for outbound transactions, WeWork will “pay landlords and third party partners in cryptocurrencies where applicable through Coinbase”. Furthermore, Coinbase “will be the first WeWork member to use cryptocurrency to pay for its WeWork membership.”

PayPal launch Venmo

Fourth, PayPal announced “the launch of crypto on Venmo, a new way for Venmo’s more than 70 million customers to buy, hold and sell cryptocurrency directly within the Venmo app”. It is worth mentioning that Venmo is only available in the US.

With Venmo’s new crypto service, customers can “view cryptocurrency trends, buy or sell crypto, and access in-app guides and videos to help answer commonly asked questions and learn more about the world of crypto”. The four types of cryptocurrency that are supported are Bitcoin, Ethereum, Litecoin and Bitcoin Cash.

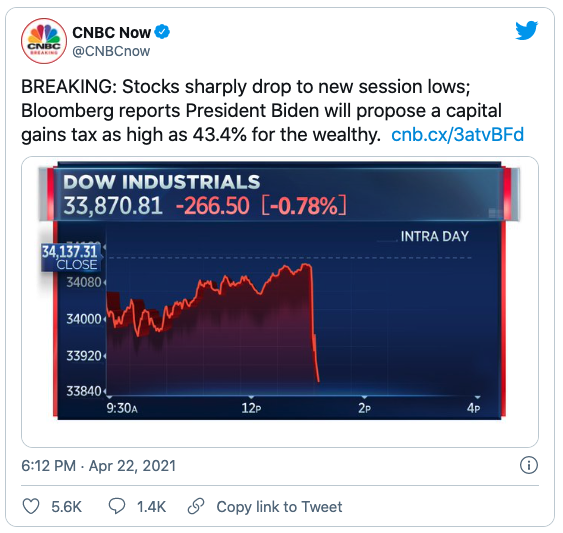

On Thursday and Friday there was much panic in the crypto markets after CNBC reported that, according to Bloomberg News, President Joe Biden plans to increase capital gains tax for US tax payers earning $1 million or more from 20 per cent (where it is now) to 39.6 per cent.

Jack Ablin, CIO at Cresset Capital Management, told CNBC:

“Biden’s proposal effectively doubles the capital gains tax rate on $1 million income earners. That’s a sizable cost increase to long-term investors. Expect selling this year if investors sense the proposal has a chance of becoming law next year.“

Even if Bloomberg’s report is accurate, it seems highly unlikely that it will get approved by the US Congress in its original form, given the tiny majority that Democrats hold over the Republicans in the US House of Representatives and a US Senate that is split 50-50.

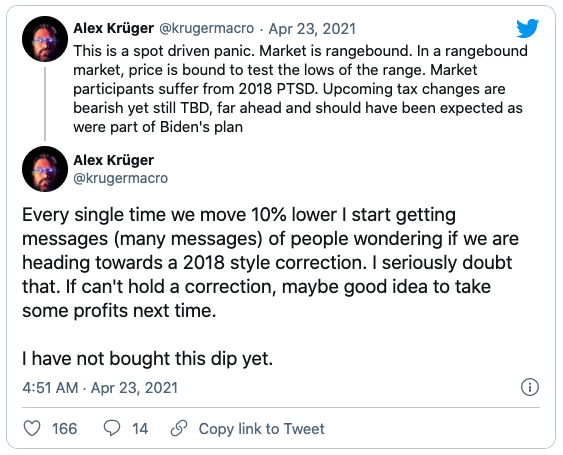

On Friday, macro-economist and crypto analyst Alex Krüger commented on the “spot-driven panic” in the cryptomarkets.

Like Krüger, those members of the crypto community who have experience of going through several other crypto market crashes, seemed calm and unconcerned about this latest correction, and some even considered it good for market health. One of those people was Su Zhu, Co-Founder, CIO, and CEO of Singapore-based crypto-focused hedge fund Three Arrows Capital.

At the time of writing, the top three cryptocurrencies — Bitcoin, Ether, and Binance Coin — are trading around $50177, $2231, and $500 respectively. Among the top 50 cryptoassets (by market cap), the only ones that ended significantly higher rather than lower were #15 Solana (up 67.5%), #22 Moneo (up 7.6%), #23 Terra (up 7.7%), #30 PancakeSwap (up 17.0%), and #40 Maker (up 16.3%).Featured Image by “stevepb” via Pixabay.com