Crypto AM shines its Spotlight on Tap

tap, the world’s first truly unified crypto banking app launched to the public on the 24 February 2020 and is the only company regulated in Europe currently operating a prepaid MasterCard.

Regulated to trade and store customers’ digital assets by the Gibraltar Financial Services Commission, tap is in essence, bridging the gap between traditional and non-traditional currency. This allows both seasoned and new crypto traders to access funds quickly and also pay day-to-day expenses selling their crypto assets to fund a prepaid Mastercard. A revolutionary approach to personal finance. Tap is paving the path to facilitate this transitioning economy by combining modern banking with crypto trading through their multi-coin e-wallet. The Tap app users in the EEA have the option of adding the Tap prepaid Mastercard that is linked to the user’s account..

With over 6k customers already using the app, the tap account comes with multiple crypto and fiat wallets and has access to real time crypto trading with numerous exchanges. All assets are held securely in multi signatory insured “cold storage” wallets or as segregated electronic money accounts with tap’s e-money partner.

Arsen Torosian, tap Founder / CEO, said: “Crypto needn’t be on the opposite end of the financial spectrum. With a growing market landscape and positive outlook for cryptocurrencies, what we do is combine the legacy of traditional banking with the allure of the crypto market to allow customers to easily access their crypto and use this as an additional or alternative method of personal finance.

“We are the only app with a Mastercard operating in Europe enabling users to instantly transform digital assets into wealth. The crypto tide is happening, and financial institutions who ride the wave could come out on top.”

tap currently supports three cryptocurrencies: BTC, ETH, LTC and three fiat currencies: USD, EUR, GBP. In the future tap will expand these supported currencies to any cryptocurrency with a daily traded volume of $1m+ and the top 14 fiat currencies supported by the card scheme.

Future of currency and investment

The U.K. has announced a £320 Billion in government-backed loans and guarantees to help businesses through Covid-19 with financial regulators across the globe freeing up £400 Billion of capital to help lenders absorb the impact of the pandemic.

Amidst this crashing economy, the forecast for bitcoin is to reach its record high of £16,000, and possibly £22,000, this year.

Quantitative easing and coronavirus pandemic are considered as fuels behind bitcoin’s maturity, particularly when benchmarked against the falling stock market and crude oil.

Covid-19 is hastening the shift away from paper money and stimulating plenty of quantitative easing, which is helping bitcoin, as it serves as an independent store-of-value. This year, Bitcoin has done better than both U.K. and world stocks, given a 25% and 16% drop in the FTSE 100 and MSCI All-Country World Index. Bitcoin, meanwhile, climbed to 2020 highs of £7,600 somewhat advancing its reputation as a so-called safe haven.

Bridging the gap between fiat and BTC

While traditional finance, which includes banking, investment, and insurance, has been severely impacted amidst the pandemic, the cryptocurrency market has been performing well.

The cumulative market capitalisation of the crypto asset class is approaching £220 billion. A major portion of this valuation comes from the potential of the crypto market to be used as a hedge against the present economic system. Countries like Venezuela and Zimbabwe are prime examples of this, where citizens have turned to crypto-assets because their local fiat currencies have depreciated significantly.

While institutional demand has undoubtedly increased, even retail adoption is on the rise. Tap Global has been at the forefront of introducing crypto among retail investors. Providing split-second access to crypto trading and payments with our revolutionary tap trading app and contactless tap prepaid Mastercard making it seamless to trade crypto and fiat currencies to allow people to instantly spend crypto-assets.

“This is just the beginning of our cryptocurrency journey” said Arsen Torosian tap CEO. He continued, “We are not just a crypto company – we are the bridge between traditional finance and crypto, geared to make crypto adoption seamless.”

tap has also now partnered with Australian company, Hay as a Service (HaaS) to issue local Australian residents with AUD banking services. This feature is tap’s first step on the road to global expansion. These accounts will allow local tap app users to receive deposits into their Tap accounts in AUD. Once funds are received, our users can then allocate these for the trading of digital assets in real time. Users will also be able to make AUD payments out to Australian bank accounts or for local payments.

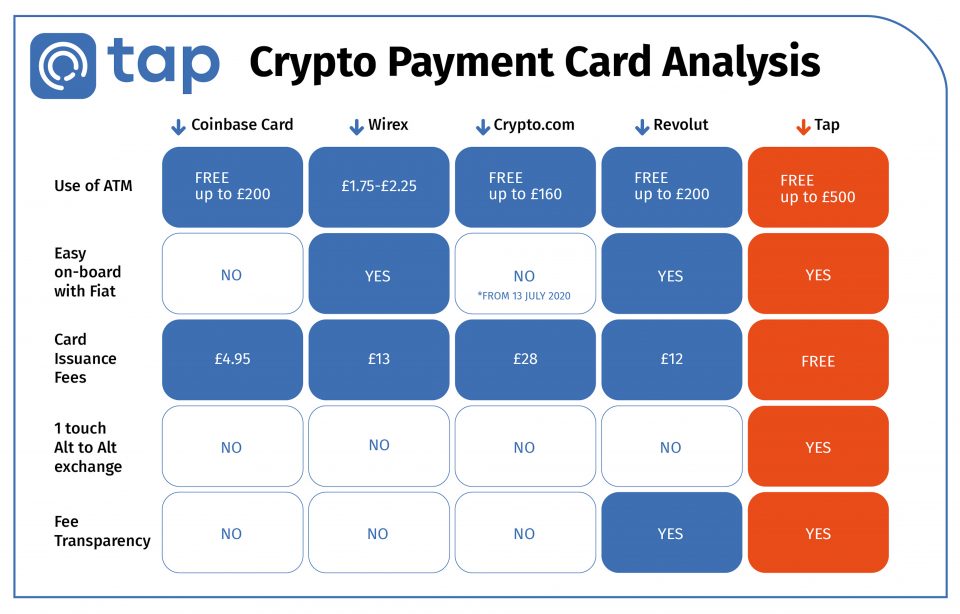

Competitor analysis

Today, the popularity of Bitcoin has grown significantly from five years ago. In London alone, there are over 130 bitcoin ATMs and more than 50 merchants accepting bitcoin for payment.

As crypto space is growing rapidly, several merchants are yet to adopt this new economy making it difficult to find some that accept crypto as a payment method. This is where the crypto revolution is witnessing a new wave through crypto prepaid cards, which serve as a great option. Crypto cards are an effective compromise between the legacy financial systems and this new paradigm. They serve as a tool to bridge the gap between the future of cryptocurrencies and the legacy fiat systems.