Crypto ETP assets under management surpass $43 billion as interest keeps growing

CryptoCompare data shows the price of Bitcoin (BTC) moved from around $47,000 to a $46,500 low amid significant volatility, but soon after recovered. Over the week Bitcoin tested the $50,000 mark numerous times but failed to stay above it.

Ether (ETH), the second-largest cryptocurrency by market capitalization, started the week above $1,500 and dipped to a $1,450 low when BTC’s price corrected, and has been moving steadily up since to now trade above $1,700.

Institutional investor interest in digital assets became clearer this week, with Goldman Sachs restarting its cryptocurrency trading desk early in the week. The desk is set to start trading Bitcoin futures and non-deliverable forwards for clients. Goldman Sachs’ activities in the digital asset space also include projects related to blockchain technology and central bank digital currencies.

The firm first set up a cryptocurrency trading desk in 2018, when the price of Bitcoin was entering a bear market that would see its price drop from nearly $20,000 to just over $3,000 a year later. Since then, digital asset market infrastructure has matured, with established financial institutions like CME, the Intercontinental Exchange, and Fidelity offering products and services.

CBOE global markets, the global equities and derivatives exchange, also showed interest in a filing with the US Securities and Exchange Commission (SEC), in which it sought approval to list and trade VanEck’s Bitcoin exchange-traded fund (ETF).

Over the week Google Finance – a data site maintained by the tech giant – quietly added a tab dedicated to cryptocurrencies with a prominent placement right at the top of the page. Cryptocurrencies are listed among five default markets, including the US, Europe, Asia, and “Currencies”.

The new section provides key pricing information for various cryptocurrencies including Bitcoin, Ether, Litecoin, and Bitcoin Cash. The number of cryptocurrencies available on the platform appears to be limited for now, with top cryptos like Cardano’s ADA, Polkadot’s DOT, and Stellar’s XLM not appearing on the platform.

On top of these developments Evolve Funds, the firm that won approval from Canadian regulators for its Bitcoin exchange-traded fund (ETF) last month, has filed to list a product based on the second-largest cryptocurrency by market capitalisation, Ether (ETH).

Moreover, PayPal is said to be in talks to acquire cryptocurrency custody firm Curv, which could be sold for between $200 million and $300 million. PayPal is said to have turned its attention to Curv after talks to buy crypto custody and trading firm BitGo fell through. The payments giant reportedly offered $750 million in cash for BitGo, but the offer seemingly wasn’t enough.

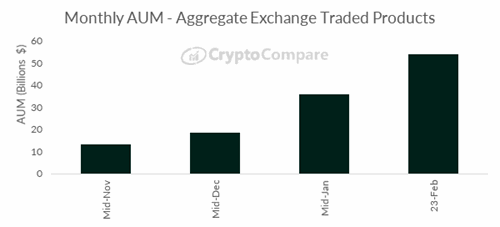

Data from CryptoCompare’s Digital Asset Management Review shows that institutional interest in cryptoassets has been steadily growing, with the assets under management (AUM) of crypto exchange-traded products (ETPs) increased to a record high near $44 billion last month, even as trading volumes for these products dropped.

Despite Bitcoin’s new all-time high exceeding $58,000 last month, exchange-traded products (ETP) volumes decreased, with the average daily trading volume increasing from $1.51 billion to $936 million.

Amazon managed blockchain adds Ethereum support

Two years after hinting about it, Amazon Web Services (AWS) has started supporting Ethereum out-of-the-box on its ‘managed blockchain’ service. The service also supports Hyperledger Fabric – a permissioned blockchain network intended for enterprise applications.

In a blog post, AWS wrote that the move allows its customers to “easily provision Ethereum nodes in minutes and connect to the public Ethereum main network and test networks such as Rinkeby and Ropsten”.

Amazon wasn’t the only company to launch crypto-related new features. Cryptocurrency exchange Bitfinex launched a payment system called Bitfinex Pay. It will use an integrated widget to appeal to businesses of every size, effectively allowing online merchants to accept contactless and borderless digital currency payments.

Bitfinex Pay will support BTC, ETH, and Tether’s USDT via the Ethereum and TRON blockchain. It also supports Bitcoin’s Lightning Network.

Over the week, the MIT Media Lab’s Digital Currency Initiative (DCI) announced a $4 million, four-year-long research and development program to protect the Bitcoin network. The funds were raised from prominent backers including CoinShares’ Meltem Demirors, Twitter’s Jack Dorsey, and MicroStrategy’s Michael Saylor. Corporate entities including Fidelity Digital Assets also participated.

The project’s core focus will be the long-term health of the Bitcoin protocol.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies but has no bias in his writing.

Featured image via Unsplash.