Crypto markets dancing in step as weekend breakout again hits rails

Crypto at a glance

It was another weekend of false starts in the crypto markets. Bitcoin again hit $60,000 on Saturday, though celebrations were fleeting as it failed to build on that momentum and quickly fell back down to $56,000. It’s currently changing hands at around the $57,000 level where it’s been making itself comfortable lately.

Resistance at the $60,000 level has proved a real sticking point for the leading cryptocurrency’s momentum lately. Can anything spark a move big enough to force it through and on to greater heights? The $55,000 region is an interesting point of interest and support is still strong there. If $60,000 is rejected again, can it hold, and where might it fall from there?

On the positive side, it’s now been 15 days since Bitcoin closed below $50,000 and 12 days since it had a market cap of under $1 trillion. It’s also holding up relatively well amid continuing concerns about the rising 10-year US Treasury yield, which is believed to have a negative impact on the appetite for risk-on assets as it prompts investors to seek safer yield-generating alternatives in Treasury bonds. It seems consolidation is the order of the day at the moment, and is that necessarily a bad thing?

Elsewhere, the smaller caps continue to look closely correlated to Bitcoin. The Ethereum price remains unable to maintain a charge past $1,800, Cardano is still floating around the $1.20 mark, and XRP is holding up last week’s gains relatively well. The big mover over the last 24 hours has been THETA, which could break the top 10 this week if it continues on its current trajectory, so it’s worth keeping an eye on that. LUNA was another big winner last week, as were VET and Filecoin after their Grayscale listing. Can they pull that wagon of delights into this week. Bitcoin Cash has now fallen to 13th in the market cap rankings – a real fall from grace.

Start your investment journey into crypto with Luno with £10 on us!

If you’ve not started your crypto journey yet, we’ve joined forces with Luno to offer you £10 absolutely free. Click on the graphic below and simply use the code CITYAM10 when you sign up.

In the markets

| Name | Price | Price Change (24h) | Price Change (7 days) | |

| Bitcoin (BTC) | $57,763.79 | +0.85% | -1.60% | |

| Ethereum (ETH) | $1,793.94 | +0.64% | -0.86% | |

| XRP (Ripple) | $0.5223 | +0.18% | +19.12% | |

| Monero (XMR) | $236.44 | +0.71% | +2.75% | |

| Polkadot (DOT) | $37.28 | +0.93% | +1.11% | |

| Algorand (ALGO) | $1.22 | +2.66% | +1.74% | |

| Cardano (ADA) | $1.20 | -0.67% | +16.21% | |

| Chainlink (LINK) | $29.15 | +0.38% | +3.99% | |

| Aave (AAVE) | $370.20 | +0.67% | +0.17% | |

| UniSwap (UNI) | $33.14 | +2.19% | +9.87% | |

| Celsius (CEL) | $4.97 | -0.19% | -0.46% | |

| Binance Coin (BNB) | $266.00 | +0.95% | +2.85% | |

| Crypto market cap | $1,791,286,788,694 | |||

| MVIS CryptoCompare Digital Assets 100 Large-Cap Index | +0.50 | |||

| MVIS CryptoCompare Digital Assets 100 Small-Cap Index | +2.29 | |||

| MVIS CryptoCompare Ethereum VWAP Close Index | +0.13 | |||

| Prices and data as of [08:00, 22/03/2021] | Source: CryptoCompare.com, MVIS |

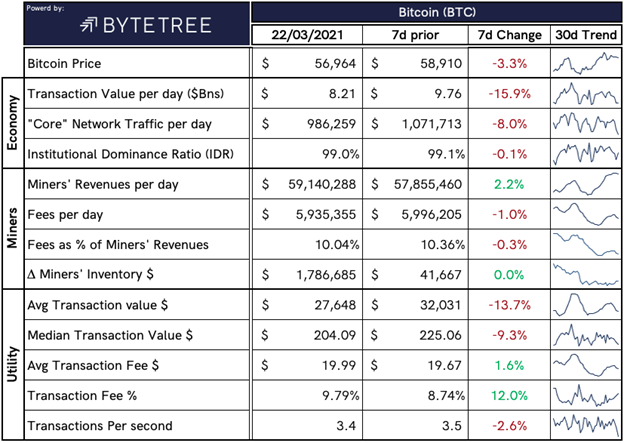

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

What Bitcoin did yesterday

We closed yesterday, March 21 2021, at a price of $57,523.42 – down from $58,313.64 the day before. It’s now 15 days in a row that the price has closed above $50,000.

The daily high yesterday was $58,767.90 and the daily low was $56,005.62.

This time last year, the price of Bitcoin closed the day at $6,185.07. In 2019, it closed at $4,029.33.

As of today, buying Bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Bitcoin market capitalisation

Bitcoin’s market capitalisation is $1,077,071,644,262. To put that into context, the market cap of gold is $10.973 trillion and Alphabet (Google) is $1.372 trillion.

Bitcoin volume

The volume traded over the last 24 hours was $48,483,428,262. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 68.47%.

Fear and Greed Index

Market sentiment is back down in Greed at 70.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 61.28. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 59.08. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Bitcoin’s market cap of $1 trillion makes it too important to ignore. As long as asset managers and companies continue to enter the market, Bitcoin prices could continue to rise.”

– Deutsche Bank research analyst Marion Laboure, Ph.D.

What they said yesterday

The crypto community is weird sometimes…

Barry…

One to watch for the week…

Certainly sounds a bit like it…

Crypto AM Editor writes

Sophia the robot to become next NFT sensation

Can Bitcoin hit $60,000 this week?

Bitcoin mounts fresh assault on $55k

Institutions are driving cryptocurrency

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with Zumo

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special Five Part Series

March 2021

Day Five

Day Four

Day Three

Day Two

Day One

Crypto AM: Recommended events

CC Forum

Global Investment in Sustainable Development

March 31 to April 1 2021 – Dubai

Global Technology Governance Summit

April 6 and 7 2021 – Tokyo

https://www.weforum.org/events/global-technology-governance-summit-2021

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.