Crypto investment products’ trading volumes plunge after China’s crackdown

CryptoCompare data shows the price of Bitcoin (BTC) moved within the $30,000 to $35,000 range throughout the week after failing to surpass the $40,000 barrier earlier this month. The cryptocurrency is down significantly from its near $64,000 all-time high seen last month.

Ethereum’s Ether, the second-largest cryptocurrency by market capitalisation, was also range-bound throughout the week, trading between $2,000 and $1,700 after failing to surpass the $3,000 mark earlier this month.

Cryptocurrency prices fell in June after authorities from China’s Sichuan province ordered a state-owned power grid to cut the energy of 26 cryptocurrency mining farms in the region. Major Chinese BTC mining pools were hit by the order, leading to a 17 per cent hashrate drop on the Bitcoin blockchain.

The move came shortly after authorities in Xinjiang directed power plants in the Zhundong Economic Technological Development Zone to shut down their mining facilities. Both Xinjiang and Sichuan have historically been major Bitcoin mining hubs in China due to their abundant fossil fuel and hydroelectric energy.

Shortly after, the People’s Bank of China (PBoC) told the country’s major financial institutions to stop facilitating cryptocurrency transactions. In a statement, the PBoC said banks must not provide products or services such as trading, clearing, and settlement for cryptocurrency transactions. They must also identify exchanges over over-the-counter dealers’ capital accounts and cut off the payment link for transaction funds.

The central bank’s statement came after consultation with the Industrial and Commercial Bank of China, Agricultural Bank of China, Construction Bank, Postal Savings Bank, Industrial Bank, and Alipay (China) Network Technology. Per the PBoC, crypto transactions are a risk for illegal cross-border transfers and money laundering.

Crypto crackdown

China’s crypto crackdown combined with environmental concerns surrounding Proof-of-Work consensus algorithms saw the prices of most top cryptocurrencies crash. The total interest in the Bitcoin futures market, as a result, dropped 59 per cent from its $27.3 billion peak on April 13 to now sit at $11.3 billion.

Similarly, total assets under management among cryptocurrency investment products dropped by 9.5 per cent to $40.5 billion. According to CryptoCompare’s Digital Asset Management Review, average weekly asset inflows across all major cryptocurrency investment products decreased by a whopping 215 per cent since May, as $86 million of outflows were recorded.

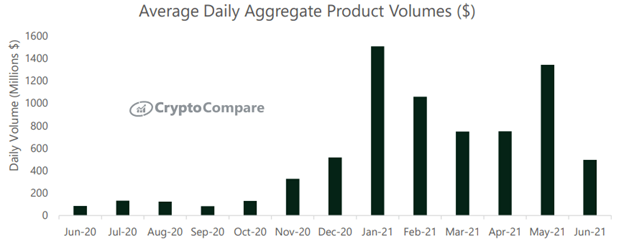

While assets under management dropped by less than 10 per cent, the report details aggregate daily volumes across all cryptocurrency investment products decreased by “an average of 63.1 per cent in June compared to May, meaning average daily volumes for this month are now at $494.4 million.

Despite these drops, Wall Street giant Citigroup is set to help its richest clients bet on cryptocurrencies as part of a new digital asset group inside its wealth management unit. The new group will help Citigroup’s clients invest in cryptocurrencies, stablecoins, and non-fungible tokens, as well as central bank digital currencies.

Morgan Stanley and Goldman Sachs have already launched their own internal initiatives to help their rich wealth management clients gain exposure to the cryptocurrency market. Prominent VC firm Andreessen Horowitz (a16z) has this week launched a $2.2 billion cryptocurrency-focused fund, called the “Crypto Fund III”. It’s a16z’s third and largest crypto venture fund.

Regulators are paying attention to crypto

El Salvador’s President Nayib Bukele said in a national address on Thursday that the recently passed law making Bitcoin legal tender in the country will take effect on September 7. The government will use an e-wallet preloaded with $30 in BTC to every citizen who downloads the wallet and verifies their identity.

Despite El Salvador’s move, regulators throughout the world have been targeting cryptocurrency exchanges and operators. Norway’s Financial Supervisory Authority (FSA) has said there is a need for a legal framework if cryptocurrencies are to become a suitable form of investment for consumers.

Moreover, the Ontario Securities Commission (SEC) charged cryptocurrency exchange Bybit with “operating an unregistered crypto asset trading platform, encouraging Ontarians to use the platform, and allowing Ontario residents to trade crypto asset products that are securities and derivatives”.

Over the week, Nasdaq-listed cryptocurrency exchange Coinbase has seen Japan’s Financial Services Agency (FSA) greenlight its move into the Japanese crypto market by registering it as a crypto exchange in the country.

Coinbase will be allowed to trade BTC, BCH, ETH, XLM, and LTC through a subsidiary of Coinbase Global, the company listed on the Nasdaq exchange.

The week was also marked by blockchain investment firm QR Capital’s Bitcoin exchange-traded fund (ETF) starting to trade on the São Paulo-based B3 exchange under the ticker QBTC11, after being approved by the Brazilian Securities and Exchange Commission.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies but has no bias in his writing.

Featured image via Unsplash.