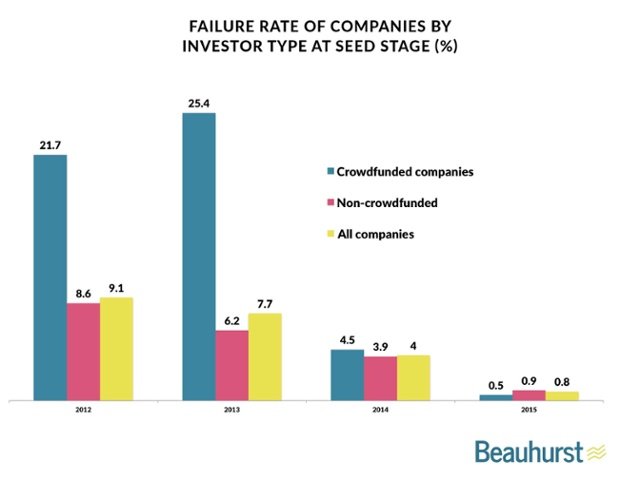

Crowdfunding is getting less risky as failure rates fall dramatically, according to Beauhurst

Crowdfunding is getting less risky, as the failure rate of equity-crowdfunded seed-stage companies in the UK falls to an all-time low.

The start-ups using crowdfunding platforms to raise capital have become more successful, reducing the risk for investors, according to the latest data from Beauhurst, which tracks venture capital activity.

Read more: The equity crowdfunding refresher: An investor's guide

In fact, not only has the failure rate of crowdfunded seed-stage companies normalised in line with non-crowdfunded companies, last year the rate of failure was lower than for non-crowdfunded startups, and the average failure rate.

Beauhurst tracked companies in troubled, as defined by the Companies House, including: companies dissolved, in administration, closed, or subject to winding up petitions, as of this week.

So, of companies that received seed-funding in 2012, four years later 21.7 per cent had failed. That dropped to 4.5 per cent from 2014. Of course, that could be because they had less time to go wrong, but Beauhurst's head of research, Pedro Madeira, said the key fact was that the rate of failure had come into line with other start ups.

This improvement in the failure rate is partly down to the fact that the fledgling crowdfunding industry has had a chance to sort out some of its teething problems, and also that the quality of companies has got better as the industry has grown more reputable.

Read more: Don't fear coming equity crowdfunding failures

Madeira told City A.M. that self selection was helping: safer companies, which were better prospects for investors, were considering crowdfunding when five years ago they wouldn't have.

He also said that over the last two and a half years, in response to criticism, the industry had matured and got better at due diligence before the companies were admitted to a crowdfunding site, adding:

Launching an equity crowdfunding campaign has, in the space of five years, gone from carrying a significant level of risk to being a highly professionalised way for companies to receive publicity alongside funding.

There are still failures. Last year, London-based luxury shoe company Upper Street went into administration just months after raising £244,000 on Seedrs, offering 5.7 per cent equity at a pre-money valuation of £3.8m.

LumeJet – a photonics tech company that raised £1.54m in exchange for 26.6 per cent equity through CrowdBnk also collapsed.