Crypto AM shines its Spotlight on Moneybrain BiPS

What if Libra Was Live Today?

The world was in a different kind of uproar for months after Facebook and their alliance announced Libra. Then it was that senators were foaming at the mouth and it was the central banks that came close to rioting.

Amid similar Trump-inspired scenes of protest on the streets of some of the cities of America today what if Libra now existed after all, quietly in some lab somewhere?

Well it does – not in a lab but ‘out in the wild’, on thousands of mobile phones downloaded from the appstores.

The Strange, but true, story of Moneybrain BiPS

This is the strange, but true, story of Moneybrain BiPS. Conceived in England’s, Alderley Edge well before Libra had been heard of by a company regulated by the FCA, but with precisely the same structure and legal underpinnings as Libra itself – including a foundation: the BiPS Foundation.

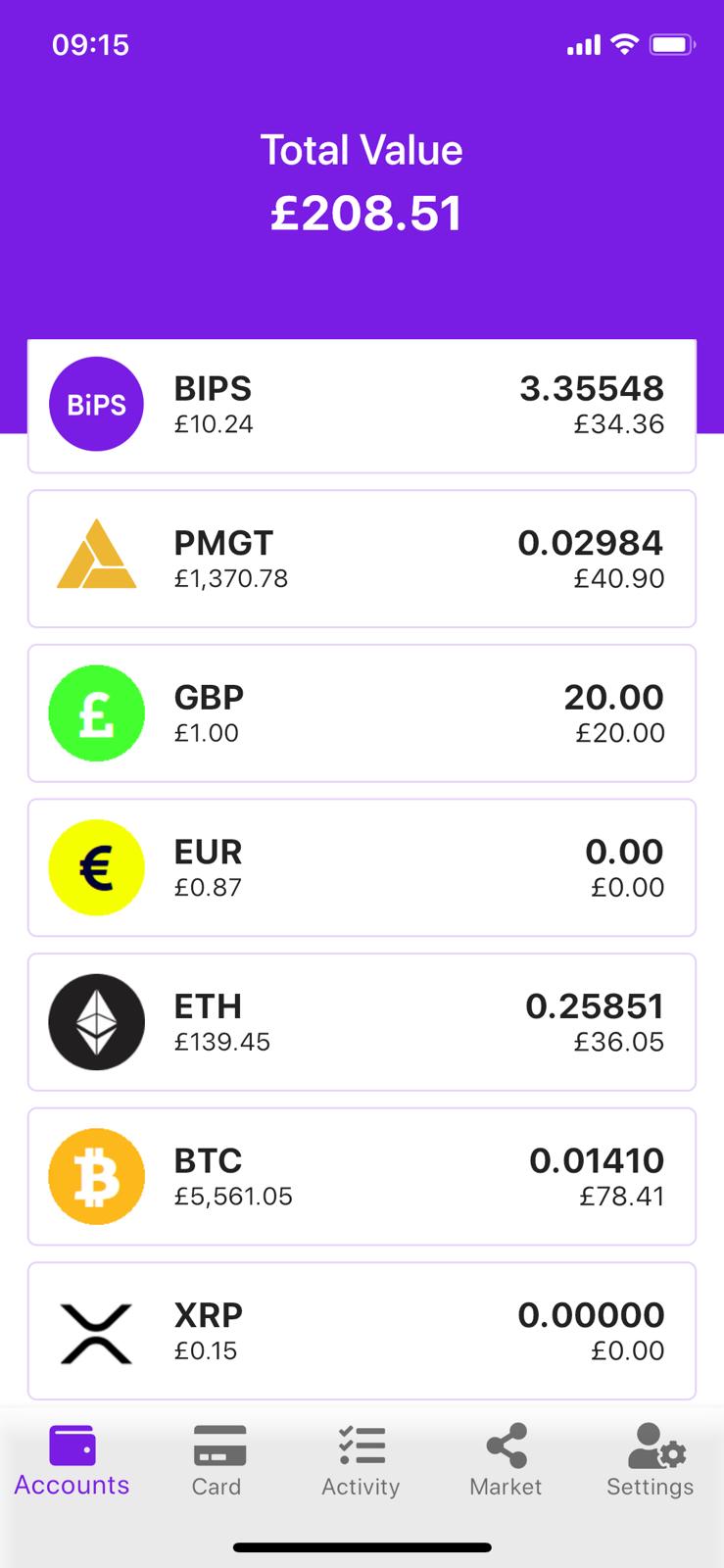

So, yes, pegged to a basket of stable assets, gilts, property and fiat currencies, that underpin its value and prevent its price swinging violently, in the manner of most cryptocurrencies. With a strictly limited supply set by the FCA authorised firm behind it, the price has drifted gently upwards from £10 at the kickoff 16 months ago to £10.24 when I checked my phone today

App to app transfers of BiPS are near instant with a fixed charge of 1p (transactions native to the Ethereum blockchain vary, but are currently running at 30p). So although BiPS was designed as an asset class and is developed by a regulated team, with a raft of financial permissionsfrom the FCA, BiPS makes a pretty ideal medium of exchange – a currency.

And that matters right now when for governments around the world, especially some smaller ones, currencies are collapsing. Plus there’s a pressing need to get money ‘Helicoptered’ to where it is needed. Right onto the persons’ phone.

Not to mention that Facebook favourite; remittances – migrant workers send money back home to families, who are routinely gouged at 7 to 10%

BiPS No Accident

But none of this was an accident – even if it was not pre-planned. The team behind BiPS, and much else, is led by Lee Birkett, perhaps better known as the face of one of the UK’s most successful P2P platforms, JustUs.

A native of Manchester Lee was a boy with a passion for technology that led him to launch one of the UK’s first online financial services firms, Presbury.com, in 1993 – named after the pub in which he and a friend hatched the plan.

So this is no flash-in-the-pan or bubble – but an entrepreneur and a team that has weathered both the 2000 internet bubble and the 2008 crash – after which Lee, the ground cut from beneath his feet, vowed never to be reliant on the banks again.

Moneybrain.com itself was launched in 2000. The first online IFA & Credit Broker. Further innovating, growing into a P2P lending platform JustUs.co. Which by 2017 was already well established as a leading, if small, P2P player – one of only four Fintech platforms that can lend to retail borrowers (the others being Zopa, Ratesetter & Lending works).

P2P… Fractionalisation… Tokenisation… Global Currency

It was in 2017 that someone asked me a question and the lightbulb moment struck. “Since you are already fractionalising regulated loans into £10 micro-loan parts on the P2P platform (as a regulated activity) isn’t it a short step to tokenisation?”. That got the ball rolling.

Lee says “So we now have a global currency for P2P digital banking and payments – even though that is not what we set out to do!”

Although he dismissed it at first Lee now says “So for us to actually take a step into that, the blockchain crypto world, was really difficult for me because of the non-regulated nature and the reputational risk of being involved in the space”. A space that at the time was dominated by wild and woolly ICOs.

“Then we saw some of the key stakeholders coming into play… But regulatory engagement was the main trigger that enabled me to say, okay, this isn’t going away!”

So “we set out on this journey nearly two years ago, specifically a digital currency – and bringing it to ordinary people. We’ve long had a ‘fair finance’ objective at our core. Now that’s being driven alongside a situation where people are expressly wanting a fairer economy, a healthier, greener Earth. They want a more democratic way – one that does not penalise those that are most vulnerable.”

“Hence we created our fair finance mission, we built the currency, we built a platform – and any good actor is welcome. Can become part of the projects and the people around it. Our team are pretty big hitters, and they’ve all been working on this project at no cost because it’s for the good of the people.”

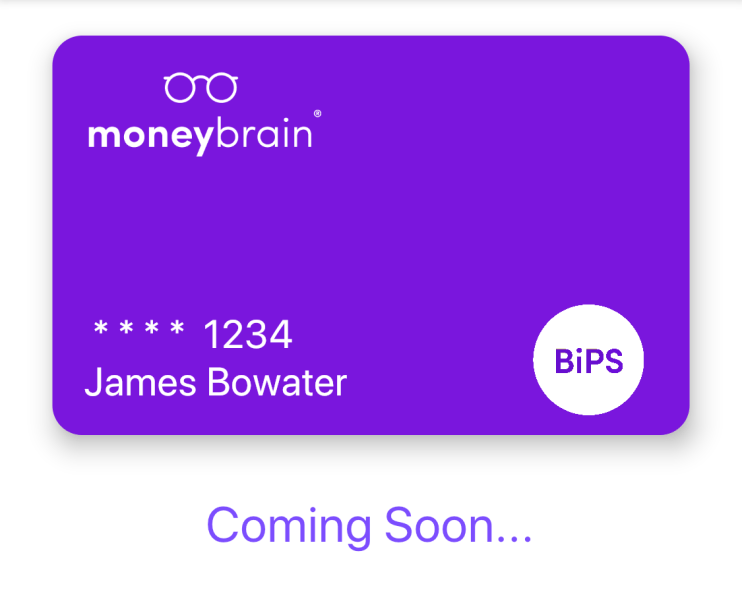

“And the final piece of that jigsaw that we’ve been waiting for for over a year has now been signed off by MasterCard globally, who have a Covid-19 taskforce. They see the immediacy of the requirement for an alternative to the banking system, and that is electronic money. And so we’ve managed to create both a Moneybrain business card, for businesses and sole traders. Plus a Moneybrain personal card, both now signed off at both European and Global level.

So while Libra have been waved off the pitch at a crucial moment in history BiPS can do what they can only aspire to – and more.

“Plus we’re really pleased to have the new gold currency from Australia, PMGT, on the app. I think we’re the first in the world to actually enable people to hold a token, backed by real gold, pegged one to one and guaranteed by the Australian government – via the Perth mint.

“We’ve got further global plans to roll the App & cards out across Asia and the Americas. But at the moment people from the UK and EEA can buy the leading cryptocurrencies, or better by far, in our opinion, the best crypto currency – BiPS on the Moneybrain IOS or Android App or via the online platform by bank transfer or Visa/Mastercard.

The full interview with Lee Birkett is available on FrontierTechRad.io here and you can follow Lee on LinkedIn or Twitter