Costain launches £10m share buyback as profit and backlog jumps

Engineering firm Costain has kicked off a £10m share buyback after it revealed a set of strong results this morning.

In its half-year results, the company revealed that adjusted operating profit had jumped 8.7 per cent to £16.3m, thanks to an increased operating margin at its transportation arm and increased revenue at its natural resources division.

However, Costain’s revenue dropped from £664.4m to £639.3m due to the cancellation of HS2.

Peel Hunt analyst Andrew Nussey stressed that Costain’s valuation was “underpinned by the net cash position”, which grew to £166m in the first half of the year, compared to its market cap of just £262m.

This is up from the group’s average net cash position of £123m in the first half of 2023.

The company confirmed it remained on track to deliver an adjusted operating margin run-rate of 3.5 per cent this year, and 4.5 per cent in 2025.

This was due in part to securing a “significant volume of work” in the first half of 2024. The company ended the first half with an order backlog of £4.3bn. In recent weeks, an additional £500m of new work with Southern Water was secured.

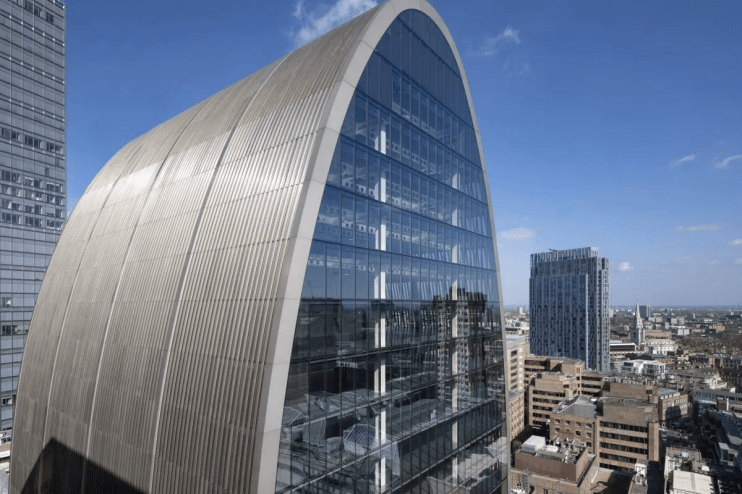

In February, Costain announced it would relocate its headquarters from Maidenhead to 70 St Mary Axe, a London tower also known as the Can of Ham.

Off the back of the strong results, Costain also announced a £10m share buyback and maintained its dividend at 0.4p per share for the first half.

Costain chief Alex Vaughan said: “We are performing strongly and are progressing with our strategic priorities in our chosen growth markets, including broadening our customer and service mix.

“Our focus on industry-leading solutions, predictable performance and long-term established customer relations has seen us win further significant water contracts post period end and we expect further wins for the group in the second half of the year.

“The quality and customer balance of our forward work position across our two divisions, together with strong highly visible market investment, gives us good visibility on future revenue and margin. We continue to deliver improvements in the business and remain confident in the group’s prospects.”