Could technology trigger a lasting boost to productivity?

Two years ago, we identified a series of inescapable investment “truths” that we expected would shape the following decade. Among these truths, we highlighted the accelerated adoption of technology and increased populism as two disruptive trends to watch. But have these two trends been strengthened or challenged by the pandemic?

Growth outlook stronger as economies adapt

Despite the persistence of Covid-19 cases, the outlook for the global economy has improved. There are three key factors underpinning this:

- Effective vaccines

- Significant spending by governments

- The improved ability of economies to adapt and operate remotely

Following the approval and ongoing roll-outs of vaccines, government spending has been centre stage recently. President Biden’s $1.9 trillion fiscal stimulus has prompted significant upgrades to forecasts for US economic growth. And the spill-over effects will help raise demand in the world economy.

However, less attention has been paid to the third factor in the recent recovery – adaptation. This may be more important in the long run as it has given business an unprecedented opportunity to undertake an experiment (albeit forced) with different ways of working. And many have successfully adjusted to the operating restrictions imposed by the virus.

We can see this at the level of the overall economy: while GDP collapsed during the first lockdown, the declines have been considerably less second time around. Undoubtedly, there has been a “survival of the fittest” effect, with the most exposed and weaker firms going out of business in the first wave of shut downs.

Nonetheless, there is also a learning process. One key driver of the ability to adapt has been the greater use of technology in allowing business to operate remotely.

Online sales have surged, enabling businesses to continue trading, and they now represent over a third of all retail sales in the UK, for example.

Worldwide spending on laptops and headsets has been massively boosted as more people work from home and business investment in IT and equipment has actually strengthened despite the downturn. Firms have to be digital to participate in the locked-down economy so investment plans have sped up.

Digital drive to boost productivity growth

Will this lead to higher output per worker? In our view yes, but the improvement seen in the figures so far is largely a result of a Darwinian selection process. This has changed the mix of output in the economy away from labour-intensive services towards more productive sectors.

The key will be whether the economy can sustain this over the medium term. It could be that the jolt provided by the pandemic is sufficient to push firms onto a higher productivity path and that the increased use of technology has taken us over a tipping point where the benefits come through.

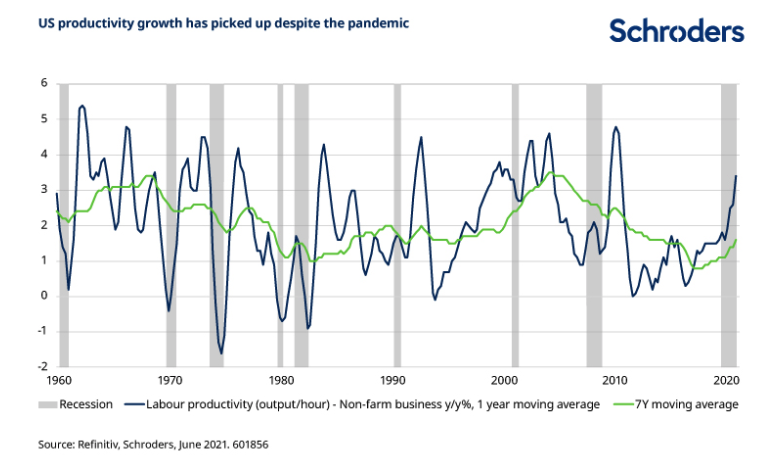

At this stage the Covid-19 recession looks like being the first where productivity ends up being stronger in more than 60 years.

The mix effect is likely to reverse somewhat as the service sector returns, but looking further ahead it seems likely that greater use of technology will contribute to an improvement in productivity over the medium term.

While there will be significant adverse effects from the pandemic as workers are displaced and businesses are permanently closed, for many the pandemic will have enabled experimentation with different ways of working. Meanwhile, increased business investment stands in contrast with the experience after the Global Financial Crisis when reduced investment weighed on potential output growth.

The key point is that, for many, productivity should not necessarily be worse and may well be better as the economy re-opens. Combine this with the increase in AI and robotics, which is bringing gains to parts of the service sector, and the long-awaited benefit of increased technology on productivity could come through and reverse the downtrend of the past decade.

Discover more at Schroders Insights or click the links below:

– Why is digital infrastructure so important for real estate investing?

– What does China’s stock market meltdown mean for investors?

– Why emerging markets could be the next digital frontier

Does this risk a rise in populism?

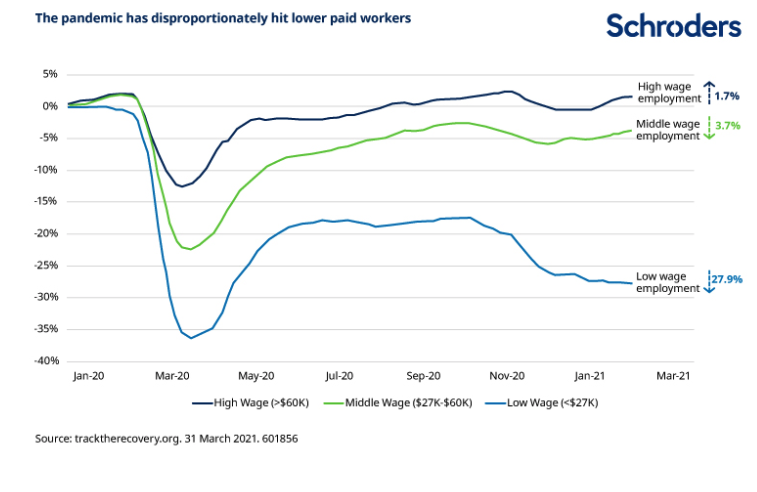

However, there is also a risk that increased use of technology may make the efforts of policymakers to address inequality more difficult as the fourth industrial revolution displaces more workers. History shows social unrest increasing after a pandemic is over, creating an environment for more populist policies.

As economic activity improves, the gap between rich and poor should narrow. But income and wealth inequality have no doubt increased during the pandemic. When people do not share in the gains of the economy they become dissatisfied and look for alternative political solutions. So far though, this does not seem to be the outcome with Covid-19. It seems that what people really value in times of crisis is competence and stability.

However, once the pandemic eases, the threat of unrest rises. Before concluding that populism has become another casualty of the crisis, we should recognise that these events play out over a long period.

It may also be that populism has taken on a different guise. Tackling inequality is high on the agenda for the new US administration. When questioned over the wisdom of the American Rescue Plan and the risk of overheating the economy, Treasury Secretary Janet Yellen emphasised the importance of getting back to full employment as rapidly as possible and making sure that the pandemic does not have a permanent scarring effect on peoples lives.

These themes can be seen elsewhere, particularly in Europe where government involvement in economies remains high and fiscal policy plays a key role in supporting demand.

After a pandemic whose economic effects have disproportionately been felt by lower paid workers, policymakers may need to be wary. The challenge will be how politicians can address issues such as inequality and meet the rising demands for higher public spending in other areas, such as health and climate issues.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.