Crypto markets rally – next stop $50,000 for bitcoin?Crypto sees record demand as bitcoin bounces back

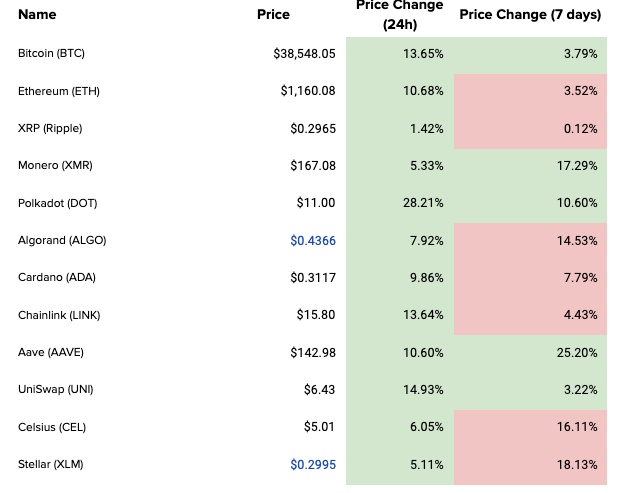

Crypto at a Glance

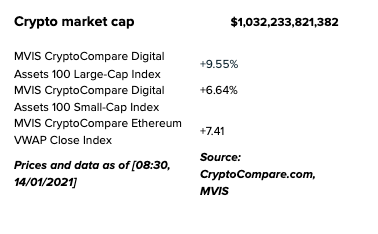

Was that the dip? It seems reports of Bitcoin’s demise have been, once again, greatly exaggerated. The price of bitcoin is now back at $38,000 and the total cryptocurrency market cap is above $1 trillion again. The sun is shining, the birds are singing in the trees, and the chemical odour of vaccine hangs in the air. Monday’s theatrics now feel almost a distant memory, though time will tell if the bulls can sustain a push towards $50,000.

The demand for bitcoin is certainly there at the moment. The likes of crypto exchange Luno and wallet Zumo (both friends of Crypto AM) are reporting record inflows of new customers, while trading platform eToro is warning users that it’s struggling to keep up with Buy orders for crypto. Meanwhile on social media, the number of Twitter users mentioning bitcoin has set a new all-time high, with the 7-day average having just touched 50,000. The 7-day average of tweets mentioning bitcoin is also nearly back at the December 2017 highs of almost 100,000 tweets per day. Twitter mentions can be a great tool in evaluating the retail hype around bitcoin. One person not loving crypto is Lindsay Lohan

In the alt markets, there were gains across the board yesterday. It was a particularly good day for Polkadot, which was up almost 30%, flipping Litecoin and joining the top 5 coins by market cap. Ether is also pushing towards $1,200 again, gaining 10% in the last 24 hours. But can it finally push to a new all-time high?

In the Markets

What bitcoin did yesterday

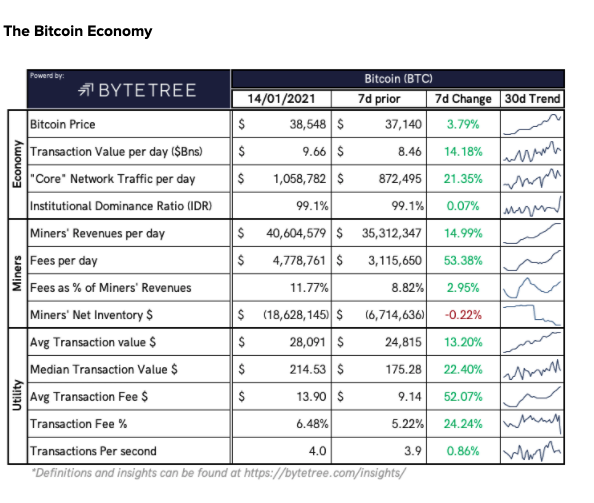

We closed yesterday, 13 January, 2020, at a price of $37,316.36 – up from $33,922.96 the day before. It’s now 12 days in a row that the price of bitcoin has closed at over $30,000.

The daily high yesterday was $37,599.96 and the daily low was $32,584.67.

This time last year, the price of bitcoin closed the day at $8,144.19 and in 2019 it was $3,552.95.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Bitcoin market capitalisation

Bitcoin’s market capitalisation is currently $716,091,190,477, up from $648,756,524,442 yesterday. Facebook’s market cap is now $716.74 billion, so not far to go before we can wipe that grin (if that’s what you can call it) off Mark’s face. The market cap of gold is $11.706 trillion, though. That’s probably not going to be achieved today. No harm in trying though.

Bitcoin volume

The volume traded over the last 24 hours was $65,207,628,346, down from $77,123,744,213 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 89.74%.

Fear and Greed Index

The Fear and Greed Index continues its streak in Extreme Greed and is back up to 83 today. Prior to this run, the index has never spent more than 24 consecutive days at this level. It’s important to remember that the index doesn’t usually stay this high for very long and this could mean a correction is on the cards, so be vigilant.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 69.88. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 68.31. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 100 – taken from 11 January.

What they said yesterday…

Big Jack on why the future is decentralised…

Following the Lindsay Lohan Twitter video, Juicy J is also on the bitcoin case.

Facts.

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM shines its Spotlight on EdenBase & its ‘Cognitive Revolution’

Crypto AM: Focusing on Regulation

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno