Could the UK economy outperform the IMF’s dire recession warning? It’ll take a lot of luck

Britain and the International Monetary Fund (IMF) have a pretty chequered past. Yesterday’s bleak forecasts marked another chapter in the pair’s hate-hate relationship.

Yes, the usual barbs that come from ministers of the incumbent government of the day after the lender of last resort’s forecast don’t help. We saw all that yesterday.

But, older people will remember Britain going cap in hand to the IMF after the country effectively ran out of money in the 1970s.

Yesterday’s dire forecast that the UK will be the only G7 country to suffer an economic contraction this year served to sharpen tensions between the Washington-based organisation and Britain.

The IMF yesterday said Britain’s economy will shrink 0.6 per cent this year, making it the only G7 nation to veer into reverse.

In fact, even Russia, hobbled by economic sanctions in response to its invasion of Ukraine, is on course to beat the UK economy.

Government ministers were up in arms. Tory MP Richard Holden told Times Radio the Washington-based organisation has been wrong before. “I think Britain can beat those predictions,” he said.

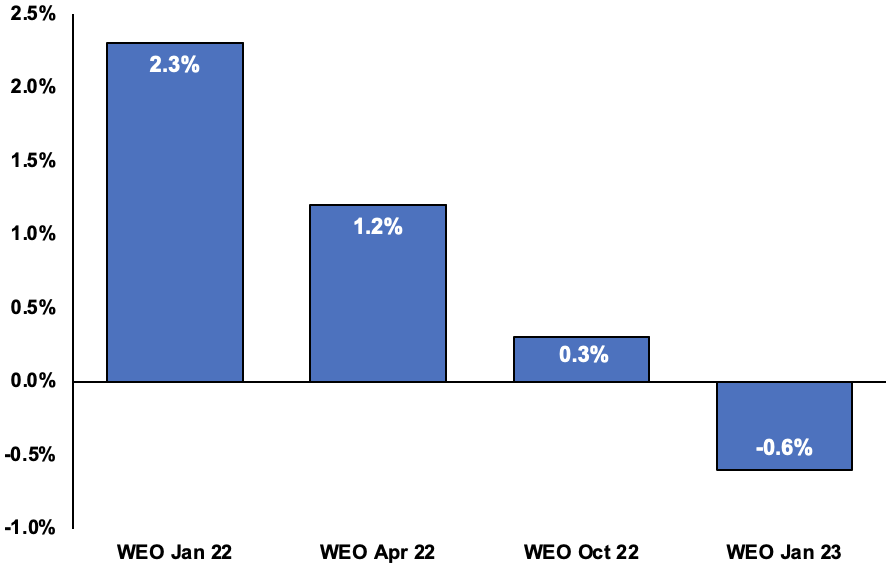

In fact, Holden is technically right. The IMF has changed its projections for the UK in each of its last four world economic outlook reports – all downgrades, mind.

But there is a chance the UK could outperform the IMF’s projections.

Fresh numbers out from the lobby group the Institute of Directors (IoD) last night indicated business leaders’ optimism in the UK economy has rebounded sharply.

The organisation said confidence among its membership, which includes directors at top companies, jumped to 30 points over the last month, although its index is still deep into negative territory at minus 28 points.

The current stability in Downing Street, after three prime ministers and four chancellors in 2022, has boosted directors’ economic outlook.

IMF has revised its forecasts in each of its last four World Economic Outlook reports

“This welcome improvement in how business leaders view the UK economy is largely due to a period of relative political calm up to the end of January,” Kitty Ussher, chief economist at the IoD, said.

Inflation seemingly passing its peak of 11.1 per cent in October supported optimism, the IoD said.

A faster than expected drop in price pressures has raised hopes of a softer hit to spending power this year, softening the hit to GDP.

Tomorrow, the Bank of England is expected to upgrade its economic forecasts markedly from projecting the longest recession in a century that will wipe off nearly three per cent of GDP back in November to a relatively short and shallow recession.

Governor Andrew Bailey recently said the economy and inflation have “turned a corner”. He is still expected to lead his fellow monetary policy committee members in backing a 50 basis point interest rate increase, taking them to four per cent and marking a tenth successive hike.

The IMF attributed the UK’s outlying economic malaise to higher borrowing costs and tax hikes.

November GDP grew 0.1 per cent, a big upside surprise compared to 0.2 per cent contraction anticipated by markets.

Output will have to shrink at least 0.4 per cent in December for Britain to meet the technical recession definition of two consecutive quarters of contraction.

It is also worth bearing in mind the IMF regularly revises its economic forecasts. This time last year, they said the UK would grow 2.3 per cent in 2023.

Of course there’s a chance Britain will avoid an economic contraction this year, but it’s going to take a lot of luck though.