Covid-19 and “stakeholder capitalism”: actions speak louder than words

The idea that companies should be run for the benefit of all their stakeholders, not just shareholders, is not new.

“Stakeholder capitalism”, as it’s become known, was actually the dominant corporate model long before “shareholder primacy” (i.e. prioritising shareholders) really took hold in the Anglo-Saxon world in the 1970s. It remains the norm in some countries, such as Japan and Germany. In the latter, supervisory boards are legally required to comprise 50% worker representatives.

The concept has made a comeback since the global financial crisis, gaining momentum with the growing focus on environmental, social and governance (ESG) issues by investors and customers.

Business leaders’ commitment

So much so that in August 2019, the Business Roundtable garnered the commitment of CEOs from leading US companies to redefine their corporate purpose to focus more on customers, suppliers, communities and employees.

The Business Roundtable is a lobbying group started in 1972 which aims to promote inclusive economic growth through sound public policy. Its members include the chief executives of US companies like Apple, Amazon, General Motors, Pepsi and Walmart.

It’s been a year since that explicit commitment was made and CEOs representing 206 companies have become signatories.

And while the year has been nothing like anyone expected, it has provided an unrivalled opportunity for companies to step up to the plate and show that they care about more than just pleasing shareholders and chasing financial gain at all costs.

So how have companies performed against this somewhat unusual backdrop?

For more from Schroders check out:

– Can behavioural finance explain how investors think about sustainability?

– Why the energy transition is about more than generating clean power

– Has demand for oil already peaked?

Who has performed best?

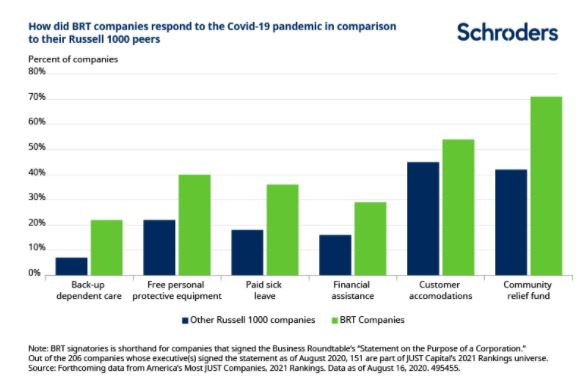

JUST Capital, a platform that measures corporate performance with regard to stakeholders, has compared US companies’ responses to six stakeholder issues that have emerged during Covid-19.

The below chart shows that signatories to the Business Roundtable have performed far better than non-signatories in providing stakeholder support during the pandemic so far.

That said, with a couple of exceptions, the absolute performance and degree of outperformance is not that impressive.

Focusing first on how companies treat their employees, JUST Capital looked at whether they provide back-up dependent care (additional resources for childcare), free personal protective equipment (PPE) to frontline workers, paid sick leave and financial assistance.

While BRT members are streets ahead of other companies, the proportion providing these benefits is still well below 50%.

We were particularly surprised to see that only one-third of BRT signatories provide additional paid sick leave and only 40% give out free PPE. This has broader societal implications in terms of slowing the pace of Covid transmission: staff who cannot afford to take time off sick are more likely to spread the virus at work.

The gap is wider when we look at the provision of back-up dependent care. While still only 22% of BRT signatories provide this, this is more than three times the proportion in the wider index and does indicate companies going beyond the normal call of duty.

Customers or employees?

Performance on wider societal concerns – the two right-hand measures on the chart – is better. 71% of BRT companies have donated to a community relief fund – though of course this tells us nothing about the magnitude.

Around half of all companies have been accommodating customers by reducing prices, deferring payments, maintaining essential utilities, or providing special accommodations for high-risk customers.

The higher proportion and smaller gap here versus on the employee measures is interesting: it suggests that companies see their customers as the more important stakeholder, and consider the risk of market share losses higher than the risk of employee turnover. A cynic might also suggest that the two right-hand metrics, and particularly the community donations, are more visible, so we could be seeing some ‘virtue-signalling’ here.

Thankfully, the pandemic is an unprecedented event. But this does mean that we have no baseline data to compare this to. It is possible – if not likely – that the BRT signatories would have shown the same outperformance on these measures regardless of whether they had signed that declaration last year.

Earlier this year, professors at Harvard Law School found that none of the 20 companies whose CEOs sit on the BRT board had changed their governance guidelines to advance stakeholder welfare.

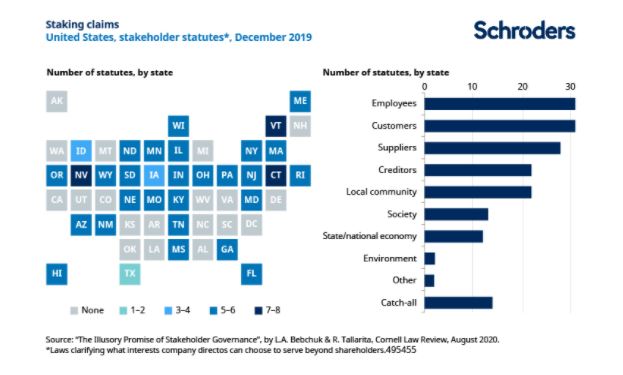

Interestingly, 32 out of America’s 50 states already legally require boards to take non-shareholder interests into account in some way. But 70% of BRT signatories are incorporated in Delaware, which has zero stakeholder statutes and where corporate law is famously shareholder-friendly.

What about the rest?

Beyond the companies in the BRT, we’ve seen widespread examples of firms putting the interests of other stakeholders ahead of shareholders’ – some of which we have discussed in our previous articles here and here.

All over the world, executives and board members have taken pay cuts, albeit temporary, in response to the pandemic. About half of FTSE 100 companies have done so, and 28% of companies in JUST’s corporate response tracker by the start of June.

While executive pay cuts might not do much to bolster a company’s finances (after all, an executive’s base salary typically accounts for just 10-15% of their full compensation package), they send a message of solidarity to employees and investors. Especially when companies are cutting dividends, investors prefer to see management ‘sharing the pain’.

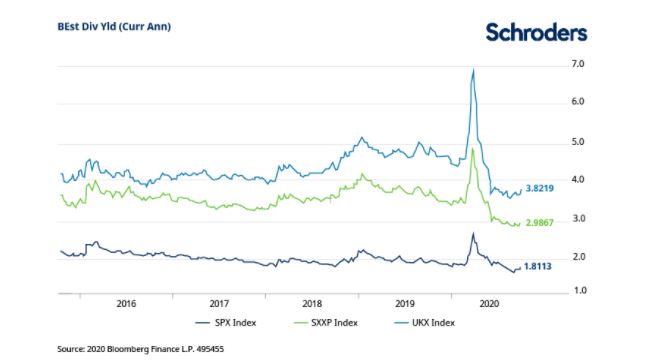

With regard to dividend cuts, European and UK shareholders have taken a bigger hit than those in the US. In absolute terms, expected dividends per share in 2020 have fallen by 26% for Europe’s Stoxx 600 index, 35% for the FTSE 100 and by a mere 6% for the S&P 500. That said, the chart below shows that US stocks already had a much lower yield. US companies are more likely to use share buybacks to return cash to shareholders, partly because they are easier to turn on and off depending on market conditions.

Note: BEst div yld (curr ann) means Bloomberg estimate of current annualised dividend yield (consensus expectations for 2020 dividend yield)

Covid crisis accelerating evolution of new social contract

We believe the relationship between companies and their stakeholders is evolving, and the Covid crisis has accelerated this trend. As we have written about earlier this year, we believe a new social contract is emerging, particularly with regard to how employers treat their employees.

The BRT declaration may not in itself have driven dramatic change, but regardless of causality, it is encouraging to see America’s leading companies outperforming their peers on stakeholder support. This suggests that the signatories do broadly practice what they preach, albeit those delivering on all stakeholder support measures are still in a minority.

The next step is to see how companies behave as the crisis subsides. Once public scrutiny lessens, some will go back to business as usual. It is up to us as investors to continue to hold companies to account.

The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

- To find out more visit Schroders Global Investor Study hub or Schroders Sustainable Investment home page

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.