CPI and the FED in focus

Another interesting week in markets this time round, where it could end up being crunch time for the FED to make a decision on when these rate hikes are going to end.

We’ve just had the November CPI print out of the US and have had some massive moves. Which begs the question, do the FED stop hiking?

The total rate of Inflation has been coming down for months. However, with the falling gas prices in the US being the main driver, it hasn’t really given us a clear picture of the overall rate of Inflation across the US economy. Once we looked the Core CPI, which excludes volatile food and fuel prices, then we get a clearer picture of the economy as a whole, which was still rising until September.

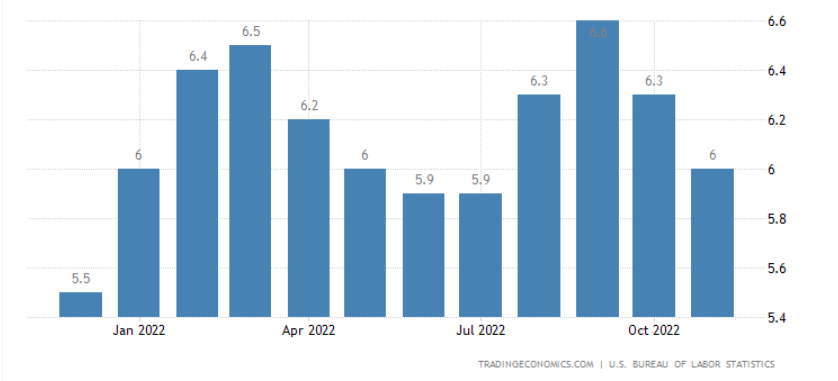

As you can see above, we peaked on the total rate back in June, which was good, but from a markets perspective, we couldn’t really read into it slowing until the Core CPI print started to trend lower as well.

As you can see here, the Core CPI was still printing higher figures throughout August and September, telling us that the drop in fuel prices was the driving factor.

Now the picture is slightly different. We’ve got both prints trending lower, and a clear as day picture that Inflation is beginning to slow down, which is the point of all these rate hikes in the first place.

We’ve had the typical cyclical reaction to these figures today, providing some good opportunities for us to jump into as traders. US stocks flying higher, Bonds flying higher, Yields down, Dollar down, Gold up and even the most bearish of current markets in Oil has made an attempt at a move higher at the time of writing, just about anywhere you look there has been some trading opportunities. Markets have clearly taken a likening to these figures and why wouldn’t they? With the FED on the most aggressive hiking cycle in decades, a slowdown of this is bound to give markets a bit of a boost, but with the potential of a recession next year, we need to keep our eyes on what they are going to tell us tomorrow, which is now an extremely interesting meeting to finish off the year.

Looking ahead to tomorrow, markets had anticipated a 50-bps hike, but that was not a foregone conclusion. I think after today’s numbers, we can be pretty sure that’s what we will get. We get updated economic projections, mainly the dot plot, but also some sort of an idea of where the bank feel the GDP figures will be at as we head into the next year. I personally think that there will be a reluctance to continue putting rates up aggressively after this, as we need to see how much of an effect these hikes have. They won’t want to hike the economy into recession if that is avoidable, and with the CPI prints today, I think there may even be a slight possibility they go on pause from tomorrow onwards. The dot plot will give us an indication of where they see the terminal rate, and you would imagine they will have known these figures before they made their projections.

4.6% was what they predicted for the terminal federal funds rate back in their September meeting and they have said since then that rates are likely to be higher than that come the end of the cycle. The question now is, is 4.5% enough?

All eyes will be on the FED tomorrow, but the picture hasn’t changed massively. They are approaching the end of the hiking cycle one way or another and I think whatever way you look at it, stay short Dollars and stay long Stocks for now. What they say tomorrow should give us an idea, but we will just have to wait and see.

How to Learn to Trade on Financial Markets?

It’s essential to ensure you have the right skills and knowledge to capitalise on the opportunities presented from a recession and studying a trading course at an accredited, award-winning academy can help provide you with an advantage. The London Academy of Trading has a combination of practical application and theory that can provide you with the skills to thrive in financial markets, whilst their 10h/day support can help provide immediate help and advice.