Crypto is a revolution built on economic and social incentives

Money is a form of energy. Blockchain/crypto bull markets are spurring the transformation of wealth. Bear markets weed out the tourists.

Crypto is socioeconomically transforming humanity while making the Industrial Revolution seem trivial by comparison.

It is changing how we interact. It is leap-frogging man-made boundaries. In consequence, countries will become less relevant. The idea of nationalism will change from man-made boundaries of an outdated era towards clusters of decentralized communities that likely start in the metaversal digital world and osmotically permeate into the physical “meatspace”.

Indeed, crypto is multidimensionally connecting us by leveraging the power of the internet, open source networks, and decentralised platforms. It is the next wave of the internet. NFTs, DeFi, and DAOs address a $400 trillion market. Crypto will thus become the socioeconomic OS/2 with transparent, immutable, secure rules that enable coordination and cooperation at orders of magnitude beyond anything we’ve seen.

Back in the early 1990s, e-mail – which had been in use by a small minority in the early 1980s – made the Internet essential and thus led to mainstream adoption. NFTs are the ’email moment’ of crypto. NFTs are living and evolving expressions of culture in real-time with everything recorded on-chain. By contrast, Picasso, Dali, and Anthony Christian are classics we learn about from art historians with little context beyond that.

But this evolution does not stop at art. E-commerce went from generalised (Craigslist) to specialised platforms transforming many industries (Airbnb, Uber, etc). Similarly, NFTs start with art and will expand into many other industries, cultures, and the like.

Many questioned when I launched one of the first 3,000 websites in 1995, www.virtueofselfishinvesting.com, saying the internet was only good for credit card fraud and porn. Then again with Bitcoin and Ethereum in the early 2010s claiming money laundering, trafficking, no value and the like. Then again with NFTs as “they’re just jpegs with many rug pulls”.

Every innovation is a double-edged sword with the capacity for good or bad, but if we listened to the pessimists, we would still be stuck in the Dark Ages.

Incentives are what drive actions. Crypto is built on economic and social incentives that make good actors of the mass majority of participants because it is transparent. When you know everyone is observing, and you know that bad actions can become a permanent record on the blockchain, you’re more likely to do the right thing. This makes positive behavior the Schelling Point.

The elephant in the room has been the rise of authoritarianism across the planet. This has spurred the rise of crypto. Not everyone understands how technology works, but everyone ends up using it because the standard way proves inferior. We have seen endless former evolve into latter from the very beginnings:

Darkness < Fire

Kerosene < Electricity

Manual entry < Printing press

Telegraph < Internet

Phone < Smartphone

Fiat < Bitcoin

CeFi < DeFi

Authoritarianism < Decentralised governance

Injustice < Crypto DAOs

Decentralised governance

Decentralised crypto governance is superior to standard democracies because each person’s vote is a token which has tangible value versus a regular vote. Such forms of governance are far more lean and efficient. As the legendary journalist Walter Lippman wrote, the average voter is ignorant and easily swayed with any form of critical thinking left behind – “The best argument against democracy is a five-minute conversation with the average voter.”

Crypto platforms (DAOs, DeFi, NFTs, etc) use tokens to tie incentives together towards a Schelling Point. By contrast, traditional systems are top down hierarchical that use force to establish order. The best of such systems may be robust but not anti-fragile.

Wall of worry

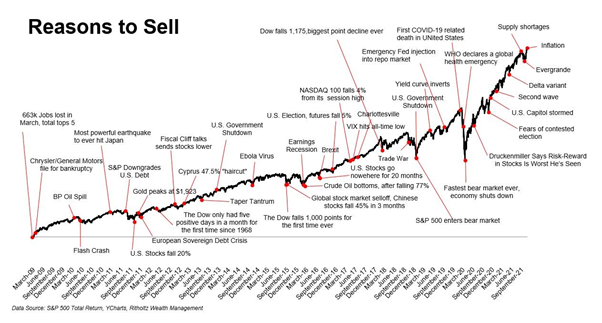

In the meantime, there are always endless reasons to sell from temper tantrums to government shutdowns to yield curve inversions to Covid scares to delta variants to Evergrande to inflation to supply chain breakdowns to gurus such as Stanley Druckenmiller saying in May 2020 that the risk-reward in stocks is the worst he’s seen.

Yet major averages have staged minimal corrections since then as they shoot higher from never-ending flows of QE.

Bitcoin also climbs this wall of worry which creates blood curdling bear markets of typically between -84% to -94% off peak and is why there are very few long term holders of Bitcoin. On the bullish side, Bitcoin is currently around $60k where it received support at its 50 dma. There are also a number of whales supporting this price level according to on-chain metrics.

Bitcoin’s Taproot was launched on August 24 2017 which is the first major upgrade since Segwit. In the months after Segwit was launched, Bitcoin rose from about $4,000 to about $20,000 where it topped. Bitcoin and Ethereum supply shortages remain key factors as both continue to be moved into cold storage. Also, Biden’s $1 trillion stimulus package is now live. Expect further trillion dollar packages in the future.

M2 does not decrease but tends to increase if history is any guide. The more credit money you put into the system, the more future demand you create for the dollar being the world’s reserve currency. Fiat currency induces indebtedness, and indebtedness requires more money to satisfy the debt, so a debt spiral is created when fiat currency inflation hits a certain rate. This bodes well for Bitcoin, hard assets, and stocks.

On the bearish side, a large number of Bitcoin from the defunct crypto exchange Mt Gox was recovered and distribution has begun. This may create short term selling pressure, though so far, the market has been able to absorb such pressure due to the shortages. The recent downturn in Bitcoin is likely due to hedge funds shorting ahead of the Mt Gox Bitcoin release date as short interest remains elevated. Finally, the dollar has been in an uptrend which historically is a headwind for Bitcoin.

With these cross currents in play, expect choppy, trendless action in the short term, but a breakout in the ensuing weeks as prime metrics point to further upside. There appears to be plenty of fuel left in the tank.

(͡:B ͜ʖ ͡:B)

Dr Chris Kacher, bestselling author/top 40 charted musician/PhD nuclear physics UC Berkeley/Record breaking audited accts: stocks+crypto/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr Kacher bought his first Bitcoin at just over $10 in January-2013 and participated in early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in Bitcoin since 2011. He was up in 2018 vs the median performing crypto hedge fund at -46% (PwC) and is up quadruple digit percentages since 2019 as capital is force fed into the top performing alt coins while weaker ones are sold.

Virtue of Selfish Investing Crypto Reports

https://www.linkedin.com/in/chriskacher/

https://hansecoin.medium.com/subscribe

TriQuantum Technologies: Hanse Digital Access

https://twitter.com/VSInvesting/ & https://twitter.com/HanseCoin