Covid-19: the inescapable truths faced by investors

Investors will need to be more agile than ever as Covid-19 reinforces many of the trends driving the world economy prior to the outbreak.

“At the beginning of the plague, when there was now no more hope but that the whole city would be visited; when all that had friends or estates in the country retired with their families; and when one would have thought the very city itself was running out of the gates…you may be sure from that hour all trade, except such as related to immediate subsistence, was, as it were, at a full stop.” A Journal of the Plague year, Daniel Defoe 1722 (Based on the events of 1665).

Alongside the tragic human impact, Covid-19 has had a profound economic effect. The great lockdown has put an abrupt end to the longest economic expansion on record in the US and pushed the world economy into the deepest downturn since the Great Depression of the 1930s.

Although there are signs that the virus is being brought under control and governments are beginning to lift restrictions on mobility and social interaction, we doubt the recovery will be rapid. We expect the effects of the pandemic to reverberate long after the outbreak has passed.

In this note, we focus on that reverberation and examine how Covid-19 will affect the longer term outlook for the world economy. We do this through the lens of the “Inescapable Truths“, the factors we previously identified as being key to shaping the medium-term outlook for economies and markets.

Before Covid-19, we argued that demographics and trends in productivity pointed to an outlook for the world economy of subdued growth and low inflation, against a backdrop of disruption from populist politics, technology and climate change.

Such a prospect meant that real interest rates should remain low, and investors would have to navigate an environment of considerable change, where stock market index returns alone were unlikely to excite.

The effect of pandemics on economies

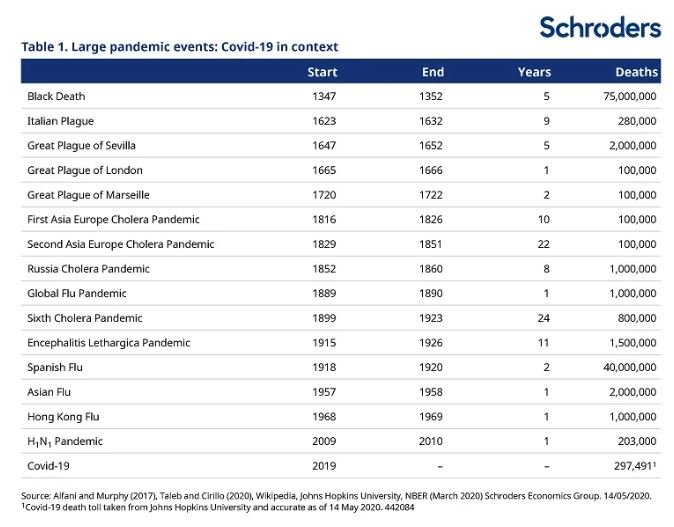

Studies of the economic effects of pandemics point to significant long run effects. Growth and returns on assets are depressed for a considerable period of time, up to 40 years after the pandemic has passed. Those studies cover outbreaks stretching back to the Black Death of the 14th century up to the H1N1 (swine flu) pandemic of 2009.

Covid-19 is most frequently compared with the Spanish flu of 1918-19, an outbreak that claimed 40 million lives, or 2% of the world population implying 150 million deaths when applied to today’s population.

Fortunately, better health systems and government action to suppress the virus mean that the current outbreak should not be anywhere near as fatal. Nonetheless, although governments may ultimately succeed in curtailing the health impact, the economic effects and debt costs are significant.

Pandemics and people

Pandemics leave deep scars in terms of their impact on those who survive and how they behave in the future. In economic terms they alter the balance of saving and investment in the economy. After the initial shock has faded and the illness has been contained, the natural response of households and business is to be more cautious.

Countries which have already lifted lockdowns in the current pandemic are finding that consumer spending is slow to recover and history suggests this is likely to persist.

Previous experience finds that the shock of a pandemic means that savings rise as households build up their precautionary balances. Having survived the outbreak, people are more aware of the vulnerability of their employment and income to ill health, causing them to save more for bad times. This means weaker consumer spending growth, the mainstay of economic demand and activity.

Pandemics and companies

On the corporate side, studies show that business investment is also weaker. In most cases this reflects the fall in labour supply as a consequence of the illness, which increases wages in the economy. The drop in profitability then weakens capital investment. Today, the impact on the working population should be significantly less due to preventative measures and the fact that it’s the elderly who are primarily affected. We therefore would not expect to see rising wages as a consequence of Covid-19.

Nonetheless, for many firms the near-death experience of the lockdown where cash flows have simply dried up, will have a long-run effect on their willingness to take risks and invest. As with households, the lockdown and fall in activity has brought a greater awareness of the risks to business. Whilst fiscal and monetary policy is working to offset the adverse effects, these scars from the crisis will weigh on future risk-taking and the willingness to invest.

Here we look at four themes from our original “truths” that the coronavirus crisis is likely to reinforce or accelerate.

For more:

– Q&A: Will Covid-19 mark a permanent economic shift?

– Slumping economy, surging stock market– what’s going on?

– Infographic: A snapshot of the world economy in May 2020

Truth #1: Low interest rates

The combination of higher savings rates and lower capital investment would point to slower growth and a lower equilibrium interest rate, i.e. the interest rate when unemployment is at its natural rate and inflation is stable.

Weaker investment will also hamper a recovery in productivity and reinforce the outcome of slower GDP growth. Consequently, the Covid-19 outbreak strengthens our conclusion from the Inescapable Truths that interest rates will remain low in real terms for a considerable period.

The long-anticipated normalisation of rates, which was briefly achieved in the US in late 2018, has been pushed out even further.

Truth #2: Rising healthcare spending

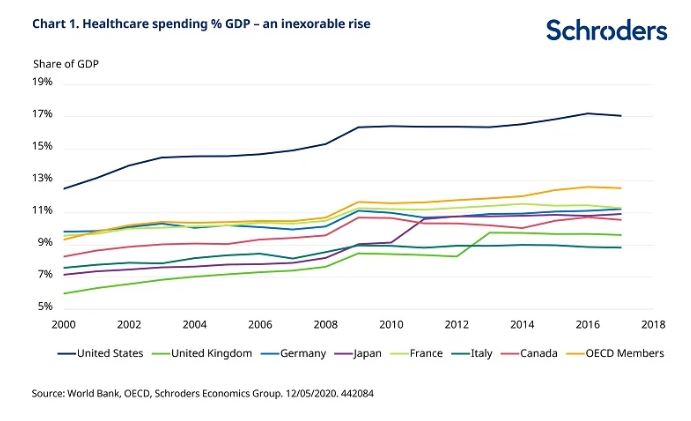

In our original Inescapable Truths paper, we pointed to increasing healthcare spending within the context of ageing populations. This theme has been super-charged by Covid-19.

It will form part of a broader trend whereby governments are likely to play a more permanent role in supporting aggregate demand in the economy through fiscal policy. Government spending will be higher to offset slower private demand. In particular, we would expect spending on health to rise as governments build more resilience into their health systems.

Just as the banking sector had to increase buffers against risk after the global financial crisis more than a decade ago, the health sector will be expected to do the same after the pandemic.

Health spending as a share of GDP has already been rising significantly largely as a consequence of demographic pressures. In the US spending on health has risen from 13% to 17% of GDP since 2000, the highest level in the OECD. In Europe, where it accounts for 11% of GDP there have also been significant gains over the last 20 years (see chart 1). The private sector will play a role, but public spending will bear the burden in the OECD. In 2018, the average OECD country spent $4,000 per head on health of which three quarters was public spending.

Healthcare spending already accounts for nearly one-fifth of OECD public expenditure.

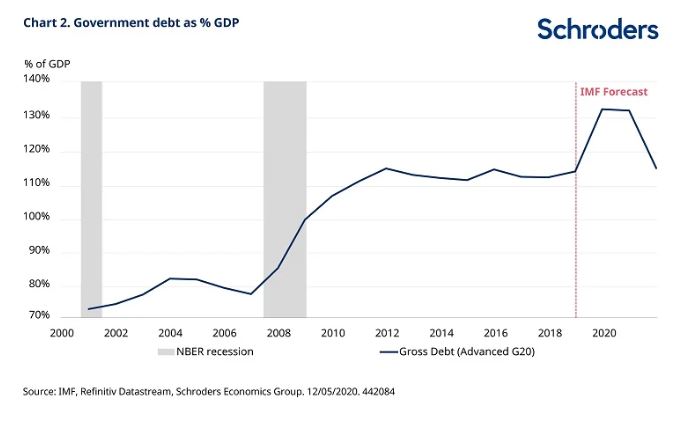

This will present a challenge to finance ministries at a time when the International Monetary Fund (IMF) forecasts that total government debt will rise to 150% of GDP for the G20 by the end of 2021 (see chart 2 below), largely as a result of Covid-19.

Governments will face the unpalatable choice of raising taxes or cutting public spending to contain budget deficits.

In our view, it is increasingly likely that governments will rely on financial repression (i.e. keeping interest rates well below nominal GDP growth) to erode their debt to income ratios. Such a policy would be implemented through a combination of central bank purchases of government bonds (QE), direct yield curve control (as seen in Japan) and regulation which forces investors to hold government bonds.

Truth #3: Rising populism

Financial repression as a means to reduce debt ratios has been used before, particularly after WW2 and since the GFC. However, it takes time and may be undermined in a world of free capital movement.

Consequently, many see the current economic orthodoxy being challenged by a swing toward populism and believe that debt will be reduced not through financial repression, but inflation.

Populism, one of the disruptive forces we highlighted in the Inescapable Truths, in this context would mean governments undermining the independence of central banks, moving away from inflation targets and ultimately adopting policies such as Modern Monetary Theory (MMT), or printing money and directly spending it in the economy.

The outcome would then be higher inflation and possibly hyperinflation if pushed far enough. Debt to GDP ratios would fall, but as those who remember the 1970s may recall, such policies do not make governments popular.

Indeed, given the demographic shift toward an older population, high inflation would be even more of an electoral liability for any government, as it would hit a key part of the electorate hardest by eroding the real value of their savings and pensions.

Truth #4: Accelerated technological change

Nonetheless, the more difficult environment we expect for the post-Covid-19 economy is likely to provide ripe conditions for populism.

Real wage growth will remain weak and income inequality could increase further. The latter is likely to be driven by the acceleration in technology after the crisis.

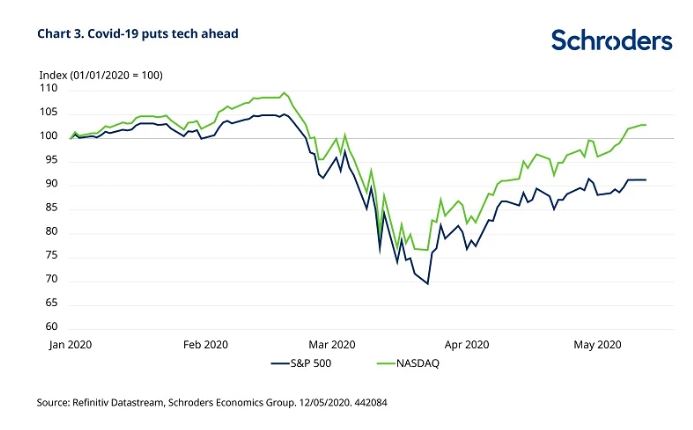

Two forces are at work here. First, there is the “crisis as the mother of invention” effect, where being forced to stay at home has provided a boost to online retailers, video conferencing and all aspects of remote working.

Covid-19 has accelerated the demise of the High Street retailer in this respect and offices may be next. The lockdown has forced companies to innovate and make remote working viable.

It is not surprising that tech firms (as represented by the NASDAQ in chart 3 below) have led the recent rally in US equity markets.

Past performance is not a guide to future performance and may not be repeated

Second, is a longer-term effect as the experience of Covid-19 forces companies to rethink their supply chains. Difficulties in travel and the need to make supply chains more resilient is likely to lead to greater diversity in suppliers. In some cases, there may well be a preference to move more production closer to home. To the extent that wage differentials between developed and emerging markets remain significant, this would mean more automation rather than a rise in demand for local labour. Artificial intelligence and robotics are likely to be the winners, accelerating the fourth industrial revolution.

Greater domestic – rather than international – production is a further blow to globalisation, which has already been hit by the trade wars between the US and China. It will, however, take some time for this to play out. In the near-term the greater threat is a deterioration in relations between the two super powers, who are currently engaged in a blame game over the origin and spread of the virus.

In the longer term, accelerated technological change will probably raise productivity as it will reduce many of the inputs associated with business such as travel costs and the maintenance of office space. More immediately though, it means job losses for those sectors of the economy which facilitate business such as travel companies, airlines and office management firms.

AI and robotics are likely to hit employment in the emerging markets if driven by a desire to reduce supply chains

Whilst the economy may be able to eventually move to a new level of higher productivity, the immediate effect is to displace workers who will then need to re-skill or relocate to gain work in the new economy. This will only add to the sense of dissatisfaction felt toward the economy and cause people to seek populist solutions.

The winner-takes-all feature of technology means that widening inequality trends will persist during this phase, again heightening the search for populist solutions. Governments will find themselves in an increasingly difficult bind; as we have seen, they are unlikely to have the spare fiscal leeway to head off some of this pressure through increased expenditure.

Conclusion

The world economy is still in the midst of the “full stop” described by Daniel Defoe some 300 years ago. However, investors are looking beyond the immediate downturn to anticipate the shape of the post-Covid economy.

In our view the virus is likely to reinforce the trends that were driving activity before the outbreak struck, by challenging the growth path, creating greater pressure on government finances and increasing inequality as technology becomes ever more pervasive.

Government intervention and the threat of populism will grow and investors will need to be more agile than ever to achieve their objectives in the face of these Inescapable Truths.

Important Information: The views and opinions contained herein are of those named in the article and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This communication is marketing material.

This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 1 London Wall Place, London, EC2Y 5AU. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.