Crypto Market Cap breaks $500 Billion As Bitcoin’s Price Blasts Through $18,000

This week CryptoCompare data shows the price of Bitcoin (BTC) moved from around $16,000 to a new high for the year of $18,800. Over the week the price fluctuates close to $19,000 and BTC is at press time trading at around $18,700.

Ether (ETH), the second-largest cryptocurrency by market capitalization, moved steadily up throughout the week, starting it at around $450. The price of ETH jumped after the $500 barrier was breached, and the crypto is now trading at $590.

Headlines this week were dominated by bitcoin’s price rise and growing market capitalization of the cryptocurrency space. Data shows all cryptoassets combined now have a market capitalization above $547 billion, with the $500 billion mark being breached this week. Bitcoin’s market capitalization hit a new all-time high of $346.8 billion this week, even though its price is not at a new all-time high.

While BTC is close to $19,000 and its all-time high was near $20,000 in December 2017, there are now more bitcoins in circulation than in December 2017, which make up the difference. Blockchain.com data shows that in December 2017 there were about 16.7 million BTC in circulation, while now there are 18.546 million BTC.

Bitcoin’s price rise over the last few weeks is believed to be a result of increasing corporate adoption for the flagship cryptocurrency, coupled with PayPal’s new service that lets users buy, sell, and hold cryptocurrencies on its platform. The service is for now only available to users in the U.S. and supports BTC, BCH, LTC, and ETH.

According to Bitcoin Treasuries, a website tracking firms’ investments into bitcoin as a reserve asset, at least 15 publicly-traded companies have now invested in the cryptocurrency. Some of the investments have already appreciated since they were made.

Such is the case of MicroStrategy’s $425 million bet on bitcoin. The firm bought 38,250 BTC for that sum, but the coins are now worth over $715 million. Similarly, Square bought $50 million worth of BTC earlier this year, and the coins it holds are now worth over $88 million.

Some of the other publicly traded firms with bitcoin exposure include BTC mining firms like Hut 8 Mining, Argo Blockchain, and Riot Blockchain. Outside of these firms, institutional investors are moving into the market via Grasycale’s investment funds. Its Bitcoin Trust product, GBTc, now holds over 500,000 BTC and the total amount of assets under management for Grayscale is now over $10 billion.

In its financial report for the third quarter of the year, Grayscale revealed inflows above $1 billion and detailed GBTC was leading in investment demand. It pointed out that institutional investors accounted for 81% of the investment in Q3.

Bitcoin’s price performance drew attention from various celebrities, including Game of Thrones’ star Maisie Williams. Maisie, who played the character Arya Stark in the series, asked her Twitter followers if she should go long on BTC. Shortly after, Maisie revealed she “bought some anyway.”

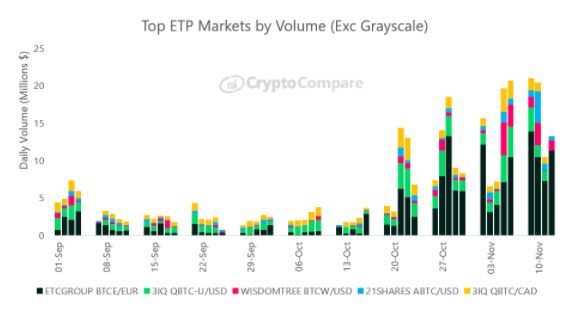

The growing interest has seen a new report reveal that the aggerate trading volume of bitcoin exchange-traded products (ETPs) has surged 53% since mid-October, with several products demonstrating above-market returns.

The report, CryptoCompares Digital Asset Management Review, adds Average ETP daily volumes are now at $173.5 million, compared to $113 million back in October. Grayscale’s Bitcoin Trust (GBTC), which now holds over 500,000 BTC in it, has seen its volume increase 68% to $162 million so far this month, and it represents the vast majority of Grayscale’s volume. It’s followed by the Ethereum Trust (ETHE), trading $10.9 million per day this month.

Decentralize Finance Plagued By Exploits

While the crypto market, in general, is advancing, several smaller decentralized finance (DeFi) projects have been exploited over the last few days, with most of the attacks using so-called flash loans.

These loans are complex, taken, and repaid in the same transaction so as to not require any collateral. Most attacks use the loaned funds to manipulate the price of a specific cryptocurrency on the protocols and make a profit for the hacker.

Top DeFi projects that have been audited, including Uniswap and Compound, have so far managed to stay above these attacks with no recorded exploits against them. Exploited DeFi protocols include Pickle Finance, Value DeFi, and Origin Protocol.

This week has also seen leading crypto trading platform OKEx reveal it will reenable withdrawals “on or before” November 27 of this year, as the private key holder it had lost contact with who was cooperating with an investigation has “completed assisting the authorities.”

Similarly, hacked cryptocurrency exchange KuCoin has resumed deposits and withdrawals. The exchange was hacked for some $280 million in various cryptoasets, and is said to have recovered over $200 million.

Crypto AM: Market View in association with Ziglu