Credit Suisse faces shake up under new boss Tidjane Thiam

Credit Suisse is braced for major changes to its investment banking units, as shareholders welcomed the appointment of Prudential boss Tidjane Thiam as chief executive.

The incoming boss gave few clues as to his plans at a press conference yesterday, but is expected to cut back investment banking and focus on the traditional core of asset management.

“There are things that need to be improved,” Thiam said.

“Credit Suisse has been successful but I don’t know an organisation that doesn’t need change.”

Thiam is not an investment banker, with Prudential instead focusing on asset management and insurance.

Industry-watchers believe this could mean bigger cuts to the investment bank.

Credit Suisse had moved down this path in recent years with a series of major reforms, but there is more room to retrench and shift the focus even further into the wealth management units.

Analysts believe that serious cuts are one option, while an alternative could be to tap investors for more funds.

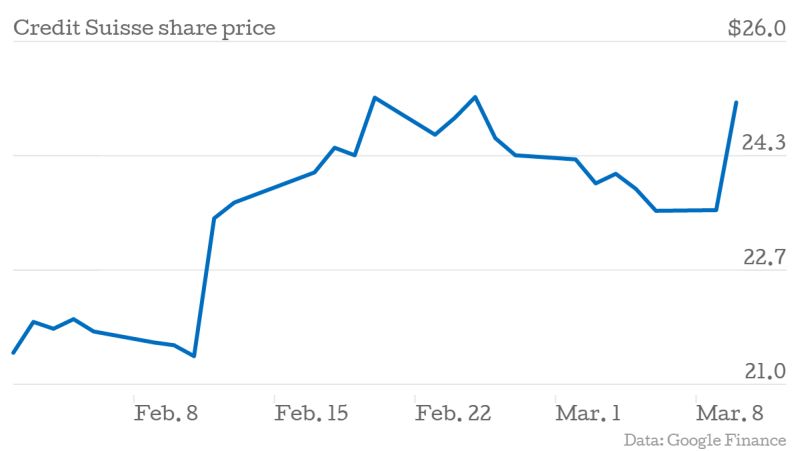

“The reality is that Credit Suisse doesn’t have enough capital on any benchmark,” said analyst Ed Firth from Macquarie. “Tidjane can either cut parts of the business or get out to raise capital in the markets. The share price reaction was one of relief, at someone breaking the stasis.”