COVID-19 has now triggered 215 profit warnings

The headline number tells you that we’ve recorded 215 COVID-19 related profit warnings in 2020, as of 9am 2 April 2020. Of those 215 COVID-19 related warnings, almost 190 have come in the last three weeks. That’s significantly higher than any quarter we’ve recorded in the last 21 years. It’s almost as many as we’ve counted in some years….

This week’s trends

In this week’s update, I’m coving two broad topics.

- Firstly this week’s trends and the increasingly layered picture behind that exceptionally large number.

- Secondly, the changing way companies are reporting their profit guidance to the market – because this has immediate and long-term implications.

1. A (slightly) slower pace….

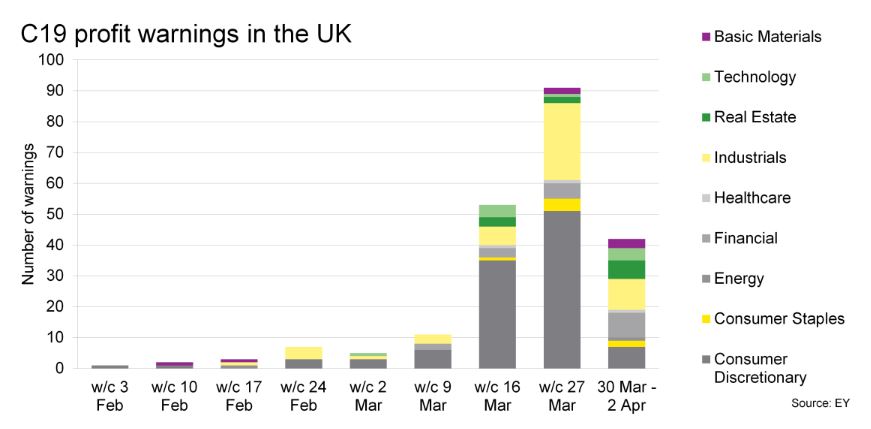

Last week (commencing 23 March) UK companies issued 91 COVID-19 related profit warnings – as many in a week than they did in the whole of Q1 2019.

This week, we’re on track for around 50 warnings. That’s still more than we usually record in two months…but the pace is slowing

This doesn’t mean the economic impact is lessening. But we have moved past the initial shock of an “all-stop” in a large part of the consumer economy, which led to so many businesses fundamentally reassessing their operational and financial outlook.

2. The broadening impact…

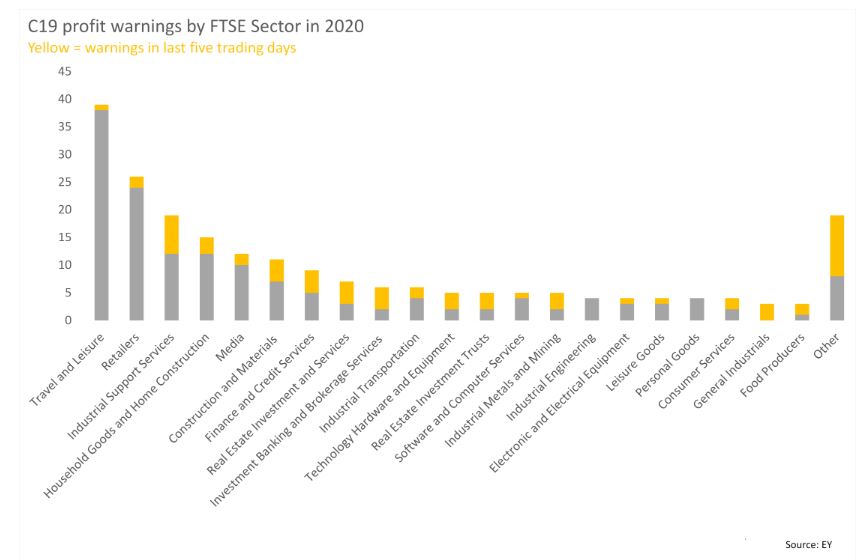

So there are fewer warnings, but they are coming from a broader base of companies.

This is my new go-to profit warning chart. It shows the initial hit to supply lines; the sudden peak of consumer-facing warnings; and now the spread into the wider economy.

Companies are now feeling the impact of the COVID-19 crisis through multiple channels, as supply and demand shocks cascade through the economy. One of the biggest themes in corporate reporting is the preservation of cash. Understandable, but capex retrenchment and delays to payments and discretionary spending have knock-on impacts – as we can see in the rise in warnings in sectors reliant on B2B spending, such as support services and recruitment.

Impacts are often complex. The real estate sector has seen one of the biggest increases in profit warnings in the last few days, as the commercial side contends with the impact of rent forbearance. But this is also providing essential support for many retailers and leisure companies.

3. Thinking ahead

We have a very long way to go, but if you are looking for hope, there are green shoots in terms of a return to production in China – very noticeable now in RNS statements and backed by the latest Chinese PMI data.

Closer to home, there’s evidence that companies are positioning for the recovery. Some are explicitly raising cash to prepare. Others are thinking about the positives they can take from this crisis. Can these newly simplified processes be our new normal? How many of us are successfully using remote working technologies today compared with a month ago.

Necessity is the mother of invention!

Reporting trends…

My second topic concerns the actual text of the mountain of RNS issued in the last few weeks. The world has fundamentally changed – and so has the way companies communicate to the market.

The language and rhythm of all corporate reporting, including profit warnings has altered significantly. We’ve moved from companies talking about profits being “below expectations” to the more fundamental “material impact”. Companies also lack the visibility to talk in the usual way about their new earnings profile. Indeed, almost all companies are withdrawing forward earnings guidance – a topic I’ll return to soon because it has deeper implications.

And ultimately, the primary focus of most earnings statements – whether they are profit warnings or not – isn’t profit, it’s cash. More specifically, liquidity:

- What’s the position now?

- What levers can the business pull to conserve cash and access new funding/government help?

- How long can this company endure?

It’s vital in this environment that companies get this communication right. I have two recent EY webcast replays to recommend in this regard.

- The first on business continuity and the measures companies can take to keep trading.

- The second on corporate reporting and the close process – including practical advice on market communication and the most important messages to impart to stakeholders in this crisis.

These are extraordinary profit warning figures, reflecting extraordinary times.

For materials and insight on responding to COVID-19, visit ey.com/uk/covid