COVID-19: A framework for business response

COVID-19 is fundamentally affecting companies’ ability to operate and plan. The sheer extent of government and central bank support unveiled in the last few days underlines the unique combination of challenges created by this crisis and the degree to which this will impact every part of our lives.

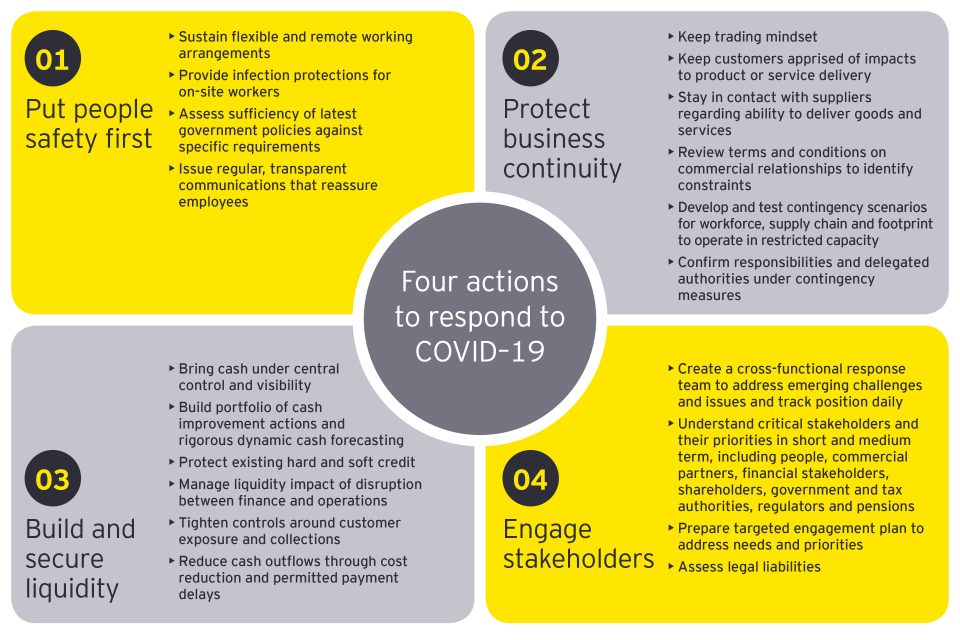

Outlined below is a summary of the UK Government’s actions in the context of EY’s framework of four key areas businesses need to address to respond to the turbulence caused by COVID-19.

Government support focuses on liquidity

Less than a week after the 2020 Budget, the UK Chancellor, Rushi Sunak, announced a further wide-ranging package to support businesses and individuals affected by the COVID-19 outbreak. These included £330bn of Government-backed and guaranteed loans, alongside an extension to the 2020-21 business-rates holiday to all retail, hospitality and leisure businesses. The measures also comprised an increase in the availability of grants for small businesses and all retail, hospitality and leisure companies.

These actions recognise that liquidity is one of the fundamental issues for companies right now – especially in retail, hospitality and leisure sectors, where we’ve seen the most profit warnings in recent week as ‘social-distancing’ measures come into effect. But, stress isn’t confined here. The wide-ranging impact of global measures being put in place to contain the virus mean that we’re hearing from concerned companies across the economy.

Framework for action

EY has developed a framework based on four key pillars to help companies consider their priorities, actions and navigate these challenging times.

Putting people first

Ensuring the safety and wellbeing of employees and customers is clearly the number one priority for all businesses. We’re now at the point where most businesses that can allow flexible working arrangements are doing so – whilst others are working to mitigate the risks in their work place.

These actions are only the start of the story. You’ve probably received emails from companies explaining how they are protecting their staff and customers. Regular communication with customers and suppliers is obviously important. But, internal communication is also vital to reassure staff and to ensure that remote workers feel engaged and connected.

Focusing on business continuity

Most businesses will experience significant disruption to their supply chain and production commitments and shifts in demand. Companies need to put in place mechanisms to assess and monitor risks in their supply chain and adapt quickly. They should also review terms and conditions on commercial relationships to identify constraints.

Companies need to keep a trading mindset. If you can’t connect directly with customers, are there alternatives? Are there contingency scenarios you can develop for your workforce, supply chain and for the delegation of authority if key approvers and decision makers are unable to work?

Whatever approach you take, it’s crucial that businesses keep customers apprised of changes to product or service delivery.

Build and secure liquidity

When revenue dries up, cash naturally becomes the centre of concern. It’s a measure of the unprecedented nature of this crisis that we’re seeing many quoted companies set out their cash and available facilities in trading statements, before essentially detailing how long this might last under a range of scenarios. Companies need to reduce cash outflow as much as they can, through rapid cost reduction, reducing operations and taking difficult judgement calls on the largest cash payments due in the coming weeks.

Bringing cash management under central control and a high level of visibility over its daily movement will be critical. Businesses should look beyond their existing stress testing, given that the range of current scenarios are likely to be well beyond anything they have considered before. Boards will need to take a view on short and long-term risks and increase discipline and monitoring around cash.

Companies are taking radical action to preserve cash, including suspending dividends and postponing capital investment. Urgency will increase further as capital markets tighten.

Companies should draw upon contingency funding and speak to lenders to extend facilities. But, they also need to be prepared for delays in accessing funding and for their usual avenues of capital to close. Boards should consider the attractiveness and long-term implications of any new and alternative forms of finance.

The package of support from Government will be critical here for many. Understanding what is available and how it can be accessed should be a priority.

Engaging stakeholders

At some point in the coming weeks many businesses will need support from their stakeholders. The question companies need to ask is: do they know and understand their critical stakeholders and their priorities – including commercial partners, financial stakeholders, shareholders, government and tax authorities, regulators and pensions trustees?

Creating a cross-functional response team to address emerging challenges and issues will help companies recognise issues and engage with stakeholders quickly. Companies need targeted engagement plans to address immediate needs and plan for longer term priorities to prevent an ad-hoc, reactive approach.

The sooner action is taken, the more effective it will be.